Results exceeded expectation: Titan International’s Q3 2021

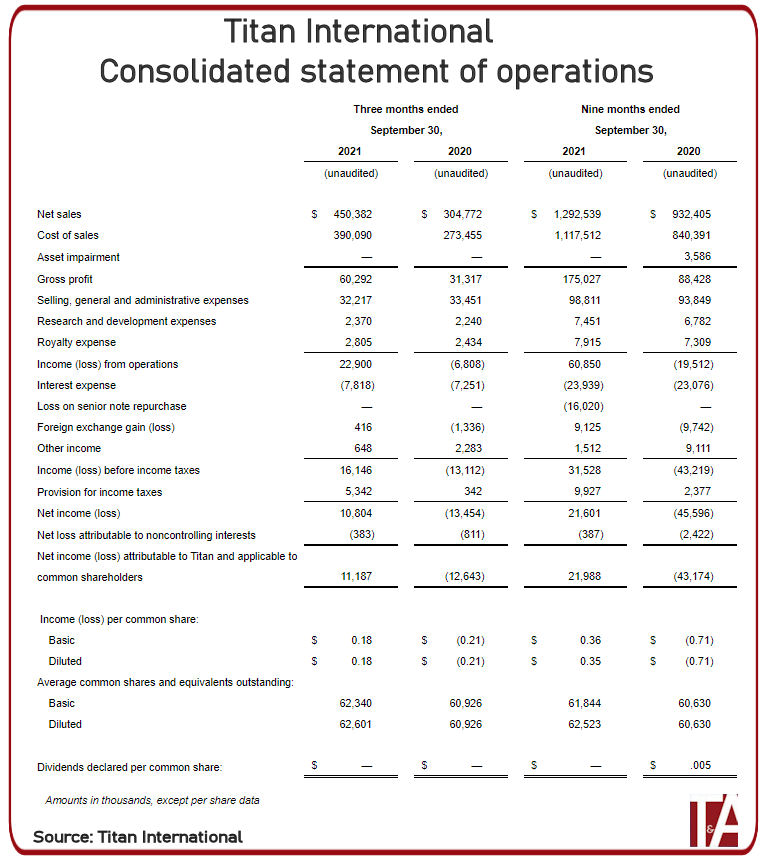

Titan International reports achieving in Q3 2021 its strongest third-quarter results since 2013. Net sales for the three months to 30 September were up 47.8 per cent year-on-year, to US$450.4 million, and the gross margin rose more than three percentage points, to 13.4 per cent on the back of gross profit amounting to $60.3 million.

“Our results this period exceeded expectations as we posted our strongest third quarter for revenue and profitability since 2013,” comments Paul Reitz, president and chief executive officer. “Again, this quarter our global Titan team has worked hard to increase our production levels and we continue to look to build our team further to increase our output in coming periods. Our third-quarter adjusted EBITDA of $35.1 million has only been surpassed a couple (of) times since 2014 with one of those times occurring in the second quarter of this year when we posted adjusted EBITDA of $37 million and the other during the first quarter of 2018 with $41.2 million. We now believe full-year adjusted EBITDA to be over $130 million. Our ‘One Titan’ team rose to the challenge and I want to thank all of Titan’s employees around the world for doing a great job.

“During the third quarter, each of our segments experienced strong sales growth, with Agriculture leading the way with an increase of over 59 per cent year over year. Our order books continue to strengthen, especially on the agriculture side, where commodity pricing remains at good levels with corn above $5/bushel, soybeans above $12/bushel and cotton at an all-time high, thus ensuring strong farmer income levels for 2022. Quite simply, farmers are doing really good again this year. High farmer incomes combined with historically low dealer inventory levels and aging equipment, creates a strong tailwind that we believe will continue through 2022.

“Our earthmoving and construction (EMC) growth in the third quarter was very strong at 36 per cent year over year. The EMC end markets continue to look increasingly promising and our undercarriage business is building momentum as we head into next year with strong development in orders as infrastructure investments are coming across most of our geographies. It is without a doubt, one of the most dynamic business environments all of us have faced and our Titan team has been successful in managing through it. We are in a good position at this time to capitalize on our reinvigorated strength to drive growth and increased financial results for our investors.”

Results of operations

Titan International says increased demand and volumes across all segments of its business, most notably agriculture, heavily influenced its overall net sales of $450.4 million. Factors contributing to higher demand include increased commodity prices, lower equipment inventory levels and pent-up demand following the economic impacts during 2020.

The increase in gross profit and margin was driven by the aforementioned increases in sales volume, which favourably impacted upon overhead absorption. In addition, Titan International executed cost reduction initiatives across global production facilities in the last year.

Income from operations for the third quarter of 2021 was $22.9 million, or 5.1 per cent of net sales, compared to a loss of $6.8 million, or 2.2 per cent of net sales, for the third quarter of 2020. The increase in income was primarily due to the higher sales and improvements in gross profit margins.

Examine Titan International’s Q3 2021 results in depth here

Vredestein

Vredestein

Comments