More online tyre retail means more pre-sale research

No-one envisioned just how many challenges the tyre market would have to face this year. As has generally been the case, the trade rose to the occasion by repeatedly pivoting to adjust to mid-pandemic customer demands and government requirements. At the bricks and mortar end of the business this has meant ensuring premises are Covid-secure and there are continuing supplies of PPE – as well as maintaining high standards of tyre service and supply. However, this year has also significantly closed the gap between exclusively conventional bricks and mortar tyre retail businesses and pure play tyre e-tailers, with consumers increasingly planning tyre purchases and looking for contactless servicing options online.

From our points of view, we – like the tyre business at large – have sought to hit the challenges of this year head-on, responding with new editorial approaches, upgraded products and additional advertising opportunities. As far as the Internet is concerned, we upgraded Tyrepress.com in April. Since then, we have added video editorial to our portfolio. Beginning with the “kick-starting your tyre business” webinar in May, we have developed and distributed dozens of completely original video interviews. The high point in 2020 was the Virtual Tyre Industry Conference held on 5 November in conjunction with the NTDA, which really showed how demand for video content is continuing to increase even in the niche tyre business to business space. Indeed, the virtual Tyre Industry Conference was the most popular page on our website that week!

For us, this was all part of our goal of helping the tyre trade traverse the challenges this year has brought; to help you keep Britain rolling. But this all refers to the B2B channel. The focus of this article is the consumer side of the business and specifically how the tyre trade can interact with the changing online habits of tyre buyers.

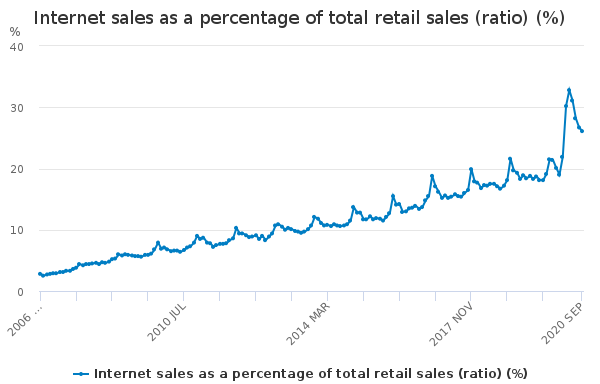

There is no doubt that online retail is growing in general. While UK online retail amounted to a record £76.04 billion in 2019, this year online buying is knocking on £100 billion (see chart 1). And it is not just absolute sales that have increased. Internet sales as a percentage of total retail sales have also increased dramatically too (see chart 2). The proportion of retail business done online peaked at 32.8 per cent of the total in May during the first national lockdown. The latest Office of National Statistics (ONS) data shows that this surge online receded in September 2020, falling back to 26.1 per cent of total retail sales. However, even this lower figure represents a huge increase on the 18.1 per cent level of September 2019. At the time of going to press, we are mid-way through the UK’s second national lockdown, which suggests online retail levels are likely to increase again, bringing the annual value up with it.

There is no doubt that online retail is growing in general. While UK online retail amounted to a record £76.04 billion in 2019, this year online buying is knocking on £100 billion (see chart 1). And it is not just absolute sales that have increased. Internet sales as a percentage of total retail sales have also increased dramatically too (see chart 2). The proportion of retail business done online peaked at 32.8 per cent of the total in May during the first national lockdown. The latest Office of National Statistics (ONS) data shows that this surge online receded in September 2020, falling back to 26.1 per cent of total retail sales. However, even this lower figure represents a huge increase on the 18.1 per cent level of September 2019. At the time of going to press, we are mid-way through the UK’s second national lockdown, which suggests online retail levels are likely to increase again, bringing the annual value up with it.

