GfK: UK automotive could face manufacturing and sales problems post-Brexit

Nationwide consumer confidence is markedly down, but especially in the North of England

Nationwide consumer confidence is markedly down, but especially in the North of England

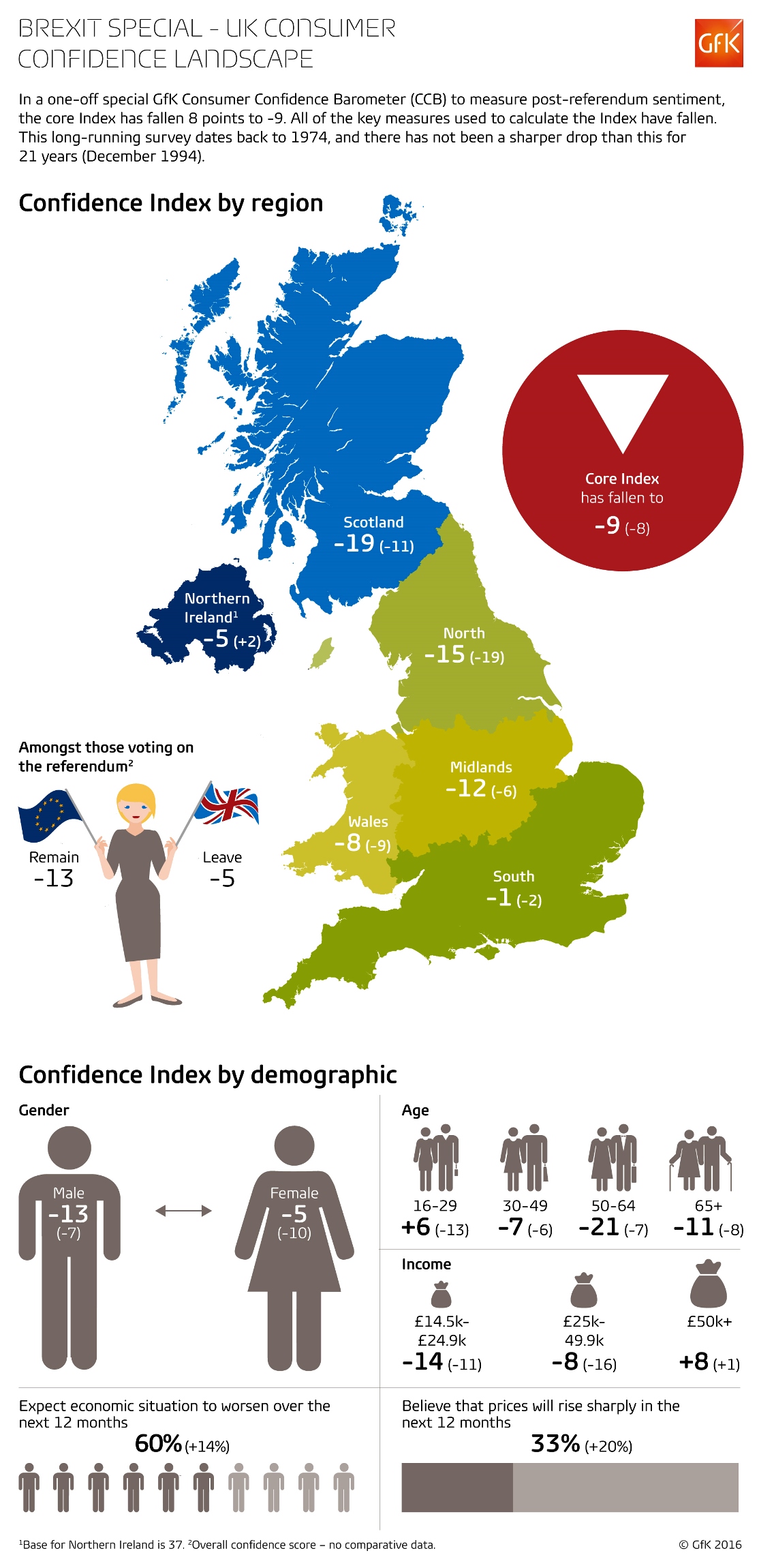

The UK automotive industry could suffer the double-blow of declining vehicle sales and declining manufacturing after its exit from the European Union. According to GfK, while new registrations grew from 1.9 million to 2.6 million between 2011 and 2015 (DVLA), the news of Brexit has had a strong impact on the long-running GfK Consumer Confidence Index. The latest figures show an 8 point decline since the June survey, and a fall of 12.8 versus the rolling 12 month average in December 2015.

The analysts report that they “are hopeful that this is a temporary reduction” but they also was clarity from the UK government over a clear plan. In the absence of such a plan, uncertainty fuels negativity.

UK consumer confidence dives post-Brexit as core index falls 8 points to -9

Looking a little close at the GfK Consumer Confidence Barometer (CCB), it shows consumer confidence has taken a nose-dive with all key measures falling. The survey dates back to 1974. There has not been a sharper drop than this most recent fall for 21 years (December 1994).

Six in 10 (60 per cent) expect the general economic situation to worsen in the next 12 months, up from 46 per cent in June. Only 20 per cent of consumers expect it to improve, down from 27 per cent in June. 33 per cent believe prices will increase rapidly in the next 12 months, a jump of 20 percentage points from June 2016.

Joe Staton, Head of Market Dynamics at GfK, said: “In the immediate aftermath of the referendum, many sectors are vulnerable to consumers cutting back their discretionary spending. As we’ve learnt from previous periods of uncertainty, consumers turn to well-known brands they love and trust as a guarantee of quality and value for money. Now is the time for companies to understand and respond to consumer concerns by anticipating and meeting their needs.”

Splitting the core Index result by how people said they voted in the referendum, Remainers were at -13, versus Leavers who were more optimistic at -5. The survey was run from 30 June to 5 July to capture the mood of consumers immediately after the Brexit decision on 24 June.

Joe Staton, Head of Market Dynamics at GfK, says: “In these extraordinary times this one-off CCB Brexit Special gauges the temperature of consumer confidence right now. During this period of uncertainty, we’ve seen a very significant drop in confidence, as is clear from the fact that every one of our key measures has fallen, with the biggest decrease occurring in the outlook for the general economic situation in the next 12 months.”

Regional variations

There are distinct differences in how confidence has changed regionally. In the north of England, confidence has dropped 19 points and in Scotland it has fallen 11 points. In the south (including London), there has been a 2-point drop. Amongst the young (16-29 year olds) confidence has dropped 13 points, but this group remains the most optimistic of all age groups.

The biggest drop in confidence, from an income perspective, is a fall of 16 points among households with income levels of £25,000-£49,999

“Our analysis suggests that in the immediate aftermath of the referendum, sectors like travel, fashion and lifestyle, home, living, DIY and grocery are particularly vulnerable to consumers cutting back their discretionary spending. As we’ve learnt from previous periods of uncertainty, consumers turn to well-known brands they love and trust as a guarantee of quality and value for money. Now is the time for companies to understand and respond to consumer concerns by anticipating and meeting their needs.”

GfK ran this one-off Brexit special online with 2002 respondents. Quotas are imposed on age, sex, region and social class to ensure the final sample is representative of the UK population. Interviewing was carried out during 30 June and 5 July 2016. The figures contained within the Consumer Confidence Barometer have an estimated margin of error of +/-2 per cent. Results for the regular monthly Consumer Confidence Barometer are normally available on the last working day of each month at 00.05am; the release date for July 2016 is Friday 29 July 2016.

This study has been running since 1974. Back data is available from 1996.

Comments