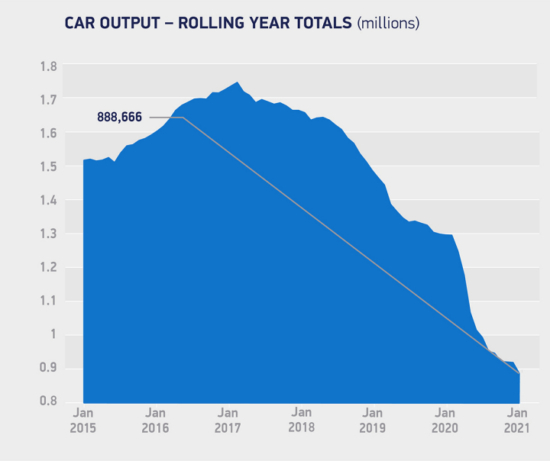

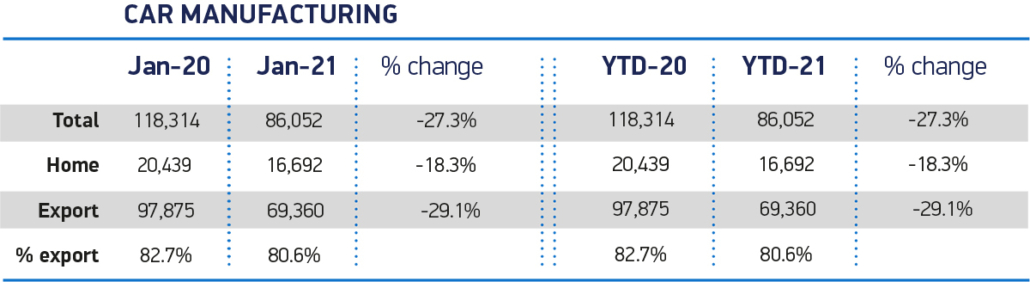

UK car production down 27.3% – 17th month of decline

According to figures from the Society of Motor Manufacturers and Traders (SMMT), UK car production fell 27.3 per cent year-on-year in January to 86,052 units. This is the worst January performance since 2009, when UK factories made just 61,404 cars, and the drop of 32,262 units represents the 17th consecutive month of decline. The SMMT attributes January’s weak output to multiple factors, including the ongoing effects of the pandemic, global supply chain issues, extended shutdowns and friction in the new trading arrangements following the end of the Brexit transition period.

Car manufacturing for both home and overseas markets was down, to 16,692 and 69,360 units respectively, representing falls of 18.3 and 29.1 per cent. While exports still accounted for more than eight in ten cars made during the month, shipments to major markets the EU, US and Asia all fell by double digits, down 26.2, 34.5 and 36.1 per cent.

The shift towards battery electric (BEV), plug-in hybrid (PHEV) and hybrid vehicles (HEV) continues, with UK production of these vehicles rising 18.9 per cent year-on-year in January 2021 to 21,792 units. This means that 25.3 per cent of all cars leaving factory gates are alternatively fuelled.

We need measures that enhance competitiveness

The SMMT calculates that the sector has lost £11.3 billion in car production since March 2020. Whilst manufacturing businesses remain open, weak demand hindered by the ongoing closure of new car showrooms is affecting production volumes. Therefore, the SMMT is urging the Chancellor to use this week’s Budget to announce measures that enhance UK automotive manufacturing competitiveness, with an extension of COVID-19 business support schemes including the CJRS furlough, amendments to business rates reform to incentivise manufacturing investment and more support for skills and training.

SMMT chief executive Mike Hawes described the decline in UK car production as a “grave concern” and considers this week’s Budget “the Chancellor’s opportunity to boost the industry by introducing measures that will support competitiveness, jobs and livelihoods.” Hawes adds: “Whilst there have been some very welcome recent announcements, we need to secure our medium to long-term future by creating the conditions that will attract battery gigafactory investment and transform the supply chain. Most immediately, however, we must get our COVID-secure car showrooms back open, ideally before 12 April. This will be the fastest way to UK automotive manufacturing recovery.”

Source: SMMT

Comments