Despite a YoY decrease, the UK performance exceeded expectations

GiPA's Aftermarket Pulse is assessing the recovery from 2020's health crisis

GiPA's Aftermarket Pulse is assessing the recovery from 2020's health crisis

Following the unprecedented storm that shook the UK aftermarket in 2020, GiPA created a quarterly aftermarket activity report called Aftermarket Pulse. The objective is simple: assess the state of recovery of the aftermarket in 2021 on a quarterly basis.

Last week GiPA delivered the Q1 results. Whilst the aftermarket suffered massively from the lack of mileage due to the third national lockdown from January to March 2021, the impact on UK workshops turnover was not as bleak as anticipated.

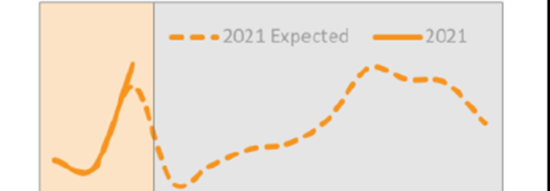

The GiPA 2021 forecast is -9.7 per cent vs 2019 (which was considered a “normal year”). Q1 2021 performed 5.3 per cent above GiPA’s expectations. If the market behaviour carries on for the remainder of the year, with the same momentum seen in Q1, GiPA UK is considering a more optimistic year end for 2021 with only a -5 per cent decrease when compared to 2019.

Measuring Q2 will be critical to either confirm the market trend of a speeding good recovery, or on the contrary if Q1 was a mirage and recovery will be slower than planned.

GiPA UK General Manager, Quentin Le Hetet says: “While Q1-2021 performed below last year’s activity level and even more when compared to 2019, this is a positive outcome. Currently the market needs this positive outlook. With that being said, we should not ignore that Q2 will be challenging with the DSVA forecasting a 53 per cent decrease in volume of MOT testing to be done compared to a typical year.”

Comments