Nokian Tyres: ‘strong volume & profit growth’ in H1 2021

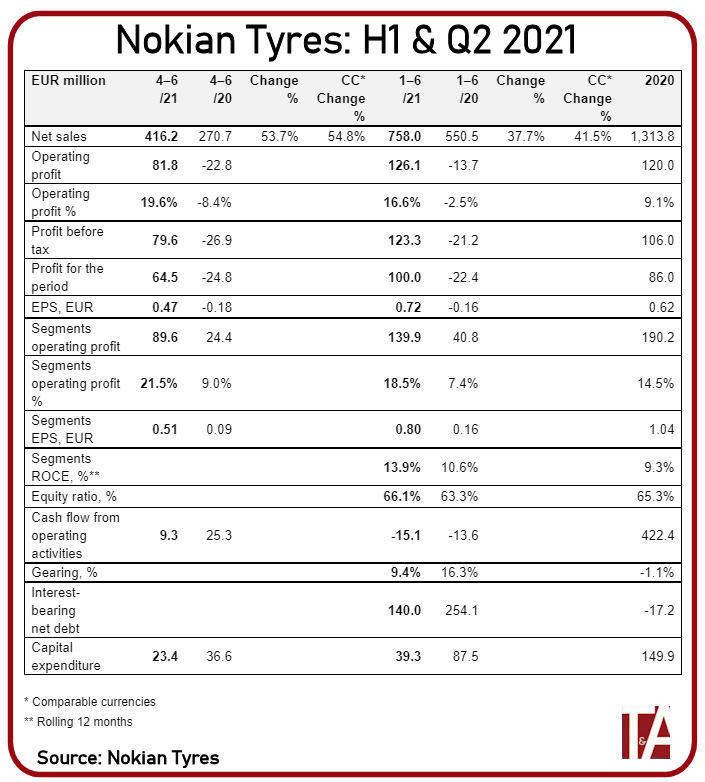

The difference a year can make. Almost 12 months to the day after reporting an operating loss of 13.7 million euros for the first half of 2020, Nokian Tyres has announced achieving an operating profit of 126.1 million in the six months to 30 June 2021 with an earnings per share of 0.72 euros. It achieved this result on the back of net sales that were up 37.7 per cent year-on-year to 758.0 million euros. Nokian Tyres notes that when looking at comparable currencies, net sales increased by 41.5 per cent.

For the quarter between 1 April and 30 June 2021, the tyre maker’s operating profit was 81.8 million, up from -22.8 million a year earlier, with earnings per share of 0.47 euros. Net sales grew 53.7 per cent year-on-year to 416.2 million euros.

Car tyre growth particularly strong

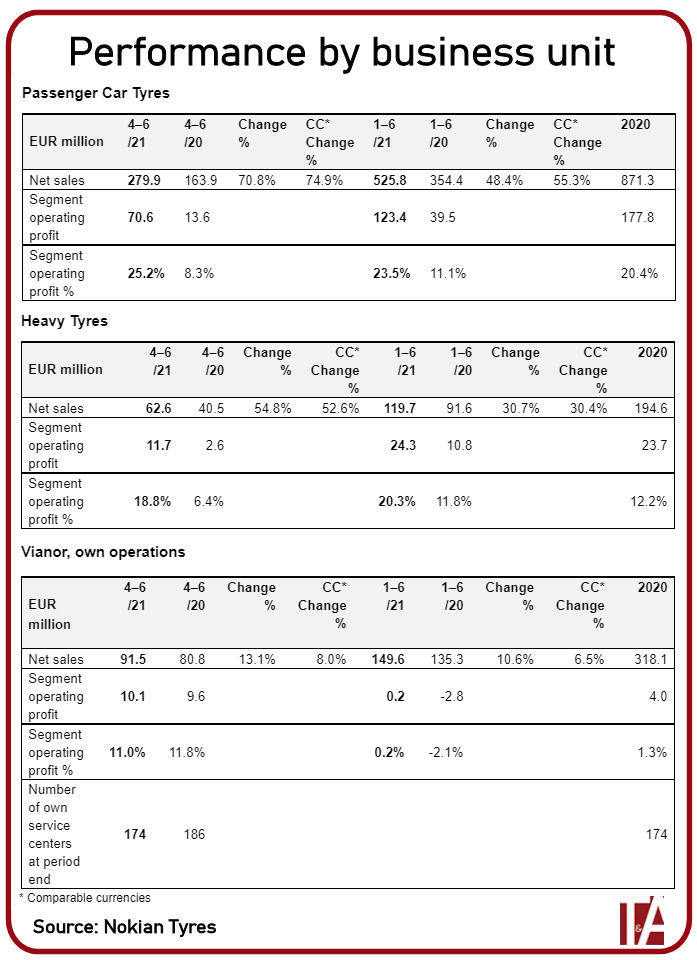

“Tyre demand continued strong in the second quarter. Thanks to a great performance by all our business units and business areas, net sales increased by 54.8 per cent with comparable currencies. Segments operating profit grew significantly driven by higher sales volume,” shares Jukka Moisio, president and chief executive officer of Nokian Tyres.

Moisio reports that volume growth was “particularly strong” within Nokian Tyres’ Passenger Car Tyres business, however the higher share of Russian volume had a negative impact on average sales price.

“To ensure the availability of our premium products, we operated the Russian factory at full capacity. In the US, we continued to ramp-up production to reach an output of around one million tyres in 2021. In Finland, we are increasing our production capacity for passenger car tyres by approximately 30 per cent this year, as announced in March.

The company’s operating cash flow was positive in the second quarter of 2021 despite increasing working capital requirements. Capital expenditure was lower year-over-year in line with Nokian’s 2021 plan. Raw material costs began to increase in the second quarter, and the company anticipates these will have a “significant negative impact” in the second half of the year compared to 2020, together with increasing logistics costs. “We are taking mitigating actions to reduce the impact of cost inflation,” states Moisio.

“In 2021, our focus will remain on growth and cash flow,” he adds. “New products and continuous improvements in go-to-market activities will help us build an even stronger foothold in our core markets. We want to benefit from a good momentum in the market while still acting prudently to keep our company strong and competitive for years to come.”

Click here for further information.

Comments