SUV tyre sell-out value up 12 per cent in 2021

All the data suggests the market is becoming an increasing diverse and increasing high-performance segment (Photo: Lloyd Freeman; Pexels)

All the data suggests the market is becoming an increasing diverse and increasing high-performance segment (Photo: Lloyd Freeman; Pexels)

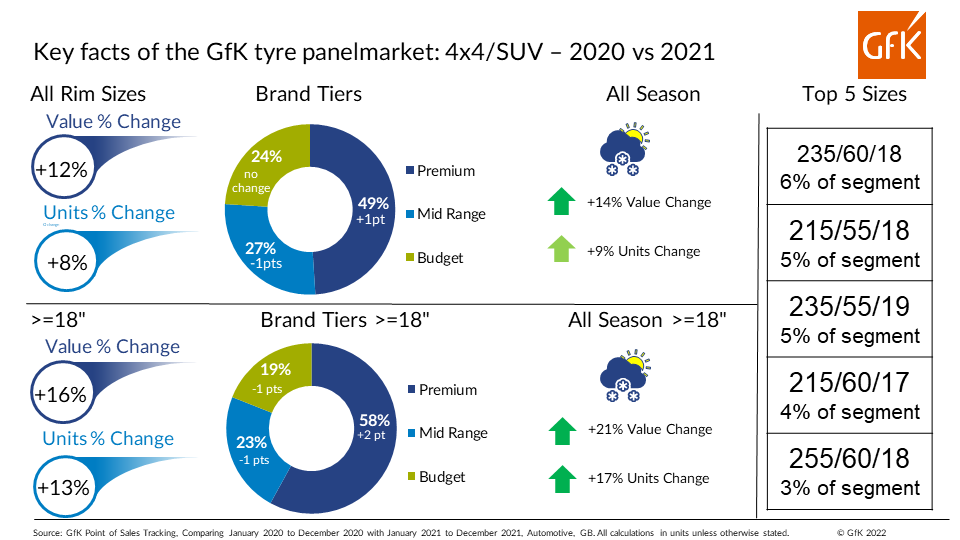

During 2020, the whole of the sell-out market declined albeit not as badly as was feared. Still, with the exception of some distinct niches – such as instances in the logistics industry where tyre service providers were kept busy throughout the lockdowns – everyone was affected. SUV tyres were no different and saw overall value and volume figures fall 12 per cent, according to market analyst GfK’s January to December 2020 panelmarket data. 2021, however, was almost the mirror image of 2020 with the value of UK 4×4 and SUV tyre sales up 12 per cent compared with the equivalent full-year 2020 data. In other words, SUV tyre sales returned to growth mode in 2021, something that sets 2022 up for an even better year for those selling SUV and 4×4 tyres.

12 per cent growth in sales value in a market as lucrative as SUV and 4×4 tyres is obviously a headline-grabbing figure. The context makes it even more interesting. Comparing GfK’s GB Automotive panelmarket data for the period between January 2020 to December 2020 with the same data for January 2021 to December 2021 shows that while the value of the market was up 12 per cent, volume was up 8 per cent. At first glance one might think that the ideal scenario would be that the market was up 12 per cent on both counts – firstly, because 12 per cent growth equates to almost complete post-pandemic recovery; and secondly, because businesses want to be as effective as they can in both pound notes and volumes. However, upon closure consideration, the market is actually in better shape with its present figures than with 12 per cent growth in both volume and value. That’s because the data means income generated per sale is up significantly. When you consider that the UK rate of inflation was 6.2 per cent at the time of going to press and tyre manufacturers have put out several price increase notices recently, it is not surprising that prices have gone up at the point of sale. But we’ll have to look closer at the data to understand more about why that’s the case.

As well as showing the percentage growth of the panelmarket in both value and volume during the last 12 months, GfK’s data is split out terms of sizes of 18 inches in diameter and over as means of breaking out the high-performance sector from the rest of the market. However, since four out of the five top sizes in the segment are 18-inches and over and only out-and-out off-road tyre ranges are 16 inches in diameter nowadays, there is an argument in favour of separating out 4×4 and SUV in order to have a better view of each of the two sub-segments down the line.

