Nokian Tyres: Lower sales & earnings in 2020

Jukka Moisio is “extremely proud” the Nokian Tyres team’s response to the challenges it faced in 2020. But no amount of pride can compensate for sales and income lost due to lockdowns and other restrictions. As expected, the Finnish tyre maker reported reduced sales and earnings for the year.

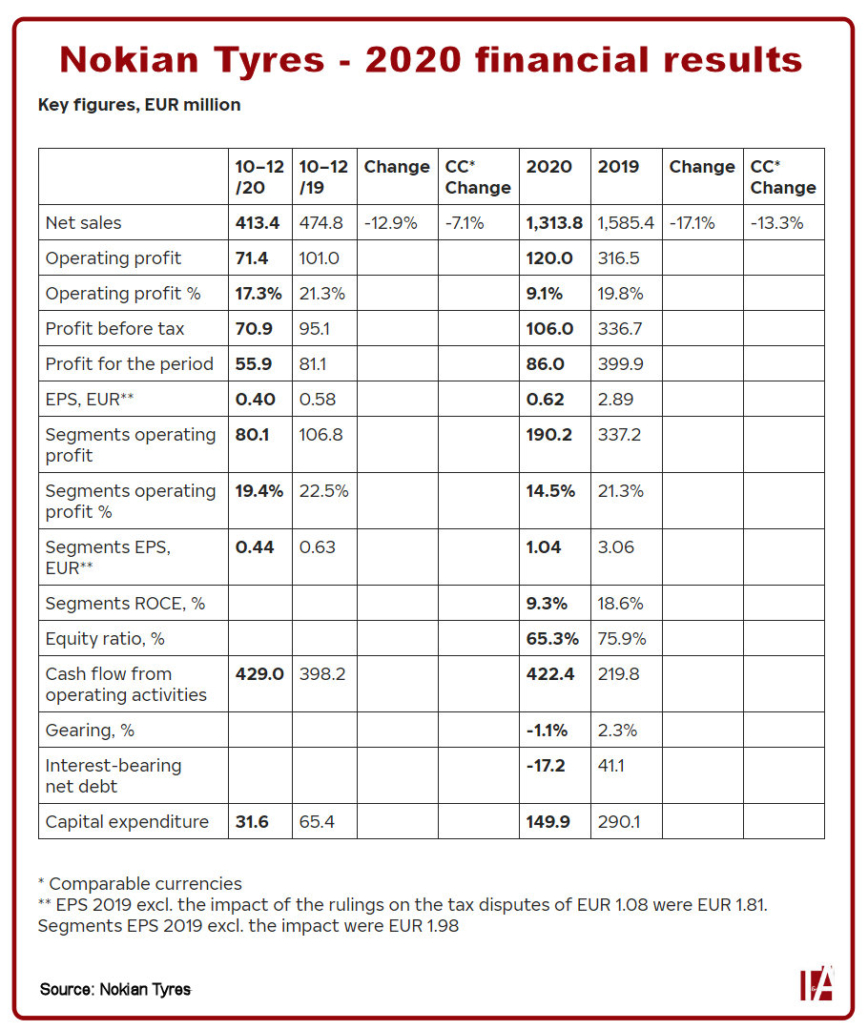

Net sales for 2020 amounted to 1.31 billion euros and were thus (with comparable currencies) 13.3 per cent lower than in 2019, a decline that Nokian Tyres attributes to the coronavirus crisis as well as to measures it undertook to reduce carry-over stocks in its Russian distribution channel and also the mild winter in all its main markets in 2019-20.

Segments operating profit decreased 43.6 per cent year-on-year to 190.2 million euros, a decline driven by lower volumes, under-absorption of factory costs and currencies. Operating profit amounted to 120.0 million euros, 62.1 per cent less than in 2019. At just 9.1 per cent, the operating margin was more than ten percentage points lower than a year earlier.

Segments earnings per share for 2020 were 1.04 euros and earnings per share were 0.62 euros. Nokian Tyres’ Board of Directors has proposed a dividend of 1.20 euros per share for the financial year 2020, which will be paid in two instalments.

Net sales for the company’s Passenger Car Tyres business unit declined 18.0 per cent (comparable currencies) to 871.3 million euros in 2020. The decrease was just 1.8 per cent (comparable currencies) for the Heavy Tyres business, which achieved net sales of 194.6 million euros. Net sales for company-owned Vianor operations were 318.1 million euros, down 2.8 per cent year-on-year (comparable currencies).

Q4 2020

For October through to the end of December 2020, Nokian Tyres achieved net sales of 413.4 million euros, 7.1 per cent less than in the final quarter of 2019.

Segments operating profit was down 25.0 per cent to 80.1 million euros, while operating profit amounted to 71.4 million euros, down 29.3 per cent, and the operating margin slipped four percentage points to 17.3 per cent.

Segments earnings per share were 0.44 euros and earnings per share 0.40 euros.

Commenting on Nokian Tyres’ performance during the final quarter of last year, president and chief executive officer Jukka Moisio said: “Our October-December 2020 sales continued to be impacted by COVID-19 as restrictions were again tightened in many countries. Passenger Car Tyres’ net sales were also negatively impacted by a delayed winter season in main markets. Heavy Tyres and Vianor continued to perform well considering the volatile market. Segments operating profit declined mainly due to the lower passenger car tyre volumes.”

Demonstrating resilience

Moisio expresses pride towards how the tyre maker’s workforce responded to the situation they faced in 2020. “We have demonstrated the resilience of our company. Our focus has been on serving demand, safeguarding supply and reducing costs. In Russia, we successfully achieved our target to lower distribution channel inventories in line with the plan. The cash flow was significantly better than in the previous year, and we maintained a strong balance sheet.

“At the same time, we have progressed on our key projects to support the company’s long-term growth,” Moisio adds. “We began commercial tyre production in the US factory and are completing our new test centre in Spain. The project to increase Heavy Tyres’ capacity in Finland is proceeding as planned. These investments, together with innovative new products and robust sales and marketing efforts, will provide an excellent foundation to capture profitable growth opportunities as we move forward.”

Higher sales & profits in 2021

Nokian Tyres anticipates that its net sales (with comparable currencies) and segments operating profit will “grow significantly” in 2021. It expects an upswing in global demand for new cars and tyres during the year, but cautions that “the COVID-19 pandemic continues to cause uncertainties for the development.”

“We are starting 2021 in a good position,” Moisio adds. “We will drive growth through new product launches, and improvements in go-to-market activities. Cash flow will continue to be in focus, with prioritised investments on a lower level compared to previous years. In the coming months, we will review our strategy to continue to deliver positive long-term results to our stakeholders.”

Click here for Nokian Tyres’ Q4 and full-year 2020 presentation.

Comments