UK replacement 17”-plus tyre market increasing in value, size – GfK

The latest Porsche 911 GT3 wears 20” & 21” versions of the Goodyear Eagle F1 SuperSport R (Photo: Goodyear)

The latest Porsche 911 GT3 wears 20” & 21” versions of the Goodyear Eagle F1 SuperSport R (Photo: Goodyear)

Panelmarket data shows 19” and above segment is more than two-thirds premium brand tyres as popularity continues to increase

GfK data shows that the 17” and above UK tyre replacement market continues to offer both increased volume and value. While the 19” and above segment retains the characteristics of specialised fitments, the top two fitments account for more than one-fifth of replacement tyres sized 17-18”.

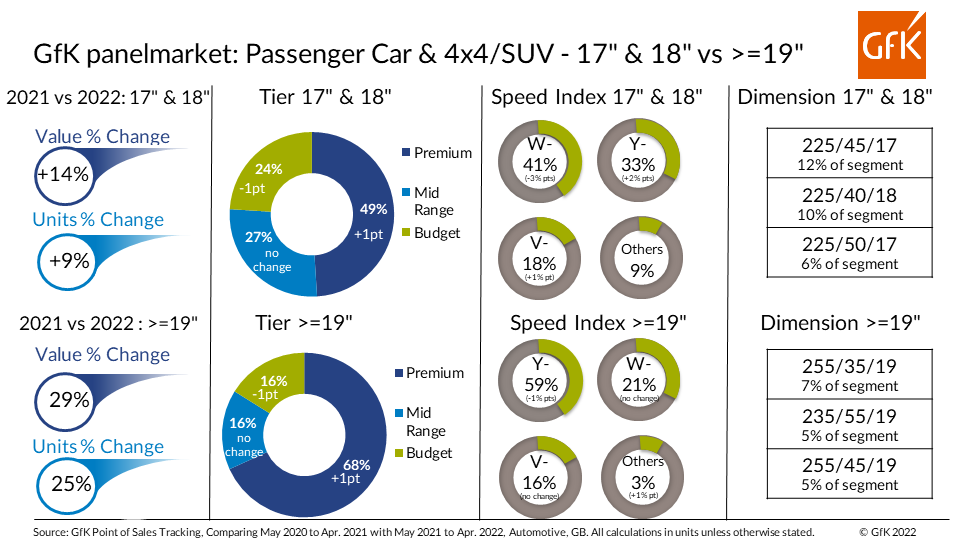

The leading market analyst shared its latest panelmarket analysis for the high performance tyre segments with Tyres & Accessories for June’s High Performance Tyres feature, with the infographic on this page. It shows the percentage growth in value and units for this car and SUV tyre segment, comparing the 17-18” “UHP tyre” segment with the “UUHP tyre” 19”-plus segment, as well as brand tier and speed index data, and the most popular sizes in each part of the market. The data reveals key differences between these two subsections of the UK replacement tyre market, offering reasons why tyre manufacturers are increasingly offering distinct product lines targeting each segment – for example, Goodyear’s Eagle F1 Asymmetric UHP series and the Eagle F1 SuperSport UUHP range. The data in the infographic was generated from GfK Point of Sales Tracking, comparing May 2021 to April 2022 versus May 2020 to April 2021. As such, the figures, which at first glance seem very positive, reflect a slightly lower base from the previous year due to the effects of the Covid-19 pandemic, which had a more pronounced negative effect on the market than was witnessed over the more recent 12-month period.

Value and units ramping up quickly

The value of 17-18” rose by 14 per cent, while 19”-plus rose an astonishing 29 per cent in this period, showing why tyre manufacturers are so preoccupied with high performance products. As we have seen elsewhere in this feature, demand for these tyres is rising across Western Europe as the car parc evolves and the rim size inflation of more recently produced vehicles takes its effect on the market. The 17-18” segment has witnessed a 9 per cent bump in units sold; while demand for 19”-plus tyres rose by one-quarter, a huge bump. The value of the segments is somewhat linked to the increased demand thanks both to rim size inflation on mass market vehicles and the increased popularity of SUVs, crossovers, and electric cars, which generally roll on larger sizes. But the fact that these rises are ahead of the units change indicates that drivers in these segments are paying more for their tyres too. This could be due in part to price increases but is also linked to the 1 per cent rise in Premium tier tyres sold in both segments, with the Budget tier contracting by the same amount in both cases.

Premium tyres dominate both segments, though with a 27 per cent share, Mid Range brands have a stronger position than usual in 17-18”. Budget brands account for just 24 per cent. Overall, consumers are still more willing to pay a premium in the segment, despite the increasing prevalence of these sizes on mass market oriented vehicles. As these vehicles age and are passed on to second or third owners, Budget brands can expect to make some headway in the relatively near future, as less monied motorists become responsible for replacing their tyres. This sort of change is much less likely in the 19”-plus segment, as cars rolling on these sizes are more likely to retain their high value for subsequent owners.

In terms of speed indices, there is evidence that the 17-18” segment is rising in tyre performance, with Y rated tyres up to 33 per cent of the market, up 2 per cent. Nearly three-quarters of tyres in this segment are rated W (41 per cent, the most popular rating) or Y; in 19”-plus these ratings are reversed with 59 per cent Y-rated and 21 per cent W. The V and Others ratings are likely to be SUVs for the most part within both categories.

Finally, the three most popular sizes in the 17-18” segment represent 28 per cent of the market, a sign that these sizes are becoming standardised for mass market vehicles with less bespoke design. At a 17 per cent share, 19”-plus is currently holding on to more specialised tyre sizes. This is also a feature of the performance-tuned vehicles running on 19” and higher tyres, many of which use mixed fitments too. Such specialist vehicles often have very few tyre suppliers, usually skewing towards the Premium tier. Still, these three 19” fitments are also emerging as dominant sizes as tyres of this size draw increased demand.

Magna Tyres

Magna Tyres Hankook

Hankook

Comments