Source: ONS

The same trend towards online retail can be seen in the actions of the segment’s largest players. As we have previously reported, in September, Amazon said it will create an extra 7,000 UK jobs this year to meet growing demand. Prior to this, the online retail giant had already added 3,000 roles in 2020. So, by the end of the year, it will have created a total of 10,000 new jobs. At the same time, the company has increased its involvement with the tyre market. While online tyre retail is about far more than Amazon, the news reflects increased demand both for online ordering in general and for online tyre sales in particular.

But it is not just Amazon that has noticed this trend and sought to identify its application in the tyre market. Speaking during a webinar in June, GfK analysts highlighted how online tyre buying is increasing as a function of lockdown and the increased take-up of online shopping in general. Their thesis? More tyres will be sold online and the budget tyre sector will be the beneficiary (they also suggested that already-growing sales of van tyres would continue as online sales prompt increased local delivery).

GfK senior insight specialist, James Ward re-iterated this point as part of “New Tyres in a Corona-World”, the first session of the virtual Tyre Industry Conference in November (all four sessions are freely available online at tyrepress.com/tyre-industry-conference-2020). Specifically, he suggested that the clear general trend towards online retail would transfer to the tyre sector as “more consumers get used to shopping online”.

Re-comparing the comparison sites

In the tyre sector, various sources suggested that between 60 and 80 per cent of consumers were doing pre-sale research online (prior to lockdown). If the overall scale of online retail has increased, the absolute numbers of people looking for tyres online must have also increased. This is certainly something that our WhatTyre.com product comparison site has witnessed. Despite only being launched in 2019, traffic has increased strongly during the course of 2020. As of October, the site is attracting 53,000 visits a month and traffic continues to grow 20 to 30 per cent a month. Now, this is just one example. But the trend is clear, more online retail means more pre-sale research. The question is: what tyre-related information are they finding?

At the moment, the data shows that consumers search online using their preferred keywords to find what the tyre-related information they are looking forward. In general terms, this takes them to one of two places – an online tyre retailer or a product comparison site. The online tyre retail space is dominated by a relatively small number of large players. On the other hand, a collection of comparison sites are positioned to influence the sale of tyres.

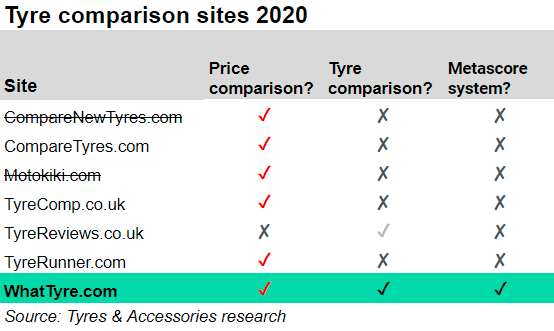

Roughly a year ago we took a closer look at what is on offer in tyre comparison space and found that – with one or two noticeable exceptions – most sites focus on price comparison, with little or no option to research products on the basis of performance. The unfortunate affect of such an approach is that it propels consumers into a price-driven race to bottom which all too often results in consumers buying low-costs tyres with low levels of performance, without bringing value to the supply chain.

Following on from the research we conducted in September 2019, we revisited the same seven leading comparison sites to see what’s changed. The first thing that stands out that is that two of the sites return page load errors. In other words, they are no longer operational. Since one of them was the best-funded project in the market, it goes some way to showing that a strategy relient on price as opposed to product comparison doesn’t work for anyone.

The next thing that becomes apparent is that the majority of the remaining sites are continuing to work on the same basis they did before – price comparison over product comparison. Cost over performance.

The two exceptions to this rule are TyreReviews.com and WhatTyre.com, which both convey extensive details of relating to consumer review data and third-party testing respectively. Of these, only one offers are metascoring system to make the comparison process easier.

So, overall as lockdown, the rise of mobile tyre fitting and increasing online buying in general all enhance the influence of pre-sale research, the question is: which sites are helping the trade raise the level of conversation about tyres away from price only?

Chart 3:

CV Show

CV Show Network Rail Air Ops team

Network Rail Air Ops team

Comments