Continental: Components supply issues hit Q3 2021 sales & earnings

Nikolai Setzer (Photo: Continental)

Nikolai Setzer (Photo: Continental)

Anniversary year ups and downs: As it marks one and a half centuries in the business, Continental reports that it has “set the strategic course for the next successful chapter in its history by making its previously announced structural adjustments” during Q3 2021. But the delivery situation for electronic components also worsened during the quarter, and Continental says this “had a significant impact on sales and earnings” that could only be partially offset by sales volumes within its aftermarket tyre and industrial product businesses.

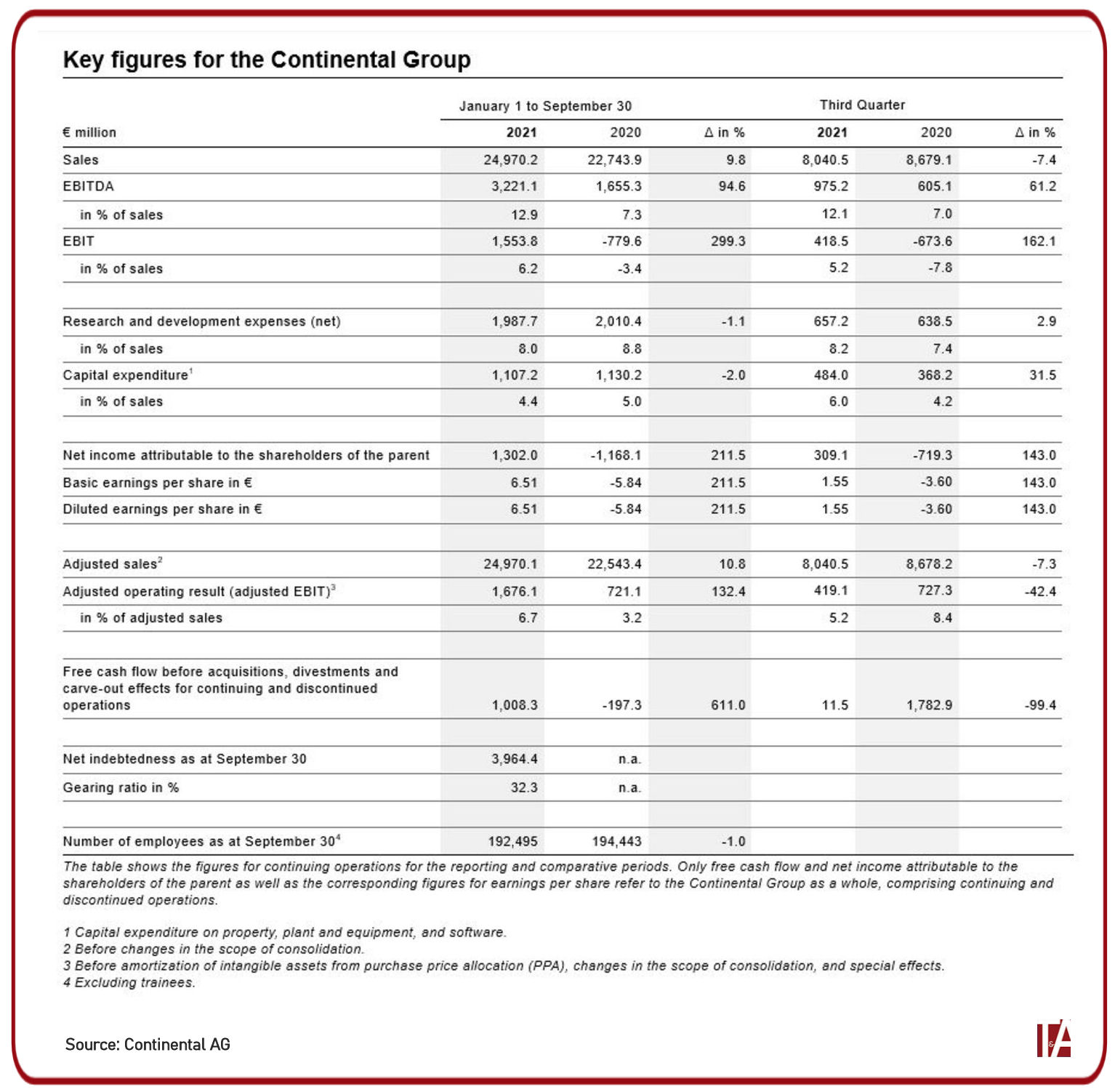

The headline news is that consolidated sales were down 7.4 per cent, to 8.0 billion euros, while adjusted EBIT plummeted 42.4 per cent, to 419 million euros and the margin shrank 3.2 percentage points, to 5.2 per cent.

