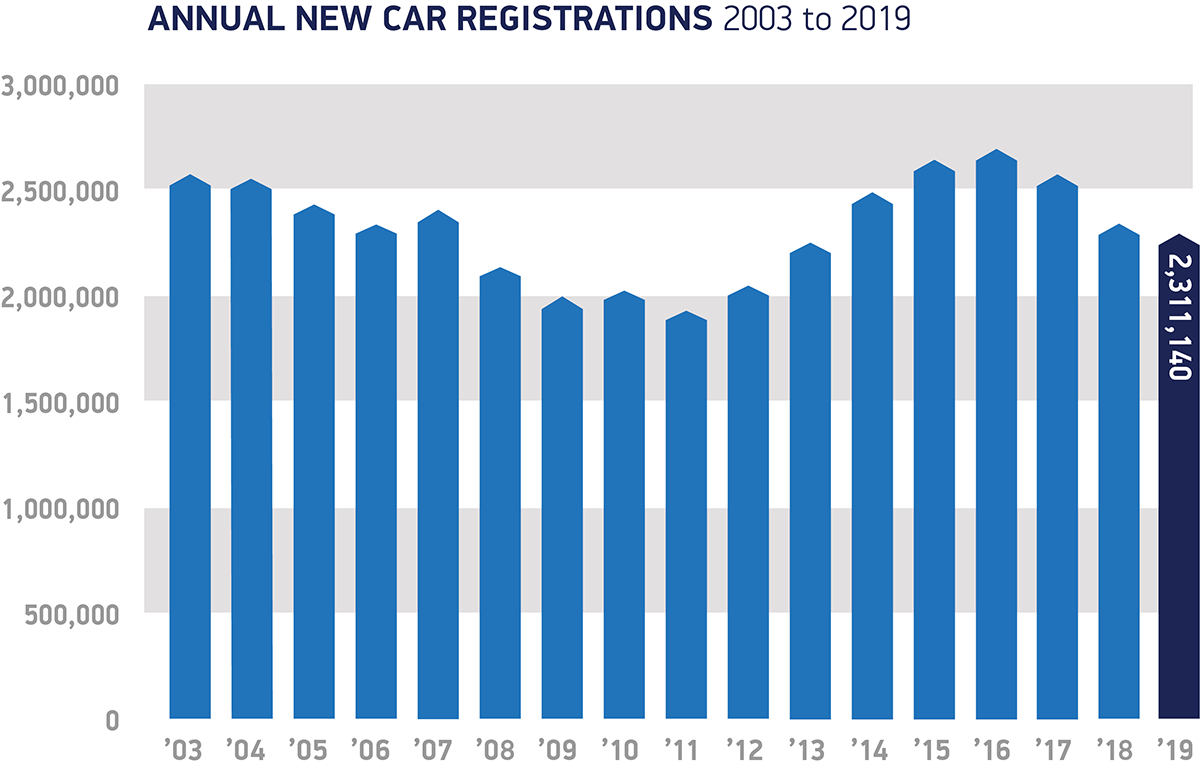

UK car registrations fall to 2013 levels

Source: SMMT

Source: SMMT

But registrations of battery electric cars surge to record levels

The UK new car market declined in 2019, with annual registrations falling for the third consecutive year. According to figures released today by the Society of Motor Manufacturers and Traders (SMMT), 2,311,140 units were registered in 2019, representing a -2.4 per cent decline. The market fell -6.8 per cent in 2018 and -5.7 per cent in 2017. This means the 2019 market is the lowest since 2013 when 2,264,737 were registered (see diagram). Representatives from industry associations and market analysts said the turbulent market reacted to weak business and consumer confidence, general political and economic instability and confusion over clean air zones.

The annual decline was driven primarily by falling private demand, with registrations from consumers down -3.2 per cent, while the small volume business market also fell, down -34.4 per cent. Fleet registrations, meanwhile, remained broadly stable, up +0.8 per cent. Demand fell across nearly all vehicle segments, with only the dual purpose and specialist sports categories experiencing growth, up +12.0 per cent and +19.2 per cent respectively. Despite registrations of superminis and lower medium cars falling (by -6.0 per cent and -4.0 per cent respectively), these smaller vehicles remain the most popular – with a combined 57.1 per cent market share.

Demand for petrol cars was up +2.2 per cent. However, this was not enough to offset the -21.8 per cent decline in diesel registrations. December marked the 33rd month of diesel decline, as continued anti-diesel rhetoric and confusion over clean air zones hit demand. This has resulted in drivers keeping their older, more polluting vehicles on the road for longer, holding back progress towards environmental goals.

Record electric vehicle registrations

However, it was a record year for battery electric (BEV) and plug-in hybrid (PHEV) vehicles, something that looks likely to continue into 2020 when 23 new BEV models are expected to launch, alongside 10 PHEVs and 1 fuel-cell electric vehicle (FCEV) – a total of 34 models.

Bucking the overall trend, combined alternatively fuelled vehicle (AFV) registrations surged in 2019 to take a record 7.4 per cent market share. Hybrid electric vehicles (HEVs) continued to dominate this sector, with registrations increasing 17.1 per cent to 97,850 units. Battery electric vehicle (BEV) registrations experienced the biggest percentage growth, rising +144.0 per cent to 37,850 units and overtaking plug-in hybrids for the first time.

Nevertheless, BEV market share of 1.6 per cent is still tiny and underlines the progress needed to reach the 50-70 per cent share the government envisages in the next 10 years. This ambition has not been helped by the significant decline of zero emission-capable plug-in hybrids, down -17.8 per cent. According to the SMMT, this is “further evidence of the consequences of prematurely removing upfront purchase incentives before the market is ready”.

The figures come as SMMT publishes data showing the UK new car fleet average CO2 rose for a third successive year, by +2.7 per cent to 127.9g/km. Massive investment by manufacturers into advanced powertrains, lightweight materials and aerodynamics means new cars are ever more efficient, with new cars emitting, on average, some -29.3 per cent less CO2 than models produced in 2000. However, this could not offset the overall rise which was due primarily to the effect of the more stringent WLTP test of new models, which generally ascribes a higher CO2 value than the older NEDC test to the same model, as well as some segment shifts and the decline in diesel.

Comments