UK’s online automotive retail outstripping cosmetics and groceries

Research by independent consultancy Frost & Sullivan, commissioned by the SMMT, shows the value of the UK automotive aftermarket

Research by independent consultancy Frost & Sullivan, commissioned by the SMMT, shows the value of the UK automotive aftermarket

SMMT report marked gathering of the UK aftermarket for Automechanika Birmingham 2017

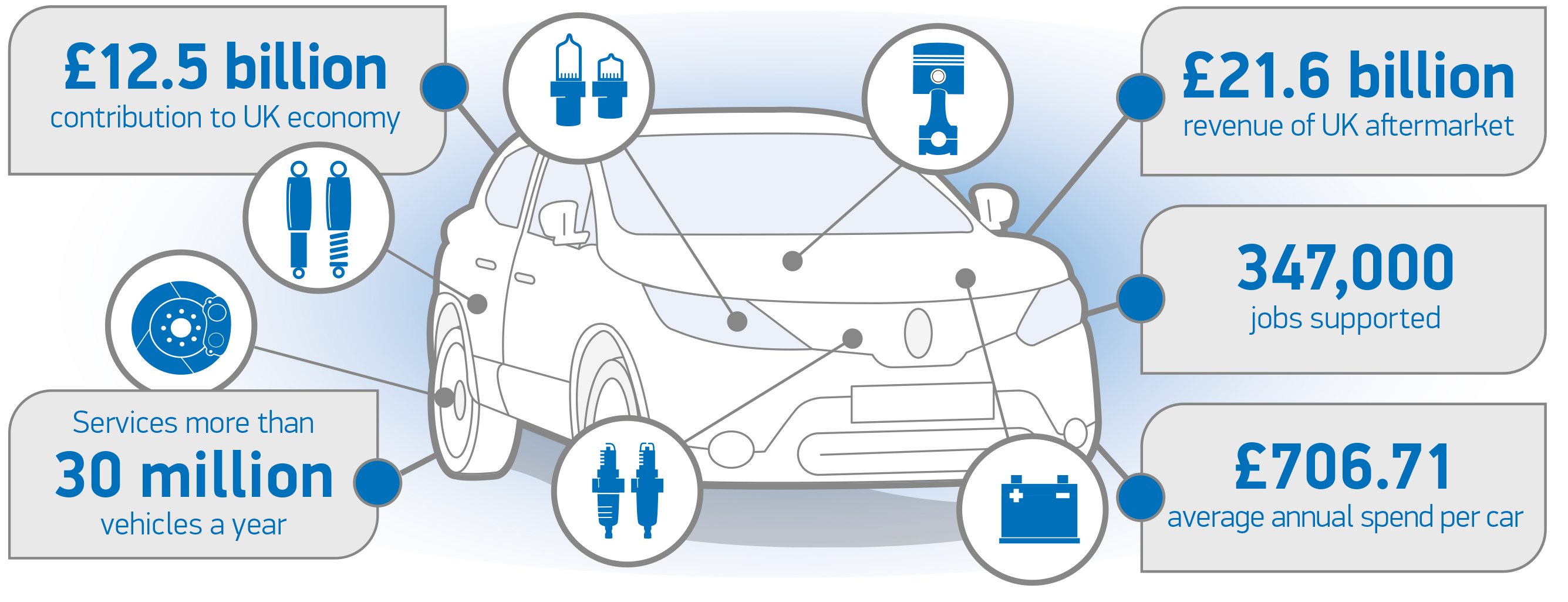

Automechanika Birmingham 2017 represented the perfect opportunity for the UK’s automotive aftermarket to gather as higher technology vehicles continue to push up turnover by 2.4 per cent in 2016. 800 such companies were present at the Birmingham NEC for this year’s show. The aftermarket accounted for £21.6 billion in turnover – a figure boosted by the presence of the more high tech vehicles on Britain’s road in addition to recent record months in new car registrations. Additionally the increasing demand for digital services has helped to boost the online side of the segment, and the Society of Motor Manufacturers and Traders (SMMT), which reported the latest figures, states that more car parts, accessories and services are bought online than cosmetics or groceries. Tyres, alongside lubricants and filters, are the most commonly replaced part, and help account for some of the growth in digital sales, though demand for digital devices, including telematics and tyre pressure sensors, has grown fastest. Overall, the SMMT states that the automotive sector makes a contribution to the UK economy of £12.5 billion.

The new research, commissioned by SMMT from independent consultancy Frost & Sullivan, shows that in 2016, UK motorists increased their annual spending on car maintenance by 1.7 per cent to an average of £707. In part, this is as a result of the need to replace more high tech components, which require new skills and equipment to fit. In the tyre sector, the core product remained one of the strongest players, but the legislation-fuelled growth in TPMS has resulted in accelerating demand for sensors, in addition to other digital services, such as telematics devices. The Frost & Sullivan research shows that tyre pressure monitoring systems are growing at 20-30 per cent (CAGR) between 2015 and 2020.

Such figures highlight the sector’s significant contribution to the UK economy. In 2016, the UK automotive aftermarket, which includes parts makers, distributors, retailers and workshops, grew its contribution by 2.5 per cent to £12.5 billion and created 1,400 new jobs. The total number of livelihoods supported by the sector now stands at 347,000 – more than the current population of Coventry.

The increasing digitalisation of cars and components presents challenges and opportunities to the sector as it strives to keep pace with advanced vehicle technology, data driven servicing and the changing needs of motorists. The research shows that British motorists are also leading the way in online car maintenance, with one of the fastest adoption rates in Europe. Last year, UK consumers bought a higher percentage of automotive parts, accessories and services online than they did cosmetics and groceries. Together they spent some £920 million on items such as tyres, brakes and batteries, and by 2022 this is forecast to rise by more than three quarters to £1.65 billion.

There is also consumer appetite for connected services such as vehicle health reports, fault detection and recall alerts, all of which make it easier to maintain cars. The research identifies growing interest in emerging forms of mobility such as car sharing schemes, forecast to attract some 2.3 million members worldwide by 2025, and e-hailing. Consumers are also increasingly turning to other digital services for their maintenance needs and online comparison websites, common in the insurance and finance sectors, are now entering the aftermarket. An estimated 100,000 people in the UK are currently using these sites to compare workshop offerings and prices, and this is set to grow significantly. This all makes clear the need for aftermarket companies to continue adapting their business models, and increasing their investment in mobile platforms to remain competitive.

Mike Hawes, SMMT chief executive, said that the figures show how vital the UK automotive aftermarket is to the country’s economy and society. “Our car maintenance sector is one of Europe’s most competitive, with vehicle owners enjoying more choice over where they have their cars serviced. The shift to digital vehicles and services will help drive this further, but the sector must continue to invest in the advanced skills, equipment and systems needed to stay abreast of evolving technology and changing mobility patterns.”

As the number and age of vehicles on UK roads increases, thanks to a strong new car market, ever-improving reliability and more complex servicing techniques, by 2022 the UK automotive aftermarket is projected to be worth some £28 billion, with an employee base of 400,000.

Comments