Pirelli stops new investment in Russia, puts brakes on tyre manufacturing in Russia

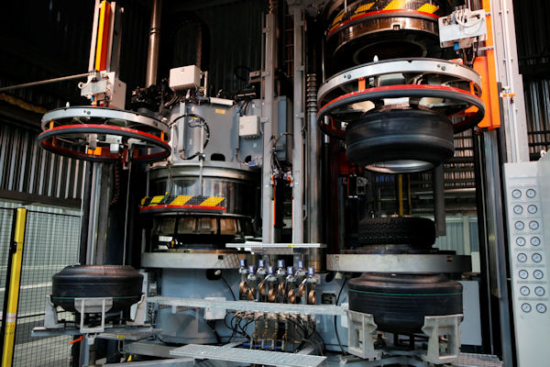

Pirelli has two plants in Russia - Kirov and Voronezh (Photo: Pirelli)

Pirelli has two plants in Russia - Kirov and Voronezh (Photo: Pirelli)

Pirelli has stopped investment in the Russian market. At the same time, Pirelli is phasing down production at its two Russian tyre plants – Kirov and Voronezh. Writing in a statement published on 18 March 2022, executives confirmed that they have stopped investment in Russia “excluding those linked to security”. At the same time, Pirelli executives said: “activities of the factories in Russia will be progressively limited to those needed to guarantee the financing of salaries and social services for employees.”

Pirelli’s two Russian tyre factories produce around 10 per cent of the company’s global tyre output, according to a recent Yale University School of Management report that also classified the company’s reaction to the war in Ukraine. As of 17 March, Yale University ranked Pirelli’s response to sanctions as fourth on a four-point scale, describing the company then positions as “Digging In – Defying Demands for Exit or Reduction of Activities”. By comparison, Bridgestone and Continental are both described as “scaling back” and ranked on the second level; and Michelin’s response is placed on the third level and described as the “suspension” of activities.

Pirelli’s decision to suspend new investment in Russia follows the calling out of Pirelli Tyre Ltd in the British Parliament by Labour MP Chris Bryant. Speaking on 17 March, Bryant said: “May I ask for a debate on those who are not pulling their weight in delivering sanctions on Russia over Ukraine…There are also British companies that are still doing business in Russia, like Subway, Pirelli and Baker Tilly…” The Pirelli brand has also been subject to some criticism of its stance on social media. Pirelli representatives have not responded to requests for comment on their reaction to critical hashtags, however such criticism is also noticeably less intense in the days since Pirelli suspension of new investment in Russia.

Since Pirelli’s 18 March announcement, as of 21 March, Yale has added a fifth level of its scale. Keeping Pirelli on level four, the updated table describes Pirelli’s current position as having suspended “new investments in Russia”, and further characterises it as “Buying time – holding off new investments/development”.

In order to manage the ongoing situation in Russia, Pirelli has constituted a “Crisis Committee” to “constantly monitor the development of the Russia-Ukraine crisis for which mitigation actions and a contingency plan have already been activated.”

Referring to earlier financial projections that suggested the war in Ukraine would have only a limited impact on Pirelli’s financial results, executives hinted that they would downgrade estimates:

“That analysis assumed the persistence of February level energy and oil prices until the end of the year, as well as the potential impact on local operations linked to imports and exports to and from Russia of raw materials and finished goods.

“In the analysis of this scenario, which does not take into account the idea of a total interruption of the import and export flows from Russia and a recessionary scenario in Europe because of an escalation of geopolitical tensions, the guidance for profitability and cash generation would be positioned in the lower part of the range (adjusted EBIT around 890 million euros and cash generation before dividends around 450 million euro).” In other words, energy and logistics challenges are actually more challenging than they were in February.

In addition, Pirelli reinforced its humanitarian message too: “Pirelli is against this war and is supporting the Ukrainian population with a donation of 500,000 euro and facilitating the collection of funds among employees.”

Triangle

Triangle

Comments