Trelleborg reorganisation brings greater prominence to tyres

Diagram: Trelleborg

Diagram: Trelleborg

At the end of February, Trelleborg invited key dealers to the company’s Swedish homeland in order to further develop connections with its UK distributors and share the details of recent developments at the well-known agricultural and off-road tyre and wheel manufacturer. Tyres & Accessories spoke with Trelleborg’s Agricultural Segment Leader – EMEA, Bruce Lauder in order to find out more.

Coming, as it did, before the coronavirus/covid-19 crisis really established itself in Europe, Trelleborg’s specialist tyre distributor meeting in Sweden was remarkably well-timed. The event took place between 26 and 28 February 2020 – a time when Italy (which is of course the Trelleborg agricultural tyre brand’s spiritual home and physical headquarters) was already feeling the effects of Covid-19 and had some regions on lockdown.

The trip’s business meeting began with apologies from recently appointed managing director Richard Lyons. Like many in the industry, Tyres & Accessories had planned to catch up with Lyons in order to find out what he plans to bring to the role. However, like many things at this challenging time, circumstances overtook us and he wasn’t able to make the flight as a precautionary measure. Still, Bruce Lauder Trelleborg’s Agricultural Segment Leader, EMEA had plenty of news to share with delegates and, Covid aside, there was a degree of optimism that (although business had been challenging) opportunities for farms and contractors were opening up.

During the event, Trelleborg took the opportunity to position its two leading brands (Trelleborg and Mitas) as well as its group brands (Cultor and Maximo) in the form of a complete portfolio. Company representatives also shared details of how Trelleborg has been investing in both its production capacity and its customers and distributors. While Trelleborg’s acquisition of Mitas was four years ago, the Stockholm event was the first time the company has taken the portfolio approach. And what’s more, Trelleborg’s UK sales team now sells both brands.

But before going into more detail, here’s a little background. In December 2019, the 37 billion Swedish krone a year (3.46 billion euros; $3.87 billion) Trelleborg Group implemented a series of organisational changes with the aim of improving profitability and focusing the company on selected segments. At the time, the group said the intention was to “continue to develop and strengthen already well-performing and well-positioned business areas that have sizeable global businesses.”

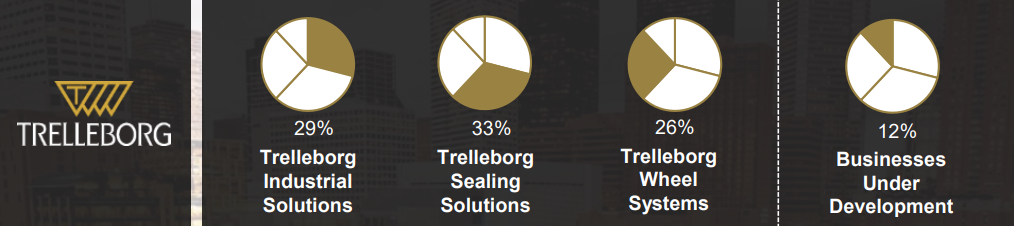

But the main feature of the reorganisation was the reducing of the number of business areas from five to three, Trelleborg Wheel Systems is one of the main three businesses under the structure.

The other two business areas in the new organisation are: Trelleborg Industrial Solutions, specialising in polymer-based niche applications and infrastructure projects; and Trelleborg Sealing Solutions, specialising in polymer-based sealing solutions. Trelleborg Coated Systems and Trelleborg Offshore & Construction are being discontinued as business areas.

As a result, the company is made up of three main similarly sized business units as well as an emerging “businesses under development” wing. Trelleborg Wheel Systems specifically accounts for 26 per cent of the Group’s annual turnover, which – according to company representatives – currently equates to 910 million euros (see diagram for further details).

Trelleborg Wheel Systems has an impressive global manufacturing footprint, with factories in Italy, UK, Latvia, Sri Lanka, China, Brazil, US, Czech Republic, Serbia and Slovenia (see diagram for more on this).

Agricultural trends might be up in the air thanks to the uncertainty of the coronavirus outbreak, but the range of Total Income from Farming per hectare (TIF) figures demonstrates just how diverse a customer base Trelleborg and its distributors are connected to. To give a concrete example, TIF figures of £900 a hectare are achievable in Cornwall, but in Cumbria it is £21. The point is that different approaches are needed in different regions and yet product and customer service excellence appeal to all customers.

However, it is fair to say that – coronavirus aside – there is a consensus amongst surveyed farmers that “increasing productivity” and “decreasing costs” were their most important considerations. According to market research Trelleborg representatives shared during the event, 48 per cent of cereals farmers reported signs of obvious compaction. A further 20 per cent have not performed a survey and therefore the figures could be substantially higher. And all of this means there are opportunities to help farms increase their productivity through buying the most appropriate tyres.

For its part, Trelleborg reports that it is aiming for speciality tyre leadership, something that it is building towards from the basis of its strong brands and – in the UK at least – the market-leading OE share of Trelleborg and Mitas. To illustrate the point, 30 per cent of tractors going into the Europe have Mitas tyres on them.

And then there is the complementary wheel strategy. Whatever tyres OEMs end up fitting, many of them make vehicles based on Trelleborg wheels. And that’s at least part of the reason why Trelleborg has “invested significantly” in its Lydney, UK wheel factory in order to strength the company’s particular special offer in this respect. And this means the firm can offer complete wheels, conversions, custom wheels and more.

Global reorganisation results in local re-shuffle

At the same time, and at least partly in response to the global reorganisation, Trelleborg has also reorganised how its team are working on the ground. Moving forward the team will operation a joint approach across all brands in the UK – a strategy different to that in place in other European nations. As of April 2020, the UK operation will be covered across four areas, with a sales manager in each in order to bring more focus and assistance to each specific area. In addition there will be one national account manager, one national field manager, and one national technical manager as well as customer service area contacts.

As a result, Jimmy Jones is now responsible for the UK West region; Keith Grant – UK North, Northern Ireland and Scotland; and Andrew Daniels – UK East. Tools at the team’s disposal include free weighing and optimal pressure advice under the banner of tyre optimisation. Further strategic options such as Trelleborg’s AGCO partnership, which is a national service designed to help customers fit more premium tyres to AGCO vehicles in order to get the most out of the machinery, will no-doubt support business.

And finally, there’s Trelleborg’s rejuvenated Agriplus loyalty scheme. Essentially Agriplus brings with it loyalty points for all kinds of interactions with Trelleborg. These can then be saved up and exchanged for rewards such as TVs, Xboxes and iPhones. Currently points can be accumulated on Trelleborg interactions, but soon this will be expanded to include Mitas (although this will not include Mitas OE owing to the fact that Mitas has such a large share of European OE.

Taken together, it is clear that Trelleborg is not only aiming for speciality tyre leadership, but its taking practical steps and reorganising its personnel in order to move towards this goal. And at the same time, looking at the situation from a group perspective, it could be said that the Trelleborg reorganisation brings with it a greater recognition of the importance of tyres.

- Diagram: Trelleborg

- Diagram: Trelleborg

- Diagram: Trelleborg

Comments