West, Central European replacement tyre market accelerating towards larger tyres

The new Porsche Panamera on Hankook’s latest UUHP tyre, the Ventus S1 evo Z

The new Porsche Panamera on Hankook’s latest UUHP tyre, the Ventus S1 evo Z

Astutus Research data shows speed of migration to higher rim diameters

The definition of a high performance tyre is not easily nailed down, especially in the context of a fast-evolving car market, which has demanded larger tyres with mostly lower profiles for such a long, sustained period. With many standard family cars now established within the car parc rolling on rims with diameters over 16”, the size threshold for what constitutes high performance is not necessarily reflected by their application. The popularity of family SUVs and crossover vehicles and the hastening proliferation of hybrid and full electric passengers cars – vehicles that mostly run on larger rim diameter tyres – continues to loosen the relationship between the size and performance application. Size-based statistical analyses of tyre markets should acknowledge that the relationship between higher performance applications and higher rim diameters is less tight than it once was.

These caveats aside, observation of tyre brand portfolios shows that product ranges remain largely divided by size, though mere “high performance” is not popularly used as a category designation any more. Largely, “ultra-high performance” or UHP models are focused around 17-19” dimensions, while “ultra-ultra-high performance” or UUHP tyres – those supplied in sizes to fit super- and hypercars capable of pushing tyres to the limit – are focused on sizes of 19” and above. With a wave of new products in these segments from global brands arriving in the post-pandemic market, Tyres & Accessories looks at data supplied by specialist tyre industry analyst Astutus Research showing just how quickly the market for high rim diameter (HRD) tyres is now growing in Western and Central Europe (this data excludes Russia, Ukraine and the rest of Eastern Europe – Astutus projections including Eastern Europe were published last year).

The largest performance tyres withstood pandemic

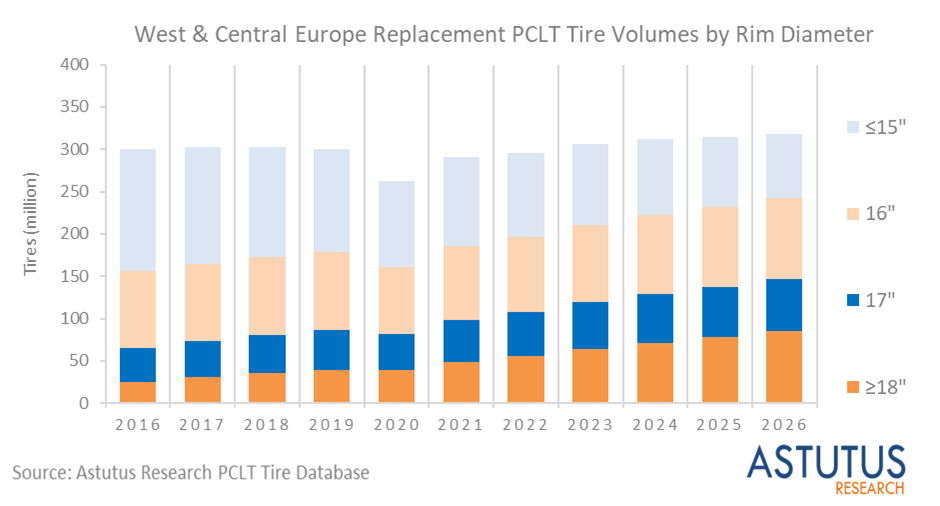

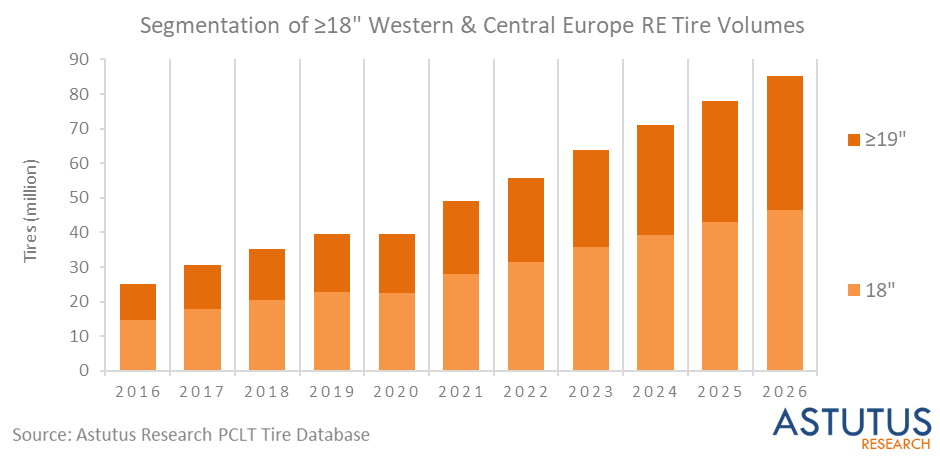

For these replacement tyre markets, the pandemic years of 2020-21 demonstrate a brief contraction that was felt least in HRD tyres, as Chart 1 shows. Cross-referencing these figures with Chart 2, we can also see that the 19” and above segment actually registered a small amount of growth in 2020. It is perhaps not entirely surprising that the segment serving the most economically secure motorists, though the reduced mileage of much of the country under the 2020 lockdown shows just how resilient the HRD tyre segments are.

Chart 1

Looking further ahead into Astutus Research’s projections, we can see that the 18” and above segment is set to grow quickly, based on projections of the car parc’s demands. Meanwhile, demand for tyres sized 15” or below is likely to contract considerably over the next five years, with both 16” and 17” segments remaining stable. This is a product of two aspects of the car market. Firstly, smaller segment vehicles have continued to size up the wheels on which they run. Secondly, the increasing popularity of SUVs and crossovers, which use larger tyres as a result of their size, has altered the shape of the car market. Both mean vehicles running on smaller tyres are gradually being replaced by larger-rimmed vehicles. Astutus Research refers to this as a “cascade effect”, as such changes in the replacement market, serving mainly vehicles already registered for at least a couple of years, take the form of slow-moving wave.

Looking over the full decade covered by these charts, we can see why tyre manufacturers supplying Europe’s major markets have put greater emphasis on developing HRD tyres. As well as offering higher value products, the 18” and above segments are the engine of growth. The electrification of the car parc will continue to support the evolving shape, with electric-powered cars typically fitting HRD tyres. By 2026, nearly half of the replacement market will be for tyres of 17” and above, with 18” challenging 17” for the largest single size segment. While 17” is currently acknowledged as the transition zone between mass market tyres and UHP tyres, the latter term is likely to become viewed as increasingly archaic, since 18” too will be commonplace.

Chart 2

The Court of Justice of The European Union

The Court of Justice of The European Union Kumho

Kumho

Comments