“Our Rubber Technologies group sector achieved robust earnings thanks primarily to the strong replacement tyre and industrial product businesses. It achieved this success despite the mounting burdens associated with rising raw material prices and energy and logistics costs,” shares Nikolai Setzer, chief executive officer of Continental, as he presented the quarterly figures today.

“At the same time, the global semiconductor shortage worsened in the third quarter due to the coronavirus situation in Southeast Asia and likely reached its peak,” adds Setzer. “This affected in particular our Automotive Technologies group sector, whose product portfolio comprises a high share of electronics. While we are severely affected by the current semiconductor shortage, there is no doubt that vehicles will be equipped with more and more electronics, sensors and software in the future. With our product portfolio, we will therefore benefit greatly from this trend.”

Although Continental expects the supply situation to improve in the coming months, the semiconductor shortage and rising raw material prices are likely to continue to have a negative impact on the automotive industry in the fourth quarter of this year and throughout 2022.

“Despite the short-term challenges, we successfully completed the spin-off of Vitesco Technologies in the past quarter. With the new structure that we have put in place in our anniversary year, we have also set the strategic course for the next successful chapter in our company’s history. The pooling of our expertise, particularly in the area of software, will benefit both us and our customers,” emphasises Setzer.

Q3 2021 consolidated sales down year-on-year

As mentioned, consolidated sales were down 7.4 per cent year-on-year in the third quarter, a result that Continental attributes to “significantly lower” vehicle production. Prior to factoring in changes in the scope of consolidation and exchange-rate effects, sales fell by 8.5 per cent. Adjusted EBIT dropped 42.4 per cent, to 419 million euros, with a margin of 5.2 per cent. Net income totalled 309 million euros, contrasting with the Q3 2020 net loss of 719 million euros that resulted from impairments and restructuring expenses.

Automotive production lower

Global automotive production suffered from the shortage of semiconductors and was thus lower than in Q3 2020. Supply of components was the limiting factor, with customer demand remaining high. Continental shares preliminary figures that indicate global automotive production amounted to 16.5 million units from July to September 2021, down 19.5 per cent from the same period last year. Production fell 30.2 per cent in Europe, to 3.0 million units.

Market outlook & fiscal 2021 forecast

“The global markets will remain highly volatile in the coming months. Given the ongoing shortages of semiconductor components as well as uncertainties in the supply chain and customer demand, we have adjusted our forecast for 2021,” comments Wolfgang Schäfer, Continental’s chief financial officer. The company currently expects global production of passenger cars and light commercial vehicles to change by between -1 and +1 per cent year-on-year in 2021, a far more modest development than its previous projection of eight to ten per cent growth.

Negative effects from cost inflation for key inputs, including electronics and electromechanical components for Automotive Technologies, raw materials for Rubber Technologies, as well as energy and logistics, are becoming more material.

As announced on 22 October, Continental has accordingly adjusted its full-year outlook and now anticipates consolidated sales of around 32.5 billion to 33.5 billion euros (previously: 33.5 billion to 34.5 billion euros). It expects the adjusted EBIT margin to be between around 5.2 to 5.6 per cent (previously: 6.5 to 7.0 per cent).

For the Automotive Technologies group sector, Continental expects sales of around 14.5 billion to 15.0 billion euros (previously: 16.0 billion to 16.5 billion euros). As a result of these lower expected sales, it anticipates the adjusted EBIT margin to be in the range of around -2.0 to -2.5 per cent (previously: 0.5 to 1.0 per cent).

The company now expects sales in the Rubber Technologies group sector are now expected to be around 17.2 billion to 17.5 billion euros (previously: 17.2 billion to 17.8 billion euros), with an adjusted EBIT margin of around 12.3 to 12.7 per cent (previously: 12.5 to 13.0 per cent). The outlook takes into account a year-on-year rise in raw material costs of around 550 million euros (previously: 500 million euros) as well as price increases for energy and logistics. The higher costs relate primarily to the Tires business area.

For the Contract Manufacturing group sector, Continental expects sales of around 800 million to 900 million euros and an adjusted EBIT margin of around nine percent.

Capital expenditure before financial investments is expected to total around six per cent of sales (previously: seven per cent).

Free cash flow before acquisitions, divestments and carve-out effects for continuing and discontinued operations is expected to be around 800 million to 1.2 billion euros (previously: 1.1 billion to 1.5 billion euros for continuing operations).

Comments