ETRMA volumes: Why almost 20 million more tyres means a weaker market

Figures recently published by the European Tyre and Rubber Manufacturers Association (ETRMA) show that its members produced almost 242 million tyres in all segments of the replacement market in 2019, two to three per cent fewer than the 248 million tyres produced a year earlier.

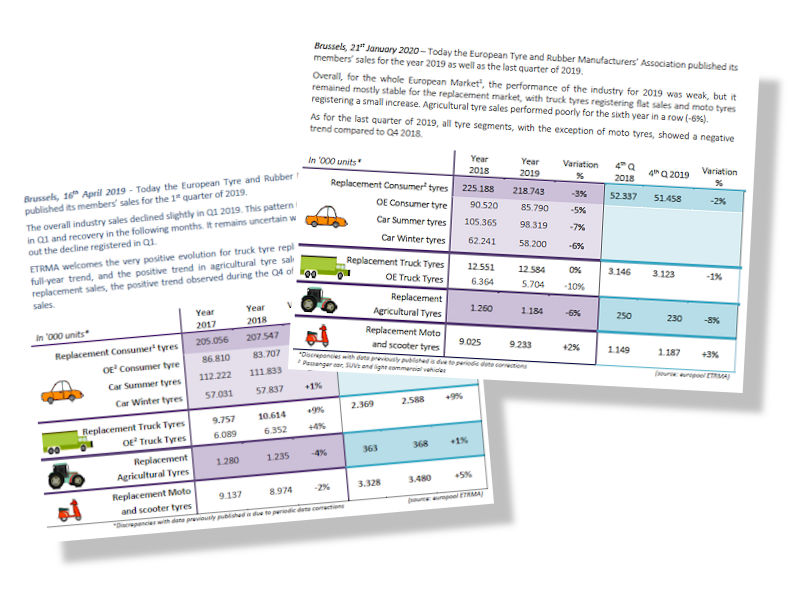

Eagle-eyed market followers may have noted that when the ETRMA published its full-year 2018 results alongside its first-quarter figures in April 2019, it reported that its members produced just 228 million replacement market tyres during the year. The association admittedly states that “discrepancies with data previously published is due to periodic data corrections,” yet the addition of 17.6 million consumer tyres (an extra 8.5 per cent) and 1.9 million truck tyres (18.2 per cent more) within just nine months can’t be so easily explained in this manner.

Where then do the almost 20 million additional tyres come from? Sumitomo Rubber’s Falken Tyre Europe subsidiary joined the ranks of the ETRMA on 1 January 2019; did gaining access to information about Falken’s volumes enable the ETRMA to more accurately revise its aftermarket figures for 2018? We asked the ETRMA, and they said the Falken factor played a role, but was not the only factor behind the changed 2018 figures.

The discrepancy between the figures published in April 2019 and January 2020 can partially be attributed to the addition of Sumitomo’s data, but it also results from the inclusion of production in Turkey in the more recent aftermarket volume figures for 2018.

Comments