Budget 2021: Corporation tax up, but business rates frozen – what it means for tyre businesses

The Covid-19 pandemic may have caused the biggest financial crisis of a generation as well as record spending and borrowing levels, but economic highlights aren't as bad as was expected and Chancellor of the Exchequer Rishi Sunak isn't raising taxes as fast as feared (Photo: Tumisu; Pixabay)

The Covid-19 pandemic may have caused the biggest financial crisis of a generation as well as record spending and borrowing levels, but economic highlights aren't as bad as was expected and Chancellor of the Exchequer Rishi Sunak isn't raising taxes as fast as feared (Photo: Tumisu; Pixabay)

The Covid-19 pandemic may have caused the biggest financial crisis of a generation as well as record spending and borrowing levels, but economic highlights aren’t as bad as was expected and UK Chancellor of the Exchequer Rishi Sunak isn’t raising taxes as fast as feared. Here, Tyres & Accessories takes a look at the main points pertaining to the tyre business and specifically: the furlough extension, the corporation tax increase, continued business rates holiday, and the introduction of freeports.

Giving his 2021 budget statement to Parliament on 3 March 2021, Sunak said the economy will be 3 per cent smaller in five years than it would’ve been: “The Office for Budget Responsibility (OBR) forecast that our economy will grow this year by 4 per cent, by 7.3 per cent in 2022, then 1.7 per cent, 1.6 per cent and 1.7 per cent in the last three years of the forecast.” This may all sound bad, but Chancellor generally sees it as better than expected.

As far as budgetary policy announcements are concerned, high spending following by tax increases were the order of the day. First off, the chancellor announced an extension of the Coronavirus Job Support Scheme to September 2021 across the UK.

At the same time, he announced an extension of the UK-wide Self Employment Income Support scheme to September 2021, with 600,000 more people who filed a tax return in 2019-20 now able to claim for the first time.

Businesses affected by the pandemic will also be able to access “A new UK-wide Recovery Loan Scheme to make available loans between £25,001 and £10 million, and asset and invoice finance between £1,000 and £10 million”.

Further support for apprenticeships

There will also be further support for apprenticeships, an area that has been of particular importance to the tyre trade, which has been seeking to secure the size of its workforce in the medium and long-term. The support measures include: An extension of the apprenticeship hiring incentive in England to September 2021 and an increase of payment to £3,000 as well as £7 million for a new “flexi-job” apprenticeship programme in England, that will enable apprentices to work with a number of employers in one sector.

However, Institute of the Motor Industry (IMI) CEO, Steve Nash thinks government policy has fallen short in this respect:

“… most disappointing is the lack of any real tangible support to improve apprenticeship take up. With the Government still refusing to waive the Apprenticeship Levy clawback, if funds are not used within two years, the picture for the apprenticeship route in automotive still looks bleak. Whilst apprenticeship starts in England as a whole dropped by 9 per cent in November 2020, for the automotive sector the fall was much more significant. Apprenticeship starts in automotive in November 2020 were 33 per cent lower than the previous year.

“We are also deeply concerned about the impact of the fall in apprenticeship starts in key parts of our sector which play a fundamental role in keeping Britain moving. Vehicle Maintenance and Repair, Vehicle Body and Paint Operations and Vehicle Parts Operations saw declines of almost 100 per cent in apprenticeship starts in November compared to the same period last year.”

The government is also more than doubling the legal limit for single contactless payments, from £45 to £100, which makes this facility available to the small end of tyre retail transactions for the first time.

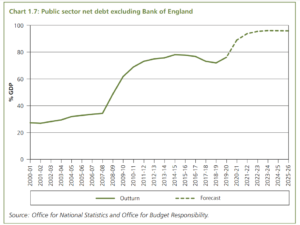

However, government spending and therefore debt has risen at record rates which the powers that be will inevitably seek to recover (see chart). Specifically, Corporation Tax rate will increase to 25 per cent. Apparently, this remains “the lowest rate in the G7″”. The increase will take effect in 2023 and will focus on larger businesses. Businesses with profits of £50,000 or less, around 70 per cent of actively trading companies, will continue to be taxed at 19 per cent and a taper above £50,000 will be introduced so that only businesses with profits greater than £250,000 will be taxed at the full 25 per cent rate.

There was also news of an extension to the business rates holidays implemented in response to the pandemic and pandemic-related lockdowns. Since March 2020 the government has provided £20 billion of grants to businesses alongside over £10 billion of business rates holidays. Business rates holidays are now being extended, but details of exactly how long this already-extended policy will last are not yet clear.

Fuel duty will be frozen for the 11th consecutive year.

Freeports and super-deductions

Two further policies could potentially impact the UK tyre business. Firstly freeports in East Midlands Airport, Felixstowe & Harwich, Humber, Liverpool City Region, Plymouth, Solent, Thames and Teesside will become “special economic zones with different rules to make it easier and cheaper to do business.”

And secondly, beginning April 2021, “a new Super Deduction will cut companies’ tax bill by 25p for every pound they invest in new equipment meaning they can reduce their taxable profits by 130 per cent of the cost.”

The latter measure will help tyre manufacturers and expanding wholesalers and retail operations alike as it supports investment in technical equipment and infrastructure upgrades as well as research and development.

Comments