Is Britain really the 4th largest PCR tyre market in Europe?

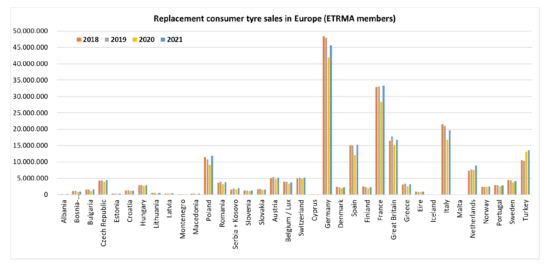

The overall trends illustrated by the most recent ETRMA tyre market data are undoubtedly useful to all parties, however some of the figures will raise eyebrows. For example, According to ETRMA’s full-year 2021 passenger car tyre data, Great Britain is the fourth-largest passenger car tyre market some way behind third-placed Italy. And is Turkey really Europe’s leading truck tyre business?

However, that is based on data suggesting that total British replacement tyre demand has hovered around 15 million units a year for the last five years. That figure is, of course, far too low and cannot be explained by pandemic-related circumstances because the level has remained roughly consistent during the pre- and mid- Covid-19 ETRMA totals. All other manufacturer and third-party whole-market estimates suggest annual UK car tyre replacement demand is north of 30 million units a year.

The reason for the discrepancy? ETRMA counts the figures of its 14 corporate members (namely Apollo Tyres, Bridgestone Europe, Brisa, Continental, Goodyear, Hankook, Marangoni, Michelin, Nexen Tire Europe, Nokian Tyres, Pirelli, Prometeon, Sumitomo Rubber Industries and Trelleborg Wheel Systems). But ETRMA doesn’t count the significant proportion of imported tyres that are sold in markets such as the UK. That reality makes a particularly significant different in the UK passenger car tyre sector where in some recent years 50 per cent or more of the market has been estimated to be so-called budget tyres, most of which are produced by non-ETRMA members. That being the case, total UK market demand would amount to around 30 million (much closer to the historic average) and make the UK a similar size market in pan-European terms to second-place France.

Something similar is probably true in the truck tyre segment, where the apparent dominance of Turkey is likely to be skewed by the presence of several significant ETRMA member production bases such as Brisa’s factories.

However, the same cannot be said for the Moto and Agricultural tyre sectors. Here, despite the growing influence of non-ETRMA member suppliers, their market share is not as significant as in the UK passenger car tyre aftermarket. And therefore, while the revelation that the French and German agricultural tyre aftermarkets are three times bigger than Britain’s must still be taken with a pinch of salt (see chart), the big difference cannot be offset by non-ETRMA imports. And therefore demand really must be a lot higher in those markets.

Browse below for further ETRMA data charts:

Comments