Goodyear reports 42% net sales increase in 2021, EMEA back in black

Source: Goodyear

Source: Goodyear

The Goodyear Tire & Rubber Company has reported full-year 2021 net sales of $17.5 billion, a 42 per cent increase on 2020. According to Goodyear, this was primarily due to “the Cooper Tire merger, higher volume, improvements in price/mix and increased sales from other tyre-related businesses.”

Tyre unit volumes totalled 169.3 million, up 34 per cent from 2020. Replacement tyre shipments increased 41 per cent. This growth included additional tyre unit volume related to the Cooper Tire merger, which closed on 7 June 2021 and brought with it improved market share. Original equipment volume increased 13 per cent, driven by higher global vehicle production in the second quarter and market share gains.

Goodyear’s 2021 net income was $764 million ($2.89 per share) compared to a net loss of $1.3 billion ($5.35 per share) in 2020. This figure includes “amortization of Cooper Tire inventory step-up adjustments of $110 million and transaction and other costs of $56 million (both in connection with the Cooper Tire merger)”, so the suggestion is that further profitability is possible in a scenario without these one-off items.

In addition, Goodyear’s 2020 net income included, “a non-cash impairment charge of $182 million to reduce the carrying value of goodwill in the Europe, Middle East and Africa business” and “a non-cash asset impairment charge of $148 million to reduce the carrying value of an equity interest in TireHub”.

Goodyear’s strong 2021 figures were driven by its post-integration fourth-quarter results – some of which were the best for a decade. Specifically, Goodyear’s fourth quarter 2021 sales were $5.1 billion, up 38 per cent from a year ago. Period tyre unit volumes totalled $48.6 million, up 29 per cent from the prior year’s period.

And all this resulted in a greater than eight-fold increase in fourth quarter net income ($553 million in Q4 2021 compared to $63 million a year ago.

EMEA returns to profitability

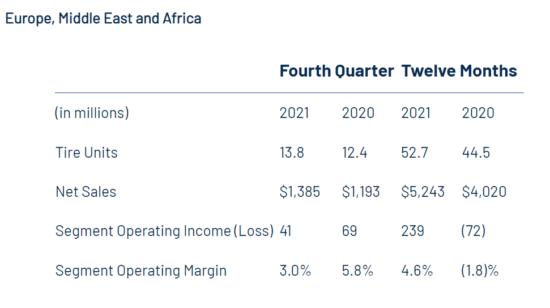

Goodyear’s Europe, Middle East and Africa’s (EMEA) business reported that fourth quarter 2021 sales increased 16 per cent from last year to $1.4 billion, primarily due to improvements in price/mix and the Cooper Tire merger. Here unit volume increased 11 per cent and replacement tyre unit volume rose 24 per cent. Excluding the impact of the Cooper Tire merger, European consumer replacement volume increased 22 per cent, driven by market share gains. However, original equipment unit volume decreased 22 per cent, reflecting lower vehicle production. However, perhaps the main news was that EMEA’s full-year figures show that segment returned to profitability by turning a 2020’s $72 million loss into a $239 million profit in 2021.

“We achieved our highest fourth quarter revenue in nearly 10 years as demand for our products remained strong and we captured higher selling prices,” said Richard J. Kramer, chairman, chief executive officer and president. “With the addition of Cooper Tire, our merger-adjusted segment operating income was significantly above last year and over 60% higher than fourth quarter 2019.”

“Looking ahead, we expect inflationary pressures to persist over the next several quarters. We remain focused on executing strategies to capture value in the marketplace and managing our costs,” continued Kramer.

“We are pleased with the pace of our integration of Cooper Tire and we continue to make solid progress toward the increased synergy targets we shared in November,” added Kramer. “I am confident we have positioned our business to deliver strong sales and earnings growth over the long-term.”

Comments