July car sales fall – SMMT revises outlook

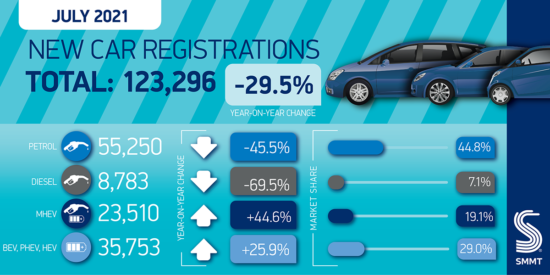

July’s new car registrations fell by -29.5 per cent to 123,296 units, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT). The decline was artificially heightened by comparison with the same month last year, when registrations rose dramatically as showrooms enjoyed a full month’s operation following the first 2020 lockdown.

However, the July performance was down -22.3 per cent on the average recorded over the past decade, as the ongoing semiconductor shortage and the ‘pingdemic’ impacted on both supply and demand. As a result, this was the weakest July for new car registrations since 1998, prior to the introduction of the two-plate system.

The decline was predominantly within large fleets which, at 61,140 units, was some -28.7 per cent lower than the average recorded over the past decade. Private registrations declined by a lesser extent, -10.7 per cent, to 59,841 units.

The bumper growth in plug-in vehicles continued, however, with battery electric vehicles (BEVs) accounting for 9.0 per cent of registrations, while plug-in hybrids (PHEVs) reached 8.0 per cent. All new car segments experienced declines, but Britain’s most popular types of cars remained superminis (32.9 per cent of registrations), lower medium (28.0 per cent) and dual purpose (27.3 per cent).

While the UK’s economic outlook continues to strengthen, with most consumer indicators suggesting a greater appetite for spending, including on so-called ‘big ticket’ items, supply challenges continue to throttle growth with the weaker market conditions expected to continue in August – traditionally a quiet month for registrations – before modest growth returns in Q4.

As a result, the latest SMMT outlook has been revised downward and now forecasts registrations to reach around 1.82 million units in 2021. This is still some 11.7 per cent up on 2020, but down from the 1.86 million forecast in April, and down around -21.8 per cent on the average new car market recorded over the past decade. More positively, however, given the continued strengthening of the electric vehicle market, SMMT now estimates that BEVs will account for 9.5 per cent of registrations by year end, while PHEVs are forecast to comprise 6.5 per cent of the market, collectively totalling around 290,000 units by the end of the year.

Commenting on the figures, Mike Hawes, SMMT Chief Executive, said: “The automotive sector continues to battle against shortages of semiconductors and staff, which is throttling our ability to translate a strengthening economic outlook into a full recovery. The next few weeks will see changes to self-isolation policies which will hopefully help those companies across the industry dealing with staff absences, but the semiconductor shortage is likely to remain an issue until at least the rest of the year. As a result, we have downgraded the market outlook slightly for 2021. The bright spot, however, remains the increasing demand for electrified vehicles as consumers respond in ever greater numbers to these new technologies, driven by increased product choice, fiscal and financial incentives and an enjoyable driving experience.”

NFDA: leveling out after pent-up demand

Despite the fall in UK car sales in July, car dealers are remaining optimistic, says Sue Robinson, Chief Executive of the National Franchised Dealers Association (NFDA) which represents franchised car and commercial vehicle dealers in the UK, adding; “The 29.5 per cent decrease in new car sales in July can be attributed to significant pent-up demand that was released when dealers reopened this time last year, after the first lockdown.”

In total 1,033,269 new cars have been registered to date in 2021 and the decrease in July yoy demonstrates the challenges with new car stock coming onto forecourts, says the NFDA.

Robinson continued, “Given the headwind we are witnessing in relation to vehicle supply, as a consequence of semi-conductor shortages and factory closures, franchised dealers continue to perform resiliently.

“It is usual for consumer demand to wane slightly as we approach the important month of September. NFDA members still remain cautiously optimistic in their outlook for the remainder of the year.”

Interpath Advisory: chip shortages impact

Commenting on the figures, Andrew Burn, head of automotive at Interpath Advisory (formerly KPMG Restructuring), said: “The ongoing chip shortages are not just impacting supply and demand for new vehicles – it is also impacting the used car market where demand and residual value prices are in unprecedented territory.

“Ripples also continue to be felt up and down the supply chain. The shortages have made the OEMs sit up and think about their procurement processes and strategies, and also about the visibility they have through the supply chains. In response, we anticipate OEMs to take a greater degree of control over key commodities and components in the future and build in additional levels of safety stocks to cushion against future disruption.”

Comments