Pirelli Q1 EBIT up 35%, but full-year estimates revised down

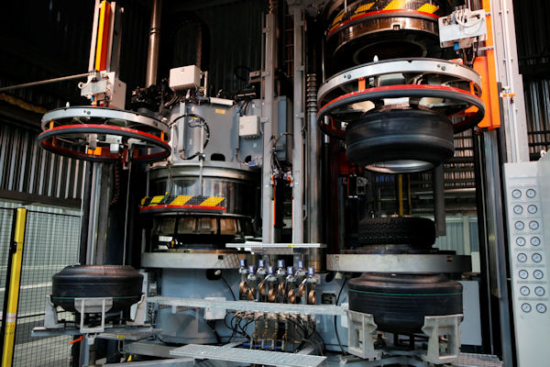

Pirelli has two plants in Russia - Kirov and Voronezh (Photo: Pirelli)

Pirelli has two plants in Russia - Kirov and Voronezh (Photo: Pirelli)

Pirelli & C. Spa has reported a strong set of first quarter 2022 results which show revenues and pre-tax profits (adjusted EBIT) were up 22.2 per cent and 35.4 per cent respectively despite considerable turmoil related to the war in Ukraine and the resultant sanctions against Russia, where Pirelli runs two tyre factories. However, the tyre manufacturer has also revised down full-year estimates due to the same “geopolitical tensions”.

Pirelli’s first quarter revenues totalled 1,521.1 million euros, up 22.2 per cent. That represents an increase of 19.0 per cent once foreign exchange effects amounting to 3.2 percentage points are taken into account.

The fact that what Pirelli calls “High Value revenues” amounted to 74 per cent of the total (up from 73 pe cent in first quarter 2021) is also good news and a continuing vindication of Pirelli’s top-end strategy. Indeed, Pirelli reports that pre-tax profits (adjusted EBIT) grew 35.4 per cent to 228.5 million euros in the first quarter of 2022 compared with 168.8 million euro in the first quarter of 2021. That makes an adjusted EBIT margin of 15.0% (Q1 2021: 13.6%).

Conflict mitigation measures

However, as good as the first quarter has been, questions remain about the impact of Russian sanctions on Pirelli’s business. According to the latest financial reports a series of steps are being taken to insulate Pirelli from the turmoil.

Pirelli has already suspended investments in its factories in Russia “with the exception of those intended for safety”. But the latest financial reports further suggest that the company “is gradually limiting its activities” in Russia. In 2021, Russia accounted for 3 per cent Pirelli of turnover and around 11 per cent of the group’s car capacity. About half of that is dedicated to exports.

Since the EU has already banned imports of Russian finished products into the EU and has banned exports of certain raw materials to Russia from the second half of the year, Pirelli has embarked on the “gradual activation of supplies of finished products from Turkey and Romania to replace Russian exports to European markets and use of mainly local raw material suppliers to replace European suppliers.”

Moving forward, the ongoing geopolitical tensions combined with lockdown-related drops in demand in China means “further measures” are planned. Details are scnat, but these will be “in addition to efficiencies and price/mix” in order to “compensate for the external scenario”.

Pirelli has also revised down its full year 2022 estimates. That means estimated revenue now stands at 5.9 – 6.0 billion euros (down from 5.6 to 5.7 billion euros); and adjusted EBIT margin is now expected to be around 15 per cent (previous that figure was projected to be between 16 and 16.5 per cent) explicitly due to Russia-Ukraine crisis and drop in demand in China.

Comments