Positive start’ to 2022 new car sales, but overall market levels still low

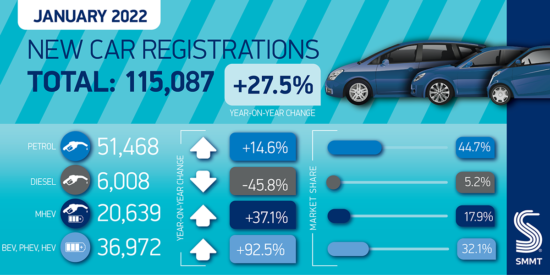

The UK automotive sector recorded a positive start to 2022 as 115,087 new cars were registered, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT). Registrations were up by more than a quarter (27.5 per cent) on January 2021, when lockdown restrictions kept car showrooms shut.

However, the market remains well below pre-pandemic levels, -22.9 per cent lower than in January 2020, as chip shortages in particular continue to impact supply.

The growth was driven by private buyers, as manufacturers sought to prioritise these customers given the supply constraints, with this segment of the market registering 62,300 new cars, up 64.1 per cent, year on year – and just -5.6 per cent off pre-pandemic levels. Large fleet registrations, meanwhile, remained broadly flat with last year at 50,817 units (down -0.4 per cent).

Electrified vehicles continue to bolster the growth, with battery electric (BEV), plug-in hybrid (PHEV) and hybrid (HEV) cars accounting for 71.5 per cent of the uplift in registrations. Plug-in vehicles enjoyed another bumper month, with 14,433 BEVs and 9,047 PHEVs registered, equal to some 20.4 per cent of the market. With 13,492 HEVs also registered, almost one in three new cars joining British roads in January was electrified.

Despite the challenges of 2021, with manufacturers battling against global semiconductor shortages, new trading arrangements and Covid impacts, including shuttered showrooms and staff shortages, it was a record year for zero and ultra-low emission vehicles. As a result, new data shows that average new car CO2 emissions fell by -11.2 per cent, to its lowest ever recorded level of 119.7g/km.

There are now more than 140 plug-in car models available to UK buyers, with almost 50 more scheduled for release in 2022. Cutting CO2 even further, however, will require more drivers to switch to electric and other zero emission technologies. One of the obstacles remains perceptions of a lack of charging infrastructure, which must be built ahead of demand – and that demand is increasing exponentially. Furthermore, as manufacturers strive to bring down the costs of these new technologies, government support through purchase incentives and reduced motoring taxes can help accelerate the take-up so that the road transport sector can meet society’s net zero timeline.

The rapid pace of change is underlined by the latest market outlook, which forecasts registrations of BEVs and PHEVs to grow by 61 per cent and 42 per cent respectively in 2022, meaning that, by the end of the year, almost one in four new cars would come with a plug. Overall, total new car registrations are expected to rise 15.2 per cent on 2021, to 1.897 million units. This is a downward revision from October’s outlook of 1.96 million, as the ongoing semiconductor shortage, increasing costs of living and rising interest rates are expected to dampen some demand in 2022. A 2022 market of 1.897 million would still be down -17.9 per cent on the pre-pandemic 2019, but the recovery is expected to continue into 2023, with the market projected to climb above two million units for the first time since 2019.

Mike Hawes, SMMT Chief Executive, said, “Given the lockdown-impacted January 2021, this month’s figures were always going to be an improvement but it is still reassuring to see a strengthening market. Once again it is electrified vehicles that are driving the growth, despite the ongoing headwinds of chip shortages, rising inflation and the cost-of-living squeeze. 2022 is off to a reasonable start, however, and with around 50 new electrified models due for release this year, customers will have an ever greater choice, which can only be good for our shared environmental ambitions.”

NFDA “confident that demand will pick up”

Commenting on the SMMT figures, Sue Robinson, Chief Executive of the National Franchised Dealers Association (NFDA), which represents franchised car and commercial vehicle retailers in the UK, said: “Despite the continued supply constraints, new car sales rose 27.5 per cent in January as last year’s market was heavily affected by the lockdown; positively, 85 per cent of franchised dealers are optimistic about levels of consumer demand in the year ahead”.

NFDA’s figures indicate that dealers are generally more optimistic now than they were in December.

Overall registrations were driven by demand from private buyers, up by 64.1 per cent from last year, whilst fleet remained stable.

Sales of electrified vehicles performed well, in particular, Battery Electric Vehicles (BEVs) were up 130.6 per cent, Plug-In Hybrid Electric Vehicles (PHEVs) rose 47.3 per cent.

Sue Robinson added: “It is encouraging to see that demand from private consumers drove the market in January, with extremely strong performances in the EV segments. At the same time, as customers come to terms with new vehicles’ lead times, also the used car market remains robust.

“To ensure sustained growth in the electric vehicle market as more models become available, NFDA encourages consumers to visit an Electric Vehicle Approved dealer where experts can help overcome any uncertainties around switching to EV.

“Last year, as showrooms were closed, retailers relied on online sales and click & collect; however, the majority of franchised dealers reported that the volume of online enquiries in January was stable or, in most cases, up from the same period in 2021, showing that consumer appetite is buoyant.

“Going forward, there is confidence that demand will pick up further as supply improves”.

Comments