Yokohama Q1: Tires division enters loss, ATG remains profitable

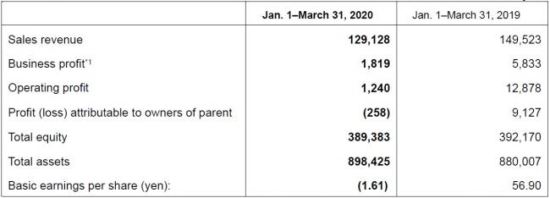

Yokohama Q1 2020 financial result. Source: Yokohama

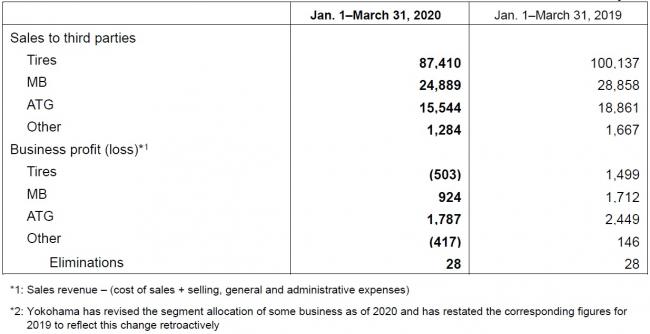

Yokohama Q1 2020 financial result. Source: Yokohama

The Yokohama Rubber Co. Ltd. posted a 258 million yen loss during the first quarter of 2020 compared with 9.1 billion yen in profit in the same period of the previous year. Meanwhile operating profit fell 90.4 per cent, to 1.2 billion yen. Sales revenue declined 13.6 per cent to 129.1 billion yen.

Yokohama’s Tires segment saw sales revenue and business profit decline as well. According to the company, the downturn in business profit reflected a decline in unit sales volume, an increase in production costs associated with reduced production volume and the costs of a tyre recall in North America.

Yokohama’s sales revenue in the original equipment business declined in Japan and overseas. That decline reportedly reflected production adjustments necessitated by a decline in Japanese demand associated with the novel coronavirus (COVID-19) outbreak and by suspended operation at vehicle plants in overseas markets.

Sales revenue also declined in replacement tyres. Sales of winter tyres in Japan were weak on account of warmer-than-usual winter temperatures at the outset of the year, and Japanese business in replacement tyres also suffered from the adverse effect of the COVID-19 outbreak on consumer spending. Business in replacement tyres was generally sluggish in overseas markets, too.

However, while Yokohama’s Tire division posted 503 million yen net loss in the first quarter of 2020, its ATG (Alliance Tire Group) division reported 1.787 billion yen profit, suggesting that this particular business is more durable in the coronavirus context.

Reflecting on the ongoing uncertainties in the market, company representatives commented that dividends and projections would be cancelled for the time being: “the full extent of that disruption is impossible to determine at this time, and the company will therefore withhold for the time being the release of revised business projections and of proposed dividends.”

In the meantime, the tyre manufacturer announced that it would focus on a series of balance sheet-fortifying measures including: “paring cash expenditures by deferring capital spending and trimming costs and reducing compensation for directors, officers, associate officers, and managers.”

Yokohama Q1 2020 financial result by business segment. Source: Yokohama

Comments