UK new car registrations fall -29.4% to 30-year low

(Source: SMMT)

(Source: SMMT)

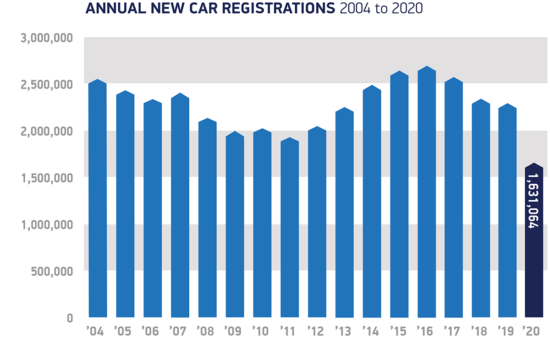

The UK new car market fell by 29.4 per cent in 2020, with annual registrations dropping to 1,631,064 units, according to figures published by the Society of Motor Manufacturers and Traders (SMMT) today 6 January 2021. A -10.9 per cent decline in December topped off a turbulent year, which saw demand fall by 680,076 units to a near 30-year low (specifically, the lowest level of registrations since 1992).

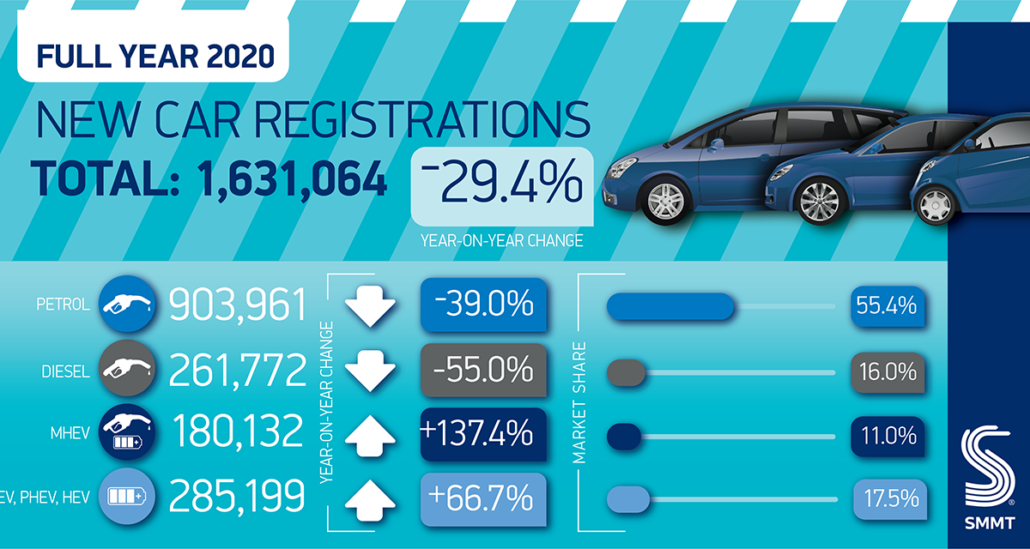

Demand fell across all segments bar specialist sports, which grew by 7.0 per cent, although Britain’s most popular class of car remained the supermini, retaining a 31.2 per cent market share despite a -25.9 per cent decline in registrations. Meanwhile, although falling by a combined -32.9 per cent, petrol and mild hybrid (MHEV) petrol cars made up 62.7 per cent of registrations, while diesel and MHEV diesels, down -47.6 per cent, comprised a fifth (19.8%) of the market.

Electric vehicle sales boomed in 2020

Battery and plug-in hybrid electric cars, which together accounted for over 10 per cent of registrations boomed during 2020. Demand for battery electric vehicles (BEVs) grew by 185.9 per cent to 108,205 units, while registrations of plug-in hybrids (PHEVs) rose 91.2 per cent to 66,877. Most of these registrations (68%) were for company cars, indicating that private buyers need stronger incentives to make the switch.

