MOT boom demands the right garage technology

It isn’t news to say that the tyre and autocentre sector is becoming an increasingly technological business. However, two recent trends confirm the need for garages to be properly equipped – increasing electric vehicle take-up and, in the short term, booming MOT demand. (Photo: S. Hermann & F. Richter; Pixabay)

It isn’t news to say that the tyre and autocentre sector is becoming an increasingly technological business. However, two recent trends confirm the need for garages to be properly equipped – increasing electric vehicle take-up and, in the short term, booming MOT demand. (Photo: S. Hermann & F. Richter; Pixabay)

It isn’t news to say that the tyre and autocentre sector is becoming an increasingly technological business. However, two recent trends confirm the need for garages to be properly equipped – increasing electric vehicle take-up and, in the short term, booming MOT demand.

In January 2019, we predicted a 5 per cent increase in MOTs during the course of the year. One calculation suggested this would work out as 2.6 million extra MOT tests during 2019, which equates to something like 50 extra MOTs per site per month. The latest DVSA numbers suggest that MOTs actually went up by an estimated 6.2 per cent last year, rising from 29.560 million in 2018 to 31.405 million last year. So far DVSA have only released data relating to the first nine months of 2019, so the final figure could go down, but in all likelihood it now looks like 5 per cent was a conservative estimate.

The theory was that the boom in new car sales that led to a few years of scrappage schemes and the like is now translating into increased call for MOTs. The good news is that these figures all point to an ongoing increase in the numbers of cars on the road as opposed to an one-off peak. However, a lot has happened since 2019. We have had a six-month test hiatus and three-month lockdown. Of course, both will have had enormously negative impact on miles-driven and demand for MOTs so far in 2020, but both factors have also stoked short-term MOT demand. The result? Anecdotally at least, we are already experiencing an MOT demand boom. For example, my local independent told me that whereas they would normally service five to 10 MOTs a day at this time of year, they are currently doing 15 a day and are booked up for weeks in advance. In other words, the early indications are that the short-term MOT boom is likely to continue at least till the end of the year.

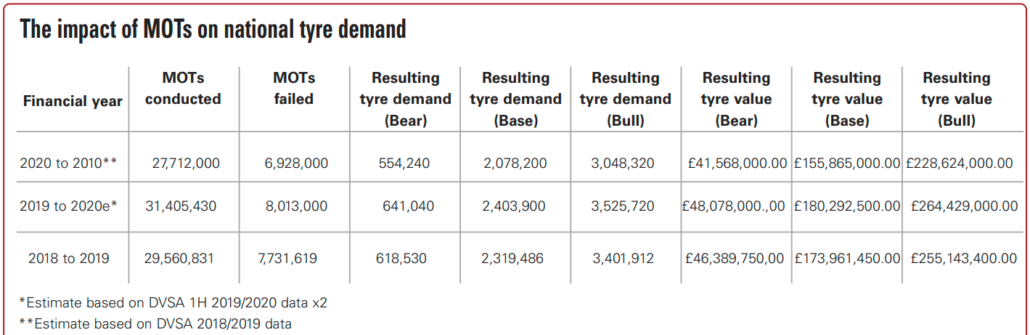

This, in turn, will cause a sharp uptick in tyre demand in the last quarter, but not in the full-year data. If we take our projected full-year 2019 MOT demand figure as a starting point, there are likely to be around 11 per cent less MOTs this year than last year. Here’s how we came to this figure: Starting with a conservative estimate based on the full-year 2018 figures (the only sensible approach given that 2018 is the last complete year of data and that the given circumstances suggest an optimistic calculation is unwarranted), we then subtracted 25 per cent to represent the stalled demand caused by three months of lockdown. This approach was taken because, owing to the facts that the MOT extension was given in a rolling fashion and MOTs are not evenly distributed across the year, it was better to use the proxy of the three month lockdown instead. Then based on widespread projects of at least double the demand for MOTs in the last quarter, we averaged out the 2018 full-year figures to represent the last three months of the year and doubled the product. These two parts were then added together to give our estimated total.

From here, we used the same scenarios from our full-year 2019 calculations to illustrate what this means in tyre demand terms. Here’s a quick summary of how that works. The “bear” case uses the lowest figure in the range of calculations of the proportion of tyre-related failures where the sale of only one replacement tyre is realised; the “base” case, which assumes a median percentage for tyre-related failure and that tyres are generally replaced in pairs; and a “bull” or optimistic scenario, which assumes the top end of percentages for tyre-related failures and that two tyres are replaced.

To summarise, full-year 2020 MOT figures will be a mess. The first three quarters of the year will be heavily distorted due to lockdown and the MOT extension. There will then be a sharp spike in the last quarter, when demand will double or even more. But, when you consider that overall annual demand has been widely predicted to be 25 per cent or more down, the fact that MOT-related tyre demand appears to be down less than half that among, there are reasons to be optimistic. And with garages’ MOT capacity full to the brim, having the right equipment is fast-becoming a necessity in order to make the most out of such stop-start traffic.

What car registration figures tell us

As we can see, the coronavirus has sent repercussions throughout the entire economy and tyre sales are not immune from this. However, positive disruption is also taking place in the wider automotive market. For example, the latest SMMT new car registrations suggest electric vehicle take-up is better than ever. Michael Woodward, UK automotive lead at Deloitte summarised the evolving market like this:

“September was another excellent month for electric vehicles, with Battery Electric (BEV) and Plug in Hybrid (PHEV) growing their market share to 11 per cent, compared to just 4 per cent last year. Both BEVs and PHEVs saw growth this month, of 184 per cent and 139 per cent respectively, accelerating an imminent overtake of diesel sales (-38%).” In other words, the motorists that are changing their cars are buying increasing numbers of electric vehicles. Electric vehicle market share growth is compounded by the fact that the overall market demand is way down. But with goals set for the entire replacement of internal combustion engines during the next decade or so, the car parc is changing this is a trend that is unlikely to regress. This month, we have a separate section on what the trend towards electric vehicle means in tyre terms. In this section, we are considering what might be called the secondary effects.

Taken together, the collapse of the new car sales combined with trends towards private ownership of electric vehicles will inevitably impact the tyre replacement business. And this, in turn, means three things: 1) low new car sales means more maintenance on existing cars and greater take up of MOTs in the short term as these only take effect on three-year and not new vehicles; 2) the trend towards private ownership means more consumers organising their own ongoing vehicle maintenance and therefore a more competitive aftermarket; and 3) increased sales of petrol-driven/plug-in hybrid electric vehicles will result in an increasingly technological car parc, meaning garages must be up to speed with the latest technologies. In other words, the changing face of the UK and European car market brings with it further secondary effects. Not only do electric vehicles require the right tyres, garages need to have the right equipment. That’s why this section brings you the latest information on the garage and tyre bay technology you need to make the most of the present business opportunities.

You can also find this article in the November edition of Tyres & Accessories magazine. Not yet a subscriber? You can change that here.

Nokian Tyres

Nokian Tyres Continental AG

Continental AG

Comments