Integration on-track: Goodyear reports 16% growth plus greater synergies from Cooper Tire acquisition

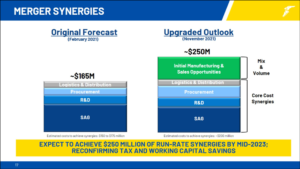

The Goodyear Tire & Rubber Company has published figures that show its third-quarter 2021 sales were $4.9 billion, up 42 per cent compared with a year ago. Of course, much of this increase was driven by the company’s acquisition of Cooper Tire, but growth still came in at 16 per cent with the benefits of the Cooper merger excluded. At the same time, Goodyear executives also reported that the company now expects circa 50 per cent greater Cooper merger-related synergies than before. Specifically, this means a benefit of $250 million in run-rate synergies by mid-2023 up from an initial forecast of $165 million. And what’s more, the company expects to realize approximately $20 million of these savings in 2021. No estimates for 2022 synergies are being released until at least the end of 2021 and more likely February 2022 when full-year 2021 data has been processed.

So where is this extra $85 million coming from? Before, Goodyear estimated savings of $165 million based on synergies in: logistics and distribution, procurement, R&D and SAG (presumably sales and general administration costs). When you compare Goodyear’s February 2021 estimates with the latest figures, apart from a significant improvement in procurement synergies, these items have remained broadly the same. Therefore, the bulk of the extra synergy comes from a single item – “initial manufacturing and sales opportunities” (see “Merger synergies” slide).

During a conference call with financial analysts on 5 November, Darren R. Wells, executive vice president and chief financial officer further explained that these manufacturing opportunities came from the ability to switch premium manufacturing equipment around between Goodyear and Cooper factories so more premium tyres could be made more efficiently during the period.

At the same time, the company has begun selling the Cooper brand through selected Goodyear points of sale as well as selected Goodyear fleet customers, presumably in the US. “That won’t be the biggest element” in the first two years, Wells added, but both the manufacturing and distribution examples illustrate the kind of additional synergies Goodyear has been able to find post-acquisition.

Overall integration is said to be “going great” due in large part to the compatible cultures of the two business, according to executives, with Goodyear chairman, chief executive officer and president Richard J. Kramer even saying progress is “on-track, maybe even better”.

Volume and market share recovery

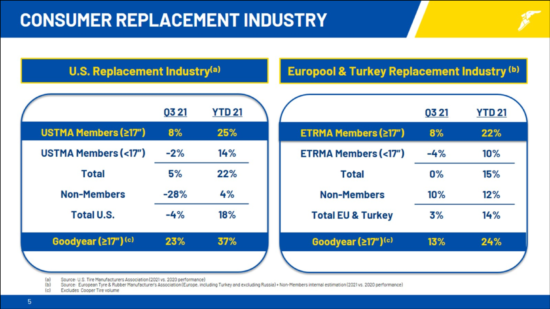

Goodyear reports third-quarter tyre unit volumes totalled 48.2 million, up 32 per cent from the prior year’s period. Replacement tyre unit volume increased 44 per cent, reflecting the addition of Cooper Tire. However, original equipment unit volume decreased 7 per cent, due to lower vehicle production, which was affected by shortages of components such as chips and raw materials.

As a result, Goodyear reported segment operating income of $372 million in the third quarter of 2021, up $210 million from a year ago. The company also reported merger-adjusted segment operating income of $449 million, which excludes certain costs triggered by the Cooper Tire merger. The reported results also include Cooper Tire operating income of $48 million, which includes $70 million of amortization of Cooper Tire inventory step-up adjustments and $7 million incremental amortization of Cooper Tire intangible assets.

“We continued to capitalize on favourable industry trends in our key replacement markets,” said Richard J. Kramer, chairman, chief executive officer and president. “Overall consumer replacement demand remains robust, and our business continues to have momentum. We delivered our strongest price/mix in nearly a decade, more than offsetting inflationary pressures and driving strong earnings performance.”

“With the transportation industry moving record freight volume, we also saw robust demand from our largest commercial customers. As a result, our commercial business delivered another strong quarter, with fleet tire volume well above pre-pandemic levels,” added Kramer.

Year-to-date results also good

Goodyear’s sales for the first nine months of 2021 were $12.4 billion, a 43 per cent increase from the 2020 period, primarily due to higher volume, the Cooper Tire merger, increased sales from other tire-related businesses and improvements in price/mix.

Tire unit volumes in the period totalled 120.7 million, up 37 per cent from 2020. Replacement tyre shipments increased 42 per cent, which included additional tyre unit volume related to the Cooper Tire merger. Nine-month original equipment volume increased 19 per cent, driven by higher global vehicle production in the second quarter and increased market share.

Goodyear’s net income was $211 million for the first nine months of 2021 (82 cents per share) compared to a net loss of $1.3 billion ($5.62 per share) in the prior year’s period. At this point it is worth highlighting that the first nine months of 2021 included several costs, including: “$165 million of Cooper Tire-related amortization and other costs”, rationalizations, asset write-offs and accelerated depreciation of $82 million. This latter primarily comes from the modernization of two manufacturing facilities in Germany and the permanent closure of a manufacturing facility in Gadsden, Alabama.

However, this item also includes a plan to “reduce selling, administrative and general expense in Europe, Middle East and Africa”. On a similar point, later in its report, Goodyear referred to “a non-cash impairment charge of $182 million to reduce the carrying value of goodwill in the Europe, Middle East and Africa business”.

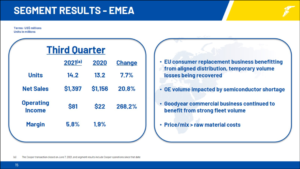

Whatever Goodyear means by its efforts to “reduce selling, administrative and general expense” in EMEA, Europe, Middle East and Africa’s third quarter 2021 sales increased 21 per cent from last year to $1.4 billion, primarily due to improvements in price/mix and the Cooper Tire merger. Tire unit volume increased 8 per cent. Replacement tyre unit volume rose 14 per cent. Excluding the impact of the Cooper Tire merger, European consumer replacement volume increased 9 per cent, driven by market share gains. Original equipment unit volume decreased 18 per cent (more than twice as severely as the company overall) due to the same component and material shortages. However, company executives were explicit that Goodyear EMEA operations have performed strongly during 2021, gaining market share in the summer, winter and all-season tyre segments, something that is large put down to the strength of the company’s products.

Comments