Continental: Lower income despite strong tyre business in Q1 2022

(Photo: Continental)

(Photo: Continental)

Announcing its financial results for the first quarter of 2022, tyre maker and automotive technology firm Continental states that it “performed well” during the period despite “an increasingly turbulent market environment.” It describes its Q1 2022 tyre business as “strong.”

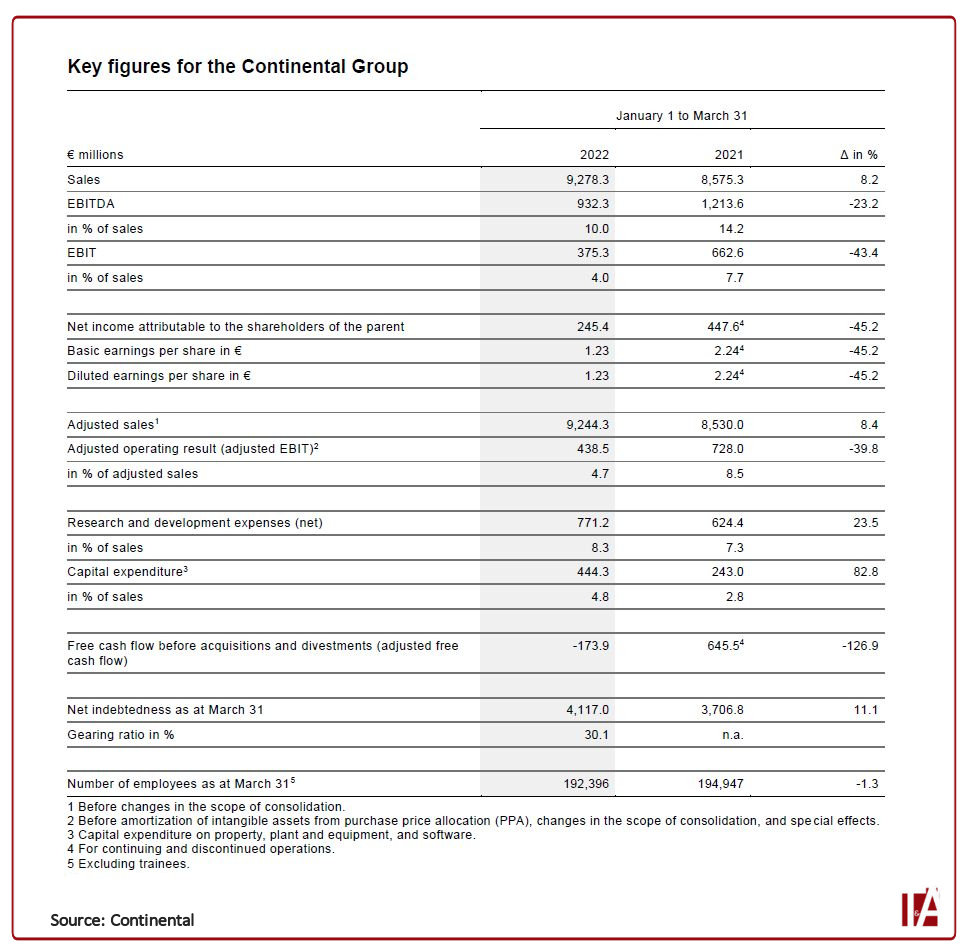

Operating in an environment in which external factors ranging from war to pandemic as well as component shortages and price rises presented major challenges, Continental achieved Q1 2022 consolidated sales of 9.3 billion euros, up 8.2 per cent on the first quarter of last year. Adjusted EBIT decreased 39.8 per cent year-on-year to 439 million euros, and adjusted EBIT margin shrank 3.8 percentage points to 4.7 per cent.

“The past quarter was overshadowed by the war against Ukraine and its drastic effects on already high energy prices and strained logistics chains and commodity markets. In addition, measures to contain the coronavirus pandemic, particularly in China, had an adverse effect on economic development. In view of the multiple challenges, we took various steps to minimise the impact on earnings,” states Nikolai Setzer, chief executive officer of Continental.

“Price increases in procurement and logistics affected us significantly in the first quarter. Despite this considerable headwind, we achieved a good result in the Tire business. For Automotive, we are confident that the measures taken will result in improved earnings over the course of the year.”

Continental reports taking “immediate action” to address the challenges it faced and to effectively maintain production and supply chains. For example, it has further diversified raw material sources, built up security stocks and reorganised its value chain in the electronics sector. Continental has also announced priced increases or, in its own words, is “working with its customers to share the burden of increased costs.”

Net income drops 45%

Net income amounted to 245 million euros in Q1 2022, compared with 448 million euros a year earlier. Adjusted free cash flow was -174 million euros.

