Pirelli lifts full-year sales forecast following strong Q3 figures

Pirelli is raising its full-year 2021 sales forecast off the back of better-than-expected performance in the third quarter of 2021, a trend that was particularly driven by performance in the so-called “high value” tyre segment. According to the Italian tyre manufacturer’s nine-month figures, which were published on the evening of 11 November, sales rose 28.6 per cent to almost 4 billion euros. At the same time, Pirelli more than doubled its earnings and can now report a pre-tax profit margin (EBIT) of 15 per cent.

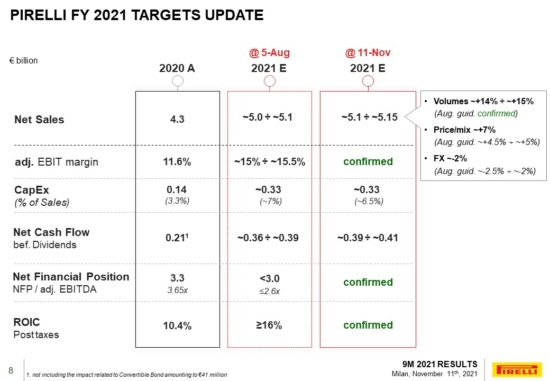

As a result of the upgrade, Pirelli now expects annual net sales of 5.1 to 5.15 billion euros, up from the previous range of 5.0 to 5.1 billion euros. Pirelli reports that its EBIT margin will be 15 to 15.5 percent at the end of the year, confirming its previous assumptions.

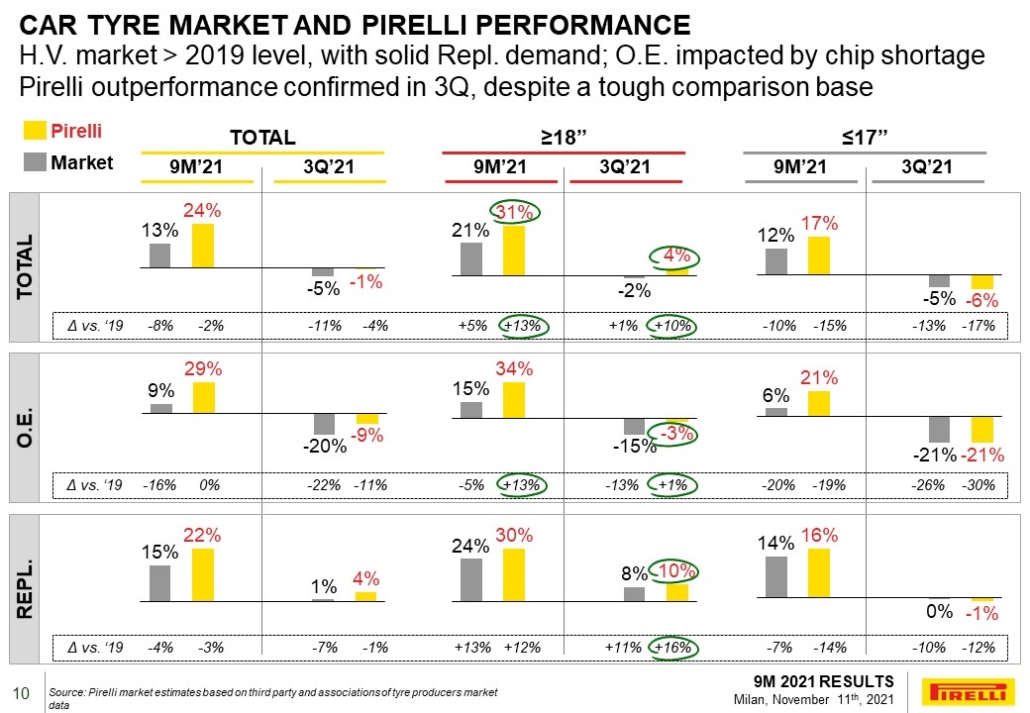

So what led to the outperformance? Tyre volumes are reported to have been in the expected range, so the lion’s share of Pirelli’s sales improvement is attributed to improved price/mix. Specifically, the manufacturer reports that in the past few months the company has benefited from what was described as “solid” demand for high-quality replacement market tyres and from a “healthy price environment”.

As a result, Pirelli’s high value tyre sales are now said to be at “greater than 2019 levels”. In the 18-inch and over segment this means outperforming the market by 50 per cent or more in both third-quarter and nine-month figures. Indeed, Pirelli’s market outperformance is most noticeable in the chip shortage-stricken OE sector. Here, tyre unit volumes may have been down 3 per cent in the third-quarter of 2021, but the wider OE tyre supply market was down 15 per cent. And, when you compare Pirelli’s third-quarter 2021 OE tyre supply growth with 2019 levels, the Italian tyre manufacturer is actually 1 per cent up on pre-pandemic levels.

Comments