Top 10 UK tyre retailers 2022 – growing fast

Times have been tough in the last couple of years, but if the growth of the top 25 tyre retailers in the UK is anything to go by, the nation’s leading tyre retail businesses are taking triumph from adversity. Of course, Halfords’ acquisition of National Tyres and Autocare’s parent company at the end of 2021 makes up a big part of the new UK tyre retail landscape, but it is clear that adding branches to existing networks (either by organic growth or by acquisition) is a common theme across the board.

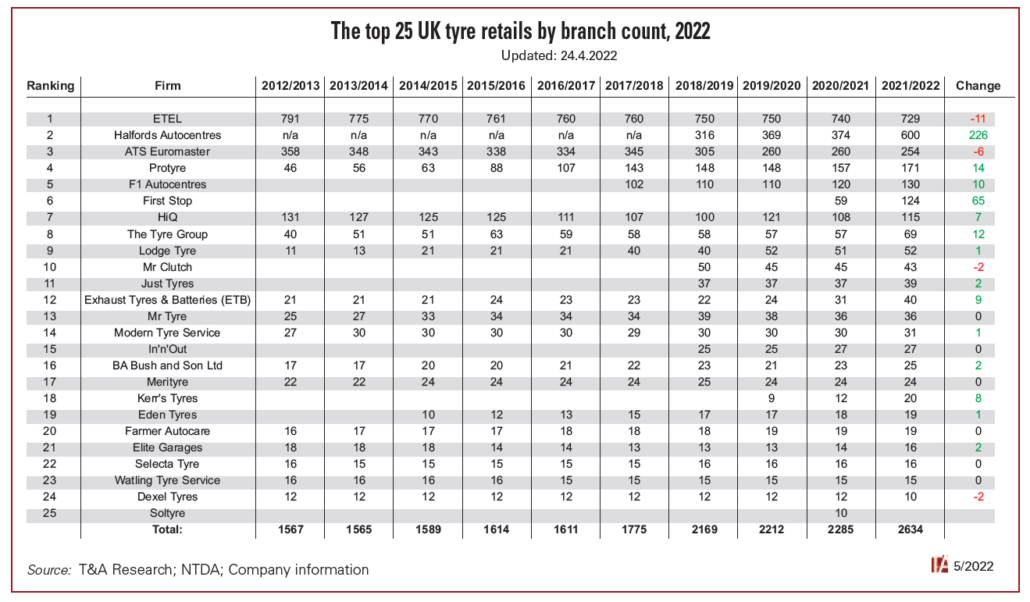

With so many changes taking place, as part of our annual tyre retail feature, Tyres & Accessories has put together a complete listing of the top 25 UK tyre retail operations sorted by branch count. The data comes directly from company spokespeople, the NTDA and/or published company information. This year’s edition is set in the context of a decade of comparative data showing how the growth of particular chains has developed and clearly illustrating key trends. One of the clearest overarching themes is that of scale. While there are an estimated 10,000 specialist tyre points of sale in the UK, more than a quarter (26.34% or 2634) of them come under the auspices of the top 25 tyre retailers. This compares with 2525 in 2021.

There has also been further consolidation at the top of the table. For example, the top five tyre retailers (ETEL, Halfords Autocentres, ATS Euromaster, Protyre and F1 Autocentres) now account for 1884 branches between them, up from 1651 this time last year. In other words, the top five represent 75 per cent of the top 25 on their own. Or, to put it another way, the top five equate to nearly a fifth of the total UK tyre retail specialists.

So, with all that in mind, here is a run-down of the latest details behind the 2022 tyre retail ranking:

European Tyre Enterprises Ltd (ETEL) – Still number one, the ETEL network totals 729 centres. While ETEL remains clearly the strongest player in the market, this year’s total is down 11 branches compared with 2021.

Commenting on the 2022 result, an ETEL spokesperson told Tyres & Accessories: “As was the case last year, we have exited some properties at the natural end of their leases and consolidated those operations with centres covering overlapping geographical areas.”

ETEL has also consolidated its tyre retail brand portfolio: “The last 12 months have also seen the removal of the Tyre City brand from our network and centres being rebranded to Kwik Fit and STS Tyre Pros. This was to simplify our portfolio to those two brands and our specialist network, Central Tyres. Although we have reduced the network size slightly over the last year, we are continually assessing potential new sites in locations which would meet our strategic objectives.”

