Michelin: Q1 sales up 19% to 6.5 billion euros

Michelin’s first quarter 2022 earnings bridge

Michelin’s first quarter 2022 earnings bridge

Michelin Group has reported that its first quarter 2022 sales amounted to 6.5 billion euros, a 19 per cent increase on the first quarter of 2021. According to the company, price increases and strengthening replacement demand helped it offset headwinds including operation disruptions and inflationary pressures exacerbated by the conflict in Ukraine plus the resurgence of Covid-19 in China.

However, growth rates varied within the quarter, with “robust gains in January and February” and a sudden contraction in March in parallel with the conflict in Ukraine and the rebound in Covid-19 cases in China.

Passenger car and light truck tyre markets edged up 2 per cent year-on-year during the period. Meanwhile, truck tyre markets rose by 4 per cent excluding China, where demand fell 37 per cent year-on-year,

At the same time, demand trended upwards in all the specialty tyre markets, in an environment constricted by the ability to fulfil customer orders, especially for mining tyres, language that suggests fill rates have been affected by the global pressures facing the macro tyre markets. However, during the first quarter results conference call, executives said inventory levels remained in line with averages.

Price increases key to first quarter 2022 sales growth

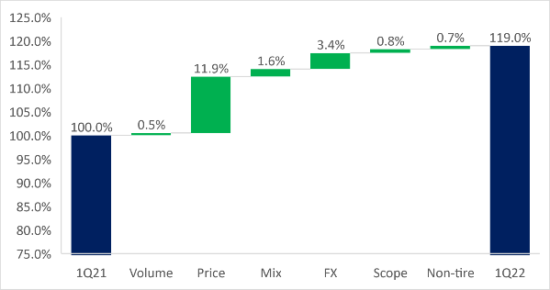

A number of factors contributed to Michelin positive first quarter 2022 figures, but price increase arguably played the biggest role. According to Michelin, price increases accounted for “a sharp 11.9 per cent gain from higher tyre prices as the group pursued its dynamic price management in response to steeply rising energy, logistics and raw material prices”.

Better tyre mix led by faster growth in replacement sales in the passenger car and light truck segments compare with the comparable OE sector led to a 1.6 per cent gain. Followed by: 0.5 per growth in tyre volumes; a 0.8 per cent gain from changes in scope, mainly reflecting the first-time consolidation of Allopneus.com and 11.9 per cent growth in Michelin’s non-tyre businesses.

As a result, despite all the uncertainties, Michelin maintained its ongoing business guidance, saying: “markets are still expected to see growth yet at the low end of the initially indicated ranges – 0 to 4 per cent in Passenger car and Light truck tyres, 3 to 7 per cent in truck tyres (excluding China) and 6 to 10 per cent in the specialty businesses. The bottom line is that Michelin continues to expect full-year segment operating income “above 3.2 billion euros…and structural free cash flow of more than 1.2 billion euros.

Sales figures outperform analyst expectations

Analysts responded positively to Michelin’s latest financials, concluding that they outperformed analyst expectation. They also reiterated that growth was driven by price and mix (which came in ahead of estimates) rather than volumes (which came in behind estimates) and were described as “almost flat (+0.5%)”. In an investor’s note dated 27 April 2022, Jefferies analysts highlighted that the 11.9 per cent contribution price played in Michelin’s first quarter 2022 growth represents “a sequential step-up of price/mix compared to Q4 (+11.4%)”.

Referring to Michelin’s guidance reiteration, the analysts interpreted the company’s cautious volume projections as implying “group volume impact of 2-6 per cent” on the basis that “Michelin is guiding to grow in line with the markets”.

Despite the obvious cautionary role of the unknowns, the analysts highlighted some potential positive news moving forward: “We estimate foreign exchange to have a positive impact of circa 300 million euros on adjusted [pre-tax profits, namely earnings before interest and taxes] EBIT in 2022. Hence, Q1 results and guidance indicate small upside to consensus, in our view.

Michelin made less than 2 million tyres a year in Ukraine before war

On the subject of unexpected disruptions, Michelin reported that its Ukraine/Russia exposure is less than 2 million units produced in Russia, which equates to around 1 per cent of its automotive tyre capacity. However, Michelin’s Russia tyre production operations were suspended in mid-March.

According to executives, the known-on effects of the Russia-Ukraine war led to an average of three days of production shut downs across Europe, but that has not affected Michelin’s market share. In line with European tyre manufacturing averages, Michelin sourced around 30 per cent of carbon black from “Eastern Europe”, according to Jefferies – something that is likely to mainly refer to Russia and Belarus. In order to address the sanctions-related carbon black sourcing deficits, Michelin expects re-sourcing to other regions will be completed by June.

Point S

Point S

Comments