Raw material as well as shipping costs to remain headwinds

At the start of 2021 we published a headline suggesting that “shipping costs [were] temporary” and “price increases less so”. While that article was based on the latest third-party data as well as the expert opinion of a leading wholesaler, it now looks like shipping cost woes are set to continue well into 2022 and that – while they have softened recently – raw material costs will remain headwinds during the next year or so as well.

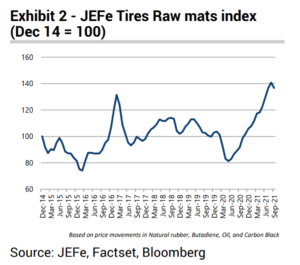

Raw material costs have arguably the most direct influence on tyre product pricing and these have been going up all year. In an October investor’s note Jefferies analysts warned investors that raw material prices are still moving up and will remain a headwind in second-half 2021 as well as first-half 2022 figures.

How did they get to this conclusion? “In addition to the monthly sell-in data from Michelin [which is widely seen as a market demand barometer], we analyze raw material price developments through the JEF raw material index for tyres.” That index tracks the weighted average prices of four main commodities in relation to the proportions of tyre make-up they represent: Natural Rubber (22%), Butadiene (26%), Oil (17%) and Carbon black (15%). Together these raw materials represent circa 80 per cent of a tyres’ raw material costs. The company’s September index at 137 was up 49 per cent year-on-year, but -2.9 per cent month-on-month. In other words, this suggests that, while raw material costs remain a high levels, the speed at which they are increasing is easing off. According to the analysts, this slight release in pressure was due to “a sequential decline in Butadiene and Natural rubber.”

However, the year-on-year increase was driven by a 316 per cent increase in Butadiene, an 82 per cent increase in oil, a 20 per cent increase in Natural Rubber costs, and a 33 per cent increase in Carbon black prices. All this means that the last 12 months’ moving average was up 28.0 per cent. Those figures combined with the current spot rates are said to “imply significant raw materials headwind” moving forward.

However, the year-on-year increase was driven by a 316 per cent increase in Butadiene, an 82 per cent increase in oil, a 20 per cent increase in Natural Rubber costs, and a 33 per cent increase in Carbon black prices. All this means that the last 12 months’ moving average was up 28.0 per cent. Those figures combined with the current spot rates are said to “imply significant raw materials headwind” moving forward.

With both shipping rates and raw materials costs remaining high, the only logical outcome is further price increases at sell-in, which the market will in all likelihood pass on to consumers when it comes to sell-out as well. As far as product mix is concerned, continuing price increase trends bode well for premium tyre brands, their group brands and upper mid-range products – all of which will be able to offer compelling performance arguments to justify they price points. Commodity brands on the other hand will inevitably be less attractive on a purely price basis and won’t be able to offer the same performance. So if ever there was a time to sell on the basis of performance as opposed to price now in the closing stages of 2021 and into the first months of 2022 is that time.

Comments