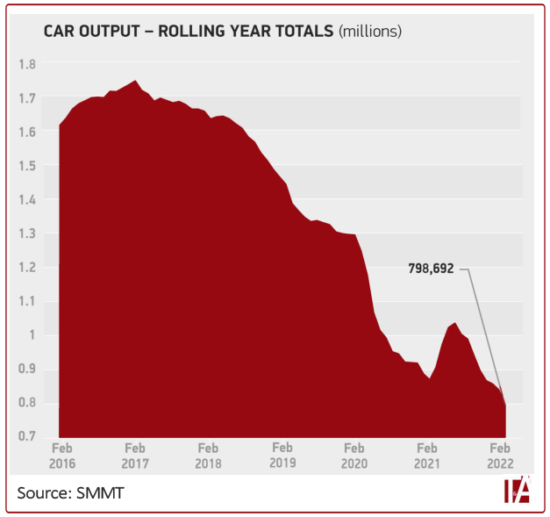

Car production falls for 8th consecutive month

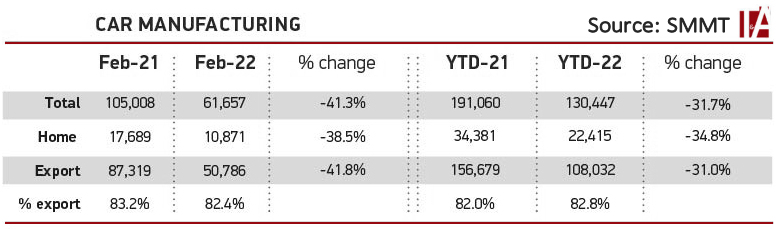

UK car production fell 41.3 per cent in February, with the Society of Motor Manufacturers and Traders (SMMT) reporting the manufacture of 61,657 units during the month, 43,351 fewer cars than were made than in February 2021. This reduced output was primarily due to the persistent global shortage of semiconductors causing some factories to pause production, as well as the loss of output following the closure of a major plant in Swindon last summer.

In what was the weakest February for UK car makers since 2009, production declined for both the domestic and overseas markets, down 35.8 per cent and 41.8 per cent respectively. Exports accounted for more than eight in ten cars made, with 62.4 per cent of shipments heading into the European Union, equivalent to 31,673 units. The US, in comparison, took 11.0 per cent of exports, and China 8.7 per cent. UK production of the latest electrified vehicles continued apace with plug-in hybrids, hybrids and battery electric cars combined representing 25.8 per cent of all production in the month, or 15,905 units.

Radical transformation

“The automotive industry is undergoing its most radical transformation in more than a hundred years, but manufacturers are simultaneously facing the most extreme operating conditions as global economic headwinds drive up costs and constrain supply,” says Mike Hawes, SMMT chief executive. “The sector entered 2022 hopeful for recovery, but that recovery has not yet begun, and urgent action is now needed to help mitigate spiralling energy costs and ensure the sector remains globally competitive to encourage the investment essential to growth, job security and the delivery of net zero ambitions.”

Against an already tough economic backdrop, the Russian state’s invasion of Ukraine at the end of February represents a further challenge for the UK automotive sector. Although, in 2021, Russia took just 1.1 per cent of UK car exports and Ukraine just 0.5 per cent, many critical raw materials, parts and components, including aluminium, palladium and nickel, which is used in battery manufacturing, and wiring harnesses, are sourced from the region. The sanctions imposed are supported by the industry but raise additional challenges to the sector in the medium to long-term.

Comments