Autocentres continue to drive Halfords sales post National Tyres purchase

Motoring will represent more than 70 per cent of Halfords (Photo: Halfords)

Motoring will represent more than 70 per cent of Halfords (Photo: Halfords)

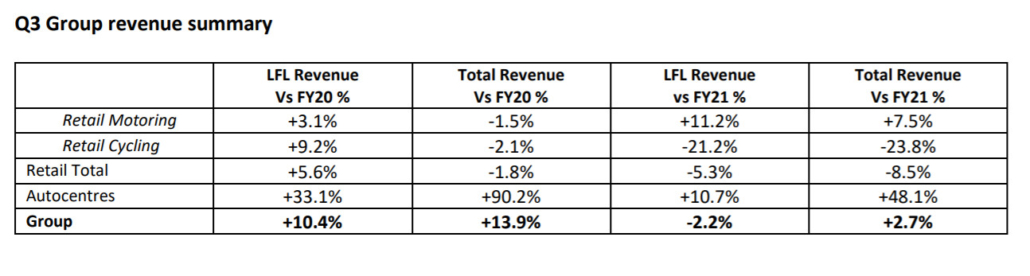

Halfords Group plc has reported strong group sales up 10.4 per cent like-for-like over two years driven by “an outstanding Autocentres performance through the third quarter 2021 MOT peak.” Indeed, ‘Motoring services’ now account for 70 per cent of sales due to the combination of Autocentres growth and the recent National Tyres purchase. Not only do these movements reflect Halfords’ efforts to lead the tyre retail/motoring services market, but represent steps towards the creation of motoring retail “fusion towns.

Writing in a third-quarter trading update for the 13 weeks to 31 December 2021 published on 13 January 2021, Halfords referred to the performance of its Autocentres business as “exceptional” and highlighted Autocentres’ 33.1 per cent like-for-like growth driven by the MOT peak and “our ongoing investment in digital platforms…”.

Halfords recently integrated the formerly separate Halfords Autocentres, Tyres-on-the-Drive and Halfords Retail websites into a single Halfords-branded portal. The re-configuration of bricks and mortar locations is next (Photo: Halfords presentation)

Investment in digital platforms refers to the recent integration of the formerly separate Halfords Autocentres, Tyres-on-the-Drive and Halfords Retail websites into a single Halfords-branded portal. That development should not be overlooked as general marketing practice because it is actually a foretaste of what Halfords plans to do with its bricks and mortar locations including both new and existing Autocentres locations. While only really visible online and in the case of earlier acquisition McConnechy’s, which is now dual-branded as either Halfords McConnechy’s (physical centres) and McConnechy’s Fleet Services – a Halfords company (mobile), both examples are steps towards the creation of fusion towns (see image).

However, the like-for-like figures don’t show just how much Halford’s Autocentres business has grown since the Axle Group/National Tyres and Autocare purchase at the start of December 2021, something that is clearly of huge strategic importance to Halfords: “The acquisition of Axle Group and associated equity raise, secures our position as the UK’s largest vehicle service, maintenance and repair business.”

Taking the National acquisition into account, “total sales growth across Autocentres was +90.2 per cent reflecting our acquired businesses, coupled with strong performance in our LFL business…”.

Acquisitions part of wider motoring retail vision

However, despite the enormous expansion that the National acquisition brings with it and despite the also-strong like-for-like growth figures, it is worth pointing out that – in terms of bricks and mortar retail locations – even post-National acquisition, Halfords Autocentres is still the second-largest tyre retailer in the UK after ETEL/Kwik-Fit.

“The acquisition of Axle Group and associated equity raise, secures our position as the UK’s largest vehicle service, maintenance and repair business.”

Meanwhile, Halfords’ Mobile Servicing business was up +72 per cent like-for-like. And the ongoing integration of Axle Group/National into Halfords is said to be “progressing to plan”.

Halfords’ trading statement summarised the company’s recent performance like this:

“In 2019, we accelerated our strategy to evolve Halfords into a consumer and B2B services-focused business, with a greater emphasis on motoring, generating higher and more sustainable financial returns. Our performance across the period has reaffirmed the importance of increasing the mix of our business into less discretionary, and more resilient Motoring services spend whilst continuing to focus

Graham Stapleton, Halfords’ chief executive officer, commented: “These results demonstrate the strength of our Motoring Services offer, and the outstanding performance from our Autocentres business confirms the rationale behind our recent acquisitions. With the recent addition of National to the group, Motoring will represent more than 70 per cent of Halfords revenue, and we expect to carry out 7.5 million motoring servicing jobs a year. We are working hard to continually increase our capacity, capabilities, and geographic reach in this area, making it easier and more convenient for customers to have a broader range of vehicles serviced than ever before at over 1,400 fixed or mobile Motoring Services locations.”

As a result, of all these figures Halfords Group is still aiming for full-year pre-tax profits of between £80 million and £90 million. Will there be further acquisitions in the tyre retail space? Very likely, for two reasons. Firstly, because Halfords executives continue to use language like “ongoing strategic investment” in their trading updates. And secondly, because – as we saw earlier – despite a recent run of large, medium and small acquisitions – Halfords is not yet number one in the tyre retail space and has not yet achieved its vision of creating tyre retail/motoring services “fusion towns”.

Source: Halfords

Comments