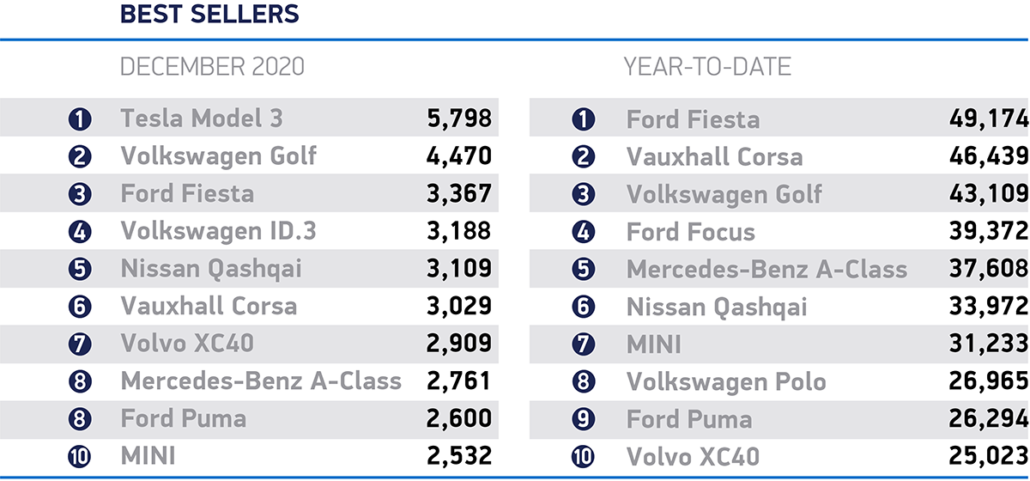

The Tesla Model 3’s pole-position in December registrations tells a story about the continued growth of electric vehicle sales during 2020 (Source: SMMT)

To increase uptake will require others to match the industry’s commitment to electrification and the SMMT reports that it will continue to work with government on the detail of a strategy to deliver a successful, rapid transition that benefits all of society and safeguards automotive manufacturing with sufficient battery production capacity.

Additionally, while Brexit uncertainty tainted industry confidence during 2020, the SMMT reported that, with the UK-EU Trade and Cooperation Agreement now in force, “the industry has avoided a catastrophic ‘no deal’ scenario and can plan for a future with more certainty over trading conditions”. Given seven out of 10 new cars registered in the UK in 2020 were imported from Europe, the continuation of tariff- and quota-free trade is critical to a strong new car market in the UK.

Mike Hawes, SMMT Chief Executive, said: “2020 will be seen as a ‘lost year’ for Automotive, with the sector under pandemic-enforced shutdown for much of the year and uncertainty over future trading conditions taking their toll. However, with the rollout of vaccines and clarity over our new relationship with the EU, we must make 2021 a year of recovery. With manufacturers bringing record numbers of electrified vehicles to market over the coming months, we will work with government to encourage drivers to make the switch, while promoting investment in our globally-renowned manufacturing base – recharging the market, industry and economy.”

Michael Woodward, UK automotive lead at Deloitte, added: “2020 saw 29 per cent fewer new cars on the road than in 2019, marking a fourth consecutive year of declining sales and suggesting the fallout may be felt for some time still.

“However, many manufacturers and dealers remain optimistic for the year ahead, in spite of the latest UK lockdown measures. Whilst showrooms will be closed as in previous lockdowns, manufacturing facilities are expected to remain open this time. For dealers, click and collect, MOT and repair services also remain permitted offering a valuable, and profitable, lifeline.”

Commenting on progress in the electric vehicle sector, he continued: “Electric vehicles (EV) continued to outperform the market in December….The stage is set for further growth with the government and manufacturers showing significant commitment to EVs. For example, bringing forward the ban on new petrol and diesel sales to 2030 brings the UK in line with some European markets, such as Ireland and The Netherlands, and is more ambitious than many other major European markets; in some cases by a decade.

“This show of commitment, coupled with financial and tax incentives and a growing focus on the green agenda, will make EVs more desirable than ever in 2021 and the sector will have diesel’s 16 per cent share of the market firmly within reach. Speed of growth over the next year will depend on consumer confidence in the UK’s’ charging infrastructure. However, we need only look at Norway, which recently reached a landmark EV market share of 54 per cent, to see what is possible with all pieces of the jigsaw in place.”

The changing face of the vehicle parc brings with it two streams of implications for tyre dealers in 2021 and beyond. Firstly, lower new car sales means lower vehicle life, which brings with it increased maintenance – good news for tyre retailers and garages. And secondly, the transition towards electric vehicles means the transition to electric vehicle-orientated tyre products, which means both greater complexity and opportunity in the tyre market.

(Source: SMMT)

Tyrepress.com / Stephen Goodchild

Tyrepress.com / Stephen Goodchild DVSA

DVSA

Comments