Titan International shares up 49% after market consolidation reports

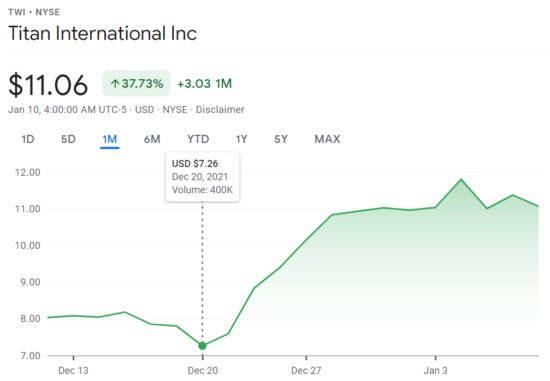

Titan International shares rallied after chairman Morry Taylor published comments on the news that Trelleborg Wheel Systems is for sale. (Photo: Google Finance)

Titan International shares rallied after chairman Morry Taylor published comments on the news that Trelleborg Wheel Systems is for sale. (Photo: Google Finance)

What a difference a month makes. Titan International shares are trading 49 per cent higher now than they were before Christmas. The difference? The news that competitor Trelleborg is in talks with “external parties” relating to the sale of its Trelleborg Wheel Systems (TWS) industrial/OTR tyre business and subsequent market comments publish by Titan chairman Morry Taylor.

Writing roughly a week after the reports emerged, Morry Taylor concluded that reported TWS suitor Yokohama had either over-valued TWS or that the market had undervalued Titan. His argument is that the apparent US$2 billion bid for TWS should be measured against his estimate that TWS will report about $1.4 billion in annual revenue for 2021.

Here’s how financial reports at Motley Fool reported the details on 22 December 2021: “With Titan expecting sales to surpass $2 billion in 2022, Taylor argued that his company should arguably have a higher price than Trelleborg. Yet even at the $2 billion reported price, Titan’s stock would trade above $24 per share — compared to the $9 it fetches now.”

Titan shares traded at $8.04 when the Trelleborg/Yokohama news first emerged on 14 December 2021. A day later that figure rose slightly to $8.18. By 20 December 2021 any gains had been wiped out by an 11.25 per cent drop, leaving the price at $7.26. A couple of days later Taylor published his remarks on 22 December and the price rallied immediately, hitting $10.84 at the time of going to press on 10 January 2021, a huge 49 per cent up on the stock’s pre-Christmas low point.

In a separate market commentary on 9 December 2021, Morry Taylor commented: “There are potential acquisitions that could be interesting for us, so it is a very exciting time at Titan heading into 2022.”. However, up till now Titan International haven’t said any more about which “potential acquisitions” the company is referring to.

Comments