Column two illustrates brand segmentation in the 4×4 and SUV sector. Once again this is shown in terms of both the whole market, compared with the 18-inch and above UHP sub-sector. Column three shows the percentage growth of the all season 4×4 and SUV panelmarket. Like the overall panelmarket picture, this is broken down in terms of volume and value during the last 12 months and then split by all sizes greater than 18-inch. And finally, column four lists the top five 4×4 and SUV panelmarket sizes.

What the 18-inch panelmarket figures tell is that larger and often UHP fitments are growing considerably faster than the already-healthy segment as a whole. To be specific, the 18-inch plus sub-sector is up 16 per cent in terms of value and 13 per cent in terms of volume. And therefore, what can be said about the increase in growth and opportunity in the overall market is even more apparent in the UHP sub-sector.

More diverse and more high-performance – the changing shape of SUV tyres

After the headline figure growth figures, arguably the next most significant developments relate to what might be called the shape of the SUV tyre segment. The top five sizes have remained basically the same for several years, but this year there have been one or two changes.

During 2021 the top five sizes accounted for some 24 per cent of the overall market. It was the same in 2020, but this year the top two accounted for more than half of that (13 percentage points). This year, the same top two sizes (235/60 R18 and 215/55 R18) accounted for 11 percentage points, a roughly 20 per cent slide. As a result, the top five sizes occupy a more similar share than they did last year.

2021 also saw an increase in the influence of 235/55 R19, which is the clearest high-performance size in the top five. It now represents some 5 per cent of the SUV and 4×4 market, up 25 per cent from its 4 per cent share last year. As a result, 235/55 R19 is now the third most popular SUV and 4×4 size in the panelmarket, suggesting the segment is becoming an increasingly high-performance orientated setting.

215/60 R17 stayed static in fourth place, with a 4 per cent share of the panelmarket.

At the same time, 225/60 R18 is a new entry into the top five, with a three per cent share of the panelmarket. One consequence of that development is that 225/55 R18, which previously held a 3 per cent share in 2020, has now dropped out of the top five.

The increasingly squeezed middle

As far as segmentatisation is concerned, the long-established trend of the squeezed middle has only increased during the last year. The full-year 2021 data shows that mid-range tyres occupied a 27 per cent share of the SUV and 4×4 panelmarket compared with a 28 per cent share the year before. Despite the economic pressure of the pandemic and overall economic inflation, this 1 percentage point of share was won by the premium end of the market and not the budget side of the equation.

It is similar story in the high-performance SUV and 4×4 tyre panelmarket only more pronounced. Here premium tyre share grew by two percentage points to 58 per cent of the panelmarket. Mid-range worked out as 23 per cent (down 1 percentage point) and budget 19 per cent (down 1 percentage point).

In other words, the mid-range is continuing to be squeezed buy premium brand sales, a trend that is especially clear in the UHP sub-sector. And since the value of the market is growing faster than its volume, price increases aside, increased premium share is another explanation.

Fastest growth in UHP all-season

2020 aside, the trend towards all-season SUV and 4×4 tyres has been clear for a few years now. And while market volumes and values may have been down a few points last year, the latest data shows rapid all-season growth of 14 per cent in value and 9 per cent in volume during 2021. Once again, that trend is even more pronounced in the UHP sub-sector. Here, value growth was up 21 per cent in 2021 and unit volumes were up 17 per cent. Since overall market growth didn’t quite return to pre-pandemic levels during 2021, and since all-season growth markedly outperformed overall growth, it is fair to say that the SUV and 4×4 panelmarket is becoming an increasingly all-season setting.

Taking all the data into account and having compared it to the equivalent information from 2020, it is basically good news on all fronts. The market is growing in terms of both volume and value. That is especially clear in the UHP sub-segment where premium tyre sales are gaining market share at twice the rate of the overall market. At the same time, market size breakdowns reveal that the top of the market is increasingly high-performance and diverse in its make-up. All of this combined with the growing influence of all-season tyres means the SUV and 4×4 market is as full of opportunity as it has been for tyre retail businesses.

Comments