“Adjusted free cash flow in the first quarter of this year was negative due primarily to higher procurement costs and inventory build-up. For the year as a whole, we anticipate an adjusted free cash flow of around 0.6 billion to 1.0 billion euros,” explains Katja Dürrfeld, chief financial officer of Continental. The higher inventories are the result of increased security stocks for raw materials and semi-finished products and the seasonal build-up in the tyre sector.

Europe weakness holds back automotive production

Global automotive production was significantly lower than in the first quarter of the previous year. Europe’s market for passenger cars and light commercial vehicles was, at 3.8 million units, 19.1 per cent lower. North America also recorded a slightly weaker start to the year compared with the previous year’s quarter, decreasing 1.8 per cent to 3.6 million units. In China, the production of passenger cars and light commercial vehicles was up 6.1 per cent year-on-year to 6.1 million units. According to preliminary figures, global production of passenger cars and light commercial vehicles fell by 4.5 per cent compared with the first quarter of 2021 to a total of 19.7 million units.

Group sector development

The Tires group sector achieved what Continental calls “a good result,” recording increased sales volumes in the car tyres and commercial vehicle tyres replacement business compared with the previous year. With sales up 20.1 per cent year-on-year, to 3.3 billion euros, it achieved an adjusted EBIT margin of 17.1 per cent, an 0.5 per cent improvement. (Inventory valuation had a positive effect of around 200 million euros on earnings due to increased acquisition and production costs.

Weak automotive production in conjunction with increasing procurement and logistics costs impacted the Automotive group sector in particular. Its year-on-year sales increased by 3.2 per cent, to 4.2 billion euros. After adjusting for exchange-rate effects and changes in the scope of consolidation, it posted organic sales growth of -1.2 per cent. Continental’s Automotive group sector nonetheless outperformed the market, with global automotive production falling by 4.5 per cent in the first quarter of this year. Adjusted EBIT margin was -3.9 per cent (Q1 2021: 2.4 percent).

Considerable cost increases for procurement and logistics also affected the ContiTech group sector, which posted sales of 1.6 billion euros, a 3.3 per cent increase on the first quarter of last year. The adjusted EBIT margin dropped 4.8 percentage points to 5.4 per cent.

Expectations for fiscal 2022

Continental anticipates that market developments will continue to be characterised by high volatility in the coming months. After a production output of 77.1 million passenger cars and light commercial vehicles worldwide last year, Continental expects an increase of between four and six per cent for the year as a whole, thus paring back its prior expectation of six to nine per cent. Negative effects from cost inflation for key inputs, especially for oil-based raw materials as well as for energy and logistics in Tires and ContiTech, continue to become significantly more material.

Continental has therefore adjusted its outlook for the year as a whole, as reported on 21 April 2022. Consolidated sales are now expected to be around 38.3 billion to 40.1 billion euros (previously: around 38 billion to 40 billion euros), and the adjusted EBIT margin is expected to be around 4.7 to 5.7 per cent (previously: around 5.5 to 6.5 per cent).

For the Tires group sector, Continental expects sales of around 13.8 billion to 14.2 billion euros (previously: around 13.3 billion to 13.8 billion euros) and an adjusted EBIT margin of around 12.0 to 13.0 per cent (previously: around 13.5 to 14.5 per cent). This includes a year-on-year increase in procurement and logistics costs of around 1.9 billion euros (previously: around 1 billion euros).

For the Automotive group sector, Continental expects sales of around 17.8 billion to 18.8 billion euros (previously: around 18 billion to 19 billion euros) and an adjusted EBIT margin in the range of around -0.5 to 1 per cent (previously: around 0 to 1.5 per cent). This still includes higher procurement and logistics expenses of around 1 billion euros as well as additional expenses for research and development of around 100 million euros in the Autonomous Mobility business area.

For the ContiTech group sector, sales of around 6.3 billion to 6.5 billion euros (previously: around 6.0 billion to 6.3 billion euros) and an adjusted EBIT margin of around 6.0 to 7.0 per cent (previously: around 7.0 to 8.0 per cent) are expected. This includes a year-on-year increase in procurement and logistics costs of around 600 million euros (previously: around 300 million euros).

Capital expenditure before financial investments is expected to total around six per cent of sales (previously: less than seven per cent).

Adjusted free cash flow is expected to be around 0.6 billion to 1.0 billion euros (previously: around 0.7 billion to 1.2 billion euros).

Remaining tension or a worsening in the geopolitical situation, particularly in Eastern Europe, could result in “further lasting consequences for production, supply chains and demand.” In addition, Continental anticipates that further negative effects could arise as a result of the ongoing coronavirus pandemic and the related supply situation. “Depending on the severity of the disruption, this may result in lower sales and especially earnings in all group sectors as well as for the Continental Group compared to the prior year.”

ETB

ETB

Comments