A “good result” – Continental returns to the black in 2021

CEO Nikolai Setzer & CFO Katja Dürrfeld (Photo: Continental)

CEO Nikolai Setzer & CFO Katja Dürrfeld (Photo: Continental)

Although chief executive officer Nikolai Setzer believes the past financial year was “a very trying one” for Continental and a period presenting “many challenges,” the tyre maker and automotive solutions company nonetheless managed to achieve a positive net income in 2021 after two consecutive years of losses.

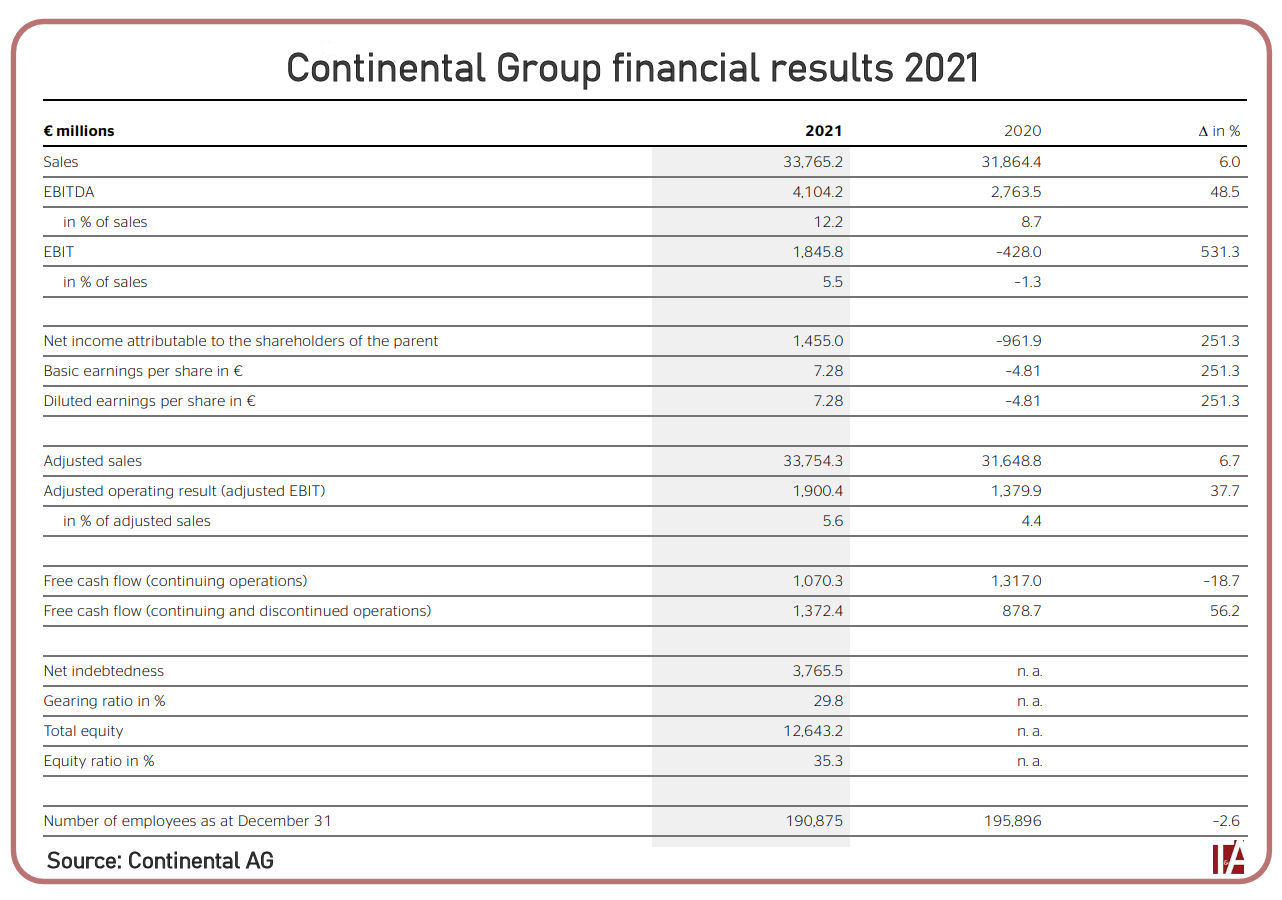

According to preliminary figures, Continental earned consolidated sales of 33.8 billion euros in 2021, a 6.0 per cent increase year-on-year. In a “persistently challenging” market environment, adjusted EBIT amounted to 1.9 billion euros, up 37.7 per cent on 2020 and corresponding to an adjusted EBIT margin of 5.6 per cent.

“While the low production level worldwide has had a negative impact, particularly on our automotive business, our Tires and ContiTech sectors achieved a good result despite massive cost increases in the areas of procurement and logistics,” said Setzer.

Following a negative net income in the previous year (-€962 million) resulting from incurred expenses and impairments on property, plant and equipment, Continental achieved a net income of 1.5 billion euros in 2021. The free cash flow before acquisitions, divestments and carve-out effects for continuing and discontinued operations amounted to 1.2 billion euros.

“Based on our net income and our stable cash flow situation, we are proposing to the Annual Shareholders’ Meeting a dividend of 2.20 euros per share, in line with our dividend policy,” said Katja Dürrfeld, Continental’s chief financial officer.

Expectations for fiscal 2022

Should the geopolitical situation, in particular in Eastern Europe, remain tense or even worsen, production, supply chains and demand will feel the effect of “lasting consequences.” Depending on the severity of the disruption, Continental anticipates that this may result in lower sales and earnings in all group sectors as well as for the Continental Group compared to 2021.

Not including these risks, Continental expects that global production of passenger cars and light commercial vehicles will increase by six to nine per cent in 2022. In 2021, this increased year on year by only around three per cent to approximately 77 million vehicles as a result of the semiconductor shortage. The company also anticipates higher procurement and logistics costs of around 2.3 billion euros.

On the basis of these assumptions regarding market and industry trends for 2022, Continental anticipates consolidated sales of around 38 billion to 40 billion euros and an adjusted EBIT margin of around 5.5 to 6.5 per cent. The company however expects that business will “gradually improve following a subdued start to the year.”

For the Automotive group sector, Continental forecasts sales of around 18 billion to 19 billion euros with an adjusted EBIT margin of around 0 to 1.5 per cent.

For the Tires group sector, Continental expects sales of between around 13.3 billion and 13.8 billion euros with an adjusted EBIT margin ranging between 13.5 and 14.5 per cent.

For the ContiTech group sector, Continental expects sales of between around 6.0 billion and 6.3 billion euros with an adjusted EBIT margin ranging between 7.0 and 8.0 per cent.

Capital expenditure before financial investments is forecast to be below seven per cent of sales. Free cash flow before acquisitions and divestments (adjusted free cash flow) of between around 0.7 billion and 1.2 billion euros is expected.

Mid-term targets confirmed despite unsatisfactory financial performance

“We are in the midst of a fundamental transformation,” stated Katja Dürrfeld. “And we want to emerge from it as winners. We are not satisfied with our current financial performance. Accordingly, we will rigorously implement our strategy and increase our profitability. We therefore firmly stand by the medium-term targets that we published at the end of 2020.”

These include an adjusted EBIT margin of between eight and 11 per cent.

Comments