All in the same boat – Maritime Cargo Services explains shipping situation

High container prices mean disruption for the tyre distribution market

For tyre distributors in import-heavy markets such as the UK, the sharp and sustained rise in the cost of shipping product from key sources such as China and South-East Asia is a major headache with potential market-reshaping consequences. While there have been varying levels of success in managing this headwind according to some in the market with whom Tyres & Accessories has spoken, strategically placed orders and bumper levels of stockholding can only ameliorate prices on such products for so long. Wholesalers have faced a difficult trading environment this year, which to this point has shown little sign of abating.

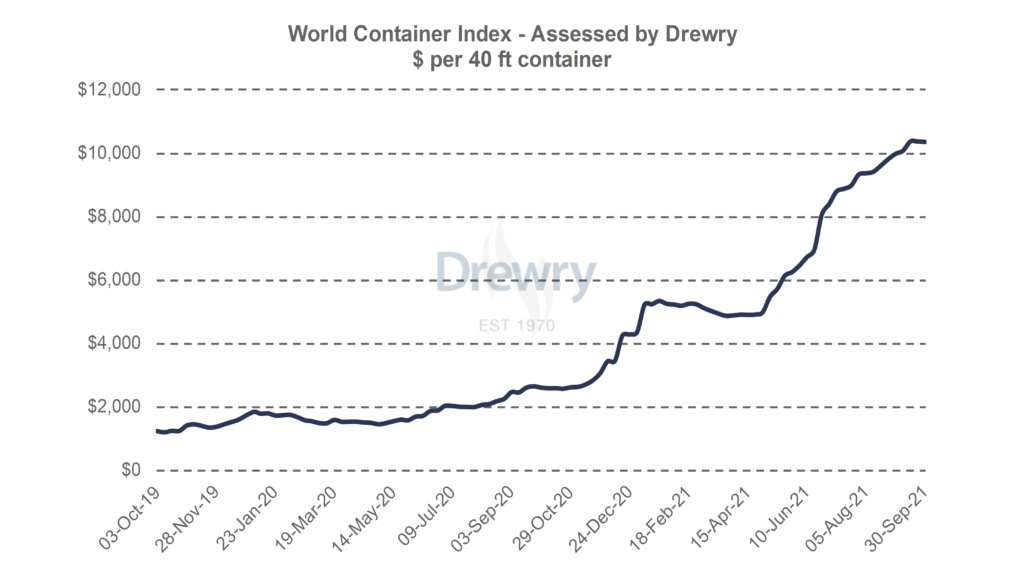

Supply chain advisor Drewry’s World Container Index, which presents a composite assessment of 40ft container rates across eight major routes between Asia, Europe and North America, shows how the steep rise in the last quarter of 2020 maintained close to its peak of more than double the rates of early 2020 throughout the first half of 2021.

(Source: Drewry World Container Index)

The rising rates since the middle of the year have then doubled rates again, with the rise only curtailed – but not reversed – in recent weeks. To put this into perspective, Drewry’s most recent assessment at time of writing (30 September) saw the composite index decrease 0.2 per cent week-on-week, with the index “291.8 per cent higher than a year ago.” What’s more, looking at a key European route of Shanghai-Rotterdam, Drewry shows 40ft container rates increasing by 1 per cent this week, maintaining its place as the sharpest annual increase among this sample set, up 535 per cent over this point one year ago. The rate on 30 September was $14,558, and the advisor said it expects rates to “remain steady in the coming weeks.” Putting this into a longer-term context, in the year to date, the average rate across Drewry’s World Container Index is $6,977 per 40ft container, which is $4,547 higher than the five-year average of $2,430 per 40ft container.

Similarly shipping company Maersk upgraded further its 2021 EBITDA guidance by 20 per cent, a move that implies container freight rates will stay stable for the remainder of the year, as Jeffries reports. The analyst reports that the latest upgrade “reflects continued strong demand, combined with restocking, and underutilised ports, warehouses, and ships, due to Covid-19, leading to persistent congestion and supply chain bottlenecks.”

Freight forwarder explains situation further

Freight forwarder Maritime Cargo Services told Tyres & Accessories that it is, like its UK tyre sector customers, “finding the current and continuing situation frustrating too and understand completely the knock-on effects that it is causing.” So what are the practical reasons for rising prices and bottlenecking?

MCS explained: “60 per cent of global goods are shipped by container and during the pandemic the average number of containers handled at major ports worldwide has escalated with major US, North European and Asian ports experiencing a rise of between 10 and 70 per cent in the first half of the year compared to 2020. Felixstowe headed the container move increase in North Europe and saw an 18 per cent leap in boxes handled, MCS added.

“The backlog of ships waiting for a free berth because of this operational strain has not been helped by a surge in cargo volumes arriving in more concentrated loads, these higher volumes result in each vessel spending a longer time in port.” MCS noted that in comparison to European ports, “Asian ports are super speedy at loading/unloading containers from large vessels, on average 27 seconds compared with 46 seconds at North European ports.”

MCS continued: “At the time of writing the 23,992teu Ever Ace, the newly crowned largest containership in the world, has just left Felixstowe with a reported exchange of some 4,000 import and export boxes. She arrived on Sunday morning and took up two berths, giving a good indication of how these backlogs soon mount up.

“China has experienced a recent Typhoon and major power cuts, all adding to the woe and with Golden Week looming and some carriers allegedly blanking sailings the future is not looking brighter yet.

“There has been a bit of good news with some carriers announcing that they might cap freight rate increases but it would seem that this could be cancelled out by proposed huge peak season surcharges!”

MCS argues that one way to handle the current situation is by working with a “reliable freight forwarder who communicates well and is transparent with you will give you the confidence that they are dealing effectively on your behalf using all the resources at their disposal.”

How can MCS help? “We are fortunate to work with a bank of longstanding and trusted hauliers and have a cracking team here who give their all to make sure that we can offer the best solution possible even in testing times like these.”

Comments