By far the clearest developments have taken place at second-placed Halfords Autocentres. With a company spokesperson totalling the business’s branch count at 600, it is now clear that the company has thoroughly surpassed its previous target of 550 branches nationwide. Of course, much of this comes from the acquisition of the National Tyres and Autocare operation at the end of last year. However, with our retail chart showing that this year’s 600 branch total is 226 centres more than last year, it is clear that Halfords has added other branches in addition to National. And what’s more, T&A understands that the 600 branch figure is very much on the conservative side of things and the current total could actually be as high as 624.

Then there’s the company’s increasing focus on the commercial vehicle tyre side of the business, which continues to develop since the acquisition of McConnechy’s a few years back. The subsequent purchase of Universal as well as strategic appointments including ex-Bridgestone commercial director Greg Ward suggest there is more to come on in the commercial sector as well. And all these developments fit into the Halfords Group’s wider vision of creating motoring retail “fusion towns.” In answer to T&A’s questions, the Halfords Team commented:

“Halfords currently operates a fleet of nearly 450 mobile vans, of which it has over 240 consumer and light vehicle-focused mobile vans. It also operates an additional 190 vans to service its commercial operations. Its portfolio includes 600 garages across the UK.”

Regarding the future branding of all its newly-acquired branches, Halfords added: “The majority of…garages and vans are Halfords branded and the company are in the process of rebranding any acquired assets to Halfords in the coming months/years. We have been able to drive our mobile business with strong organic growth and customer demand for mobile services, alongside strategic acquisitions such as National Tyres.”

ATS Euromaster reports that it currently runs 254 tyre retail centres across the UK, a figure that puts it in third place nationally. This year’s total is six branches smaller, but no reasons have been given for that change.

“We are always looking to maximize our footprint so we are always looking for opportunities for new centres. We have opened and relocated a number of centres this year already”, an ATS Euromaster told T&A, commenting on the 2022 result and perhaps suggesting that ATS Euromaster is considering adding additional branches to its network via acquisition. Whether that turns out to be the case or not, there are clearly plans in place to stabilise growth for the future.

Protyre continued on its ongoing growth path during the last year, with the 2022 table showing that the Micheldever Tyre Services (and therefore Sumitomo Rubber Industries)-owned business added 14 more branches to its total. As a result, 171 Protyre branches are live across the UK. Growth continued as recently as 25 April 2022 when Mid Devon Tyres & Servicing Ltd became a Protyre operation. Based on the long-term trend, Protyre are likely to add another 10 to 15 branches during the course of the year, something that is taking it closer and closer to third-placed ATS Euromaster.

Formula One Autocentres grew at a similar rate and the current total stands at 128. However, with seven more planned during the next year, we can expect this figure to rise northward too.

We began our coverage of First Stop on this table last year on the basis that Bridgestone’s franchise network owns a significant amount of tyre retail directly via Exhaust Tyres & Batteries (ETB – see below) and because it is executing on ambitious plans for growth that are likely to impact the rest of the market. The latest data suggests that First Stop has more than doubled its previous total, adding 65 franchised branches by the end of 2021 and making a current total of 124.

Meanwhile, Goodyear’s HiQ tyre retail franchise operation has added seven branches to its number, which brings its total to 115, up seven from last year and securing seventh position on the ranking.

Despite the tragic death of founder Rob Freeman in 2021, The Tyre Group developed strongly during the last year. The group’s multi-brand retail network currently counts 69 branches in its number, up 12 from last year.

Lodge Tyre can also be counted among the many chains that grew during the course of the year, adding one branch to its number, which makes a running total of 52 branches. The latest addition is Lodge’s Hull branch, which has been open since February. But that is not the end of it, “a number of other expansion opportunities on the horizon”, according to the company.

10th placed Mr Clutch contracted by two branches resting on a total of 43.

Click here to find further details on the rest of the top 25:

- The UK’s leading retailers 2022 (#11 to #15)

- The UK’s leading retailers 2022 (#15 to #25) – New entries and stable growth

The complete text as well and table will be distributed alongside the June Tyres & Accessories magazine. Not a subscriber? No problem, click here to become one.

Comments