New van market growth stemmed only by supply issues – SMMT

Almost 35,000 new vans hit British roads in June as monthly figures catch up with 2019 levels

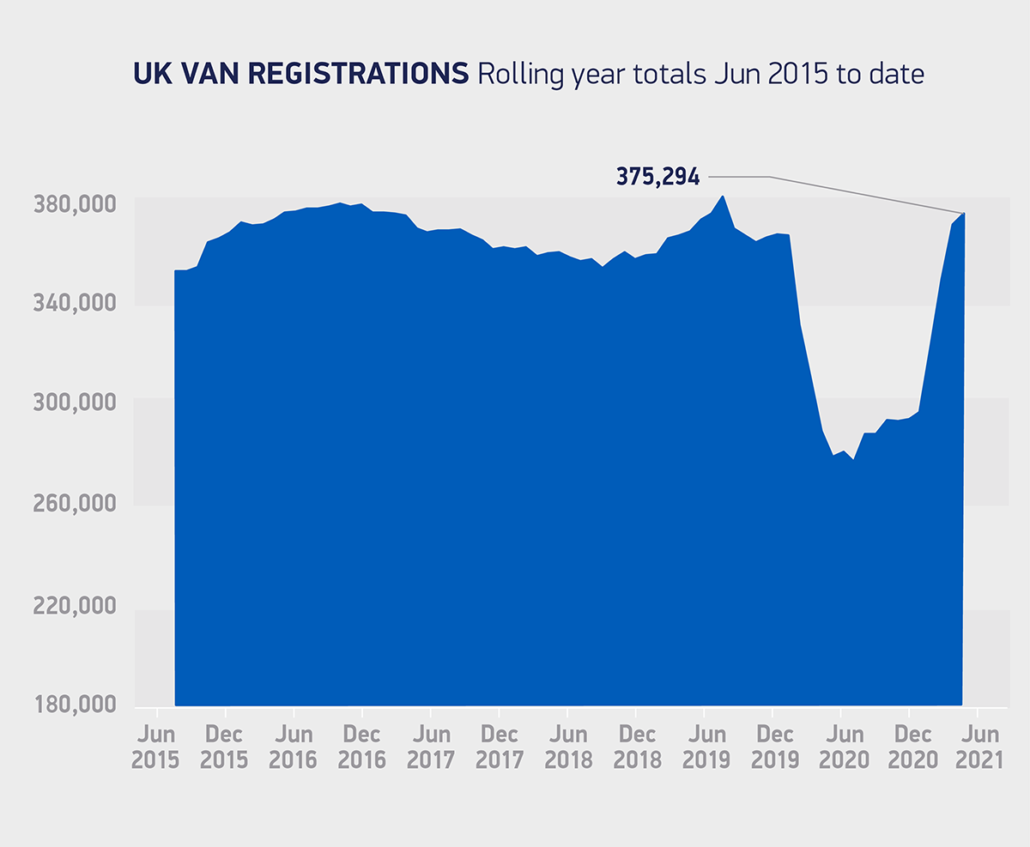

The buoyancy of the British van market post-lockdown is demonstrated by the swift rise in new van registrations in 2021. While certain goods and service industries have supported business continuity for van fleets during the pandemic – such as home delivery and mobile vehicle servicing – the rise in new van purchases demonstrates both confidence in the market and demand for newer, more efficient van technologies. This is good news for UK van tyre suppliers, with original equipment sales supported well in the short-term, and continuity of demand for the latest tyre models to suit new van technologies in the replacement stream, notably including electric vans.

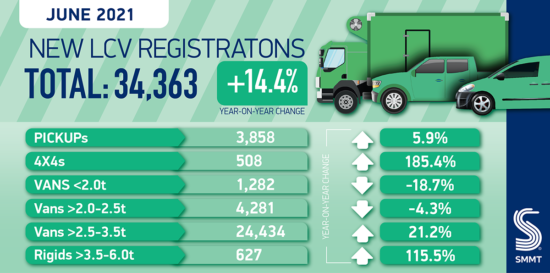

Society of Motor Manufacturers and Traders (SMMT) light commercial vehicle market figures over the second quarter of 2021 have been very encouraging, but not fully devoid of headwinds. Growth was tempered after a bumper recovery in April and May, with 34,363 vans registered in the month. June 2021 was down -13.9 per cent on 2019, a shortfall of some 5,566 units. This was not primarily a demand issue; supply shortages – notably of semi-conductors – affected production volumes and caused delays in the market. Nevertheless, van registrations remain up 14.4 per cent on Covid-impacted 2020.

Year-to-date figures were up 75.9 per cent on last year, and up 1.8 per cent on the pre-pandemic 2015-2019 five-year average. In total 191,513 new vans have exchanged hands, meaning that 2021 is currently the third best year for van uptake since records began. Demand for vans was particularly bolstered by operators looking to renew and expand their fleets to meet rising online delivery business and demand from the construction sector.

Demand for larger 2.5-3.5 tonne vans drove the increase in June, comprising the majority (71 per cent) of all registrations in the month, some 24,434 vans. Other van segments saw drops in demand compared to 2020, with registrations of lighter vans weighing less than or equal to 2.0 tonnes down -18.7 per cent and those of vans weighing more than 2.0-2.5 tonnes down -4.3 per cent.

Mike Hawes, SMMT chief executive, said: “It’s good to see the van market continue to perform well, with pent up demand, online retail and the construction sectors all on the rise. Semi-conductor supply issues have extended lead times, but business confidence is growing and fleets are embarking on decarbonisation programmes. Full market transition, however, still depends on the creation of nationwide charging infrastructure to support society and maintain commercial vehicle momentum.”

(Source: SMMT)

‘Market could have performed better’ – NFDA

Sue Robinson, chief executive of the National Franchised Dealers Association (NFDA) which represents franchised commercial vehicle dealers in the UK, commented: “There is a general belief the market could have performed even better, had it not been for the worldwide shortage of semiconductors which is slowing supplies. Dealers are confident that the market will remain at high levels, but there are concerns with supply issues and subsequent delays in delivering new vans to customers.”

Although sales of light commercials grew in June, supply issues continue to affect the market. This is, in turn, inflating the price of used vans, making it difficult for dealers to evaluate prices to offer for part exchange against a new LCV.

Fleets had a major positive effect on the market as maximum capacity vans above 2.5–3.5 tonnes dominated with a 71 per cent market share. Demand for these vehicles has been growing over the past few years thanks to a rise in online deliveries and they usually represent around 60 per cent of all light commercials sold.

Year to date, all sectors of the light commercial market have experienced growth. However, in June, light ‘car derived vans’ under 2.0 tonnes saw a decline of -18.7 per cent and mid-size vans between 2.0-2.5 tonnes were also down -4.3 per cent; these vehicles are often used in the service industries. The record-setting April and May figures had previously proved much more encouraging for lighter models.

The leading products for June were aligned with year-to-date trend with the Ford Transit Custom in first position, followed by Ford’s Large Transit commercial and Volkswagen’s Transporter.

Fleetcor

Fleetcor Bridgestone

Bridgestone

Comments