Aramid – a material for a changing industry

Twaron is produced from a para-aramid that Teijin Aramid makes itself in facilities in Delfzijl and Emmen, the Netherlands using raw materials sourced from the oil industry

Twaron is produced from a para-aramid that Teijin Aramid makes itself in facilities in Delfzijl and Emmen, the Netherlands using raw materials sourced from the oil industry

On average, new