Linglong, Hubtrac and what makes a European tyre

(Photo: Chris Anthony; Tyre Industry Publications Ltd)

(Photo: Chris Anthony; Tyre Industry Publications Ltd)

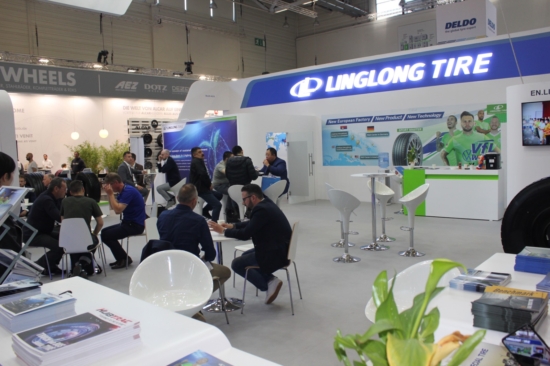

If you design your products in Germany and manufacture them in Serbia, in what sense are they Chinese tyres? A question anyone interested in Linglong’s Hubtrac tyre brand must address. During the recent Tire Cologne exhibition, Tyres & Accessories spoke with Hubtrac UK general manager Dr Edward Xu in order to engage with that particular question and find out more about Linglong’s progress in Europe and beyond.

Like Japanese and South Korean tyre brands before them, Chinese tyres have faced the up-hill brand-building struggle of imported brands. Owing to the fact that large number of no-brand low-cost Chinese-produced tyres have been shipped to Europe and particularly the UK over the years, the leading Chinese tyremakers have had to work hard at differentiating their product on something other than price. According BrandFinance data, Linglong’s name is worth north of $700 million – a milestone that has (prior to 2022) seen the company’s unashamedly Chinese-sound climb into the top 10 of global tyre brands.

That progress has been achieved by virtue of significant investments in football sponsorship of teams including Wolfsburg and Juventus. Those investments are also indication of the company’s ongoing original equipment strategy, which brings with it progressive product performance developments. And yet, especially when it comes to the truck tyre marketplace, achieving a value that reflects the firm’s overall global position remains a challenge.

A constant argument for any Chinese-owned manufacturer is that China is a low-cost production country; and that its products should therefore be priced lower than others. But what about tyres that are designed in Germany and made in Serbia? That’s where the Hubtrac brand comes in – a global export orientated marque designed to achieve the level of market penetration and price point that the Linglong name already has in mainland China.

Aiming to grow in European prominence

In order to achieve that kind of level in the demanding European market, Linglong/Hubtrac are seeking to leverage the domestic strength and global scale of its overall business along with the local power and market specificity of its European operations.

Hubtrac UK general manager Dr Edward Xu explained Linglong and specifically Hubtrac’s European brand positioning (Photo: Chris Anthony; Tyre Industry Publications Ltd)

In fact, Hubtrac has already developed a partnership with Europe’s largest liquid transport company, Kortimed, which began in early 2022. According to the company, such an achievement demonstrates the “strength and ambition” of the Hubtrac team. As Dr Xu explained: “Hubtrac is not a Chinese tyre sold in Europe, but rather a European tyre specifically designed and made for the European tyre market.”

Nevertheless, while Linglong is a top tier name in its Chinese homeland, the company has tempered its goals for the European market and is aiming for the space between tier two and tier three. And this means offering service levels comparable with what tier 2 brands offer as well. That specifically means 0 per cent interest options and 12 months terms, where applicable (in UK only). Indeed, Dr Xu emphasised the company’s strong position in terms of financial assistance in cooperation with the company’s UK financial provider.

The next step, in the UK at least, is to appoint a strong UK truck and bus tyre dealer to “share the glory of the brand”. And, when that UK brand distribution partner is established, the company’s UK office will not sell directly into the UK market. From here, Dr Xu is looking for growth in other key market, not least in the kinds of North African markets that form part of his general manager remit.

All of this is supported by significant ongoing investment in research and development, which takes place at R&D centres in Beijing, Zhaoyuan, Yantai, Shanghai and Jinan in China; as well as additional R&D centres in the USA and Germany. In addition, Hubtrac UK is looking for investing in a special showroom in London as well.

As Dr Xu explained: “Hubtrac is not a Chinese tyre sold in Europe, but rather a European tyre specifically designed and made for the European tyre market.”

Nevertheless, while Linglong is a top tier name in its Chinese homeland, the company has tempered its goals for the European market and is aiming for the space between tier two and tier three. And this means offering service levels comparable with what tier 2 brands offer as well. That specifically means 0 per cent interest options and 12 months terms, where applicable. Indeed, Dr Xu emphasised the company’s strong position in terms of financial assistance in cooperation with the company’s UK financial provider.

The next step, in the UK at least, is to appoint a strong UK truck and bus tyre dealer to “share the glory of the brand”. And, when that UK brand distribution partner is established, the company’s UK office will not sell directly into the UK market. From here, Dr Xu is looking for growth in other key market, not least in the kinds of North African markets that form part of his general manager remit.

All of this is supported by significant ongoing investment in research and development, which takes place at R&D centres in Beijing, Zhaoyuan, Yantai, Shanghai and Jinan in China; as well as additional R&D centres in the USA and Germany. In addition, Linglong is also investing in a special showroom on Finchley Road in North London as well.

And that’s all before anyone has mentioned the company’s Serbian tyre manufacturing operation, which produced its first truck tyres on 27 June 2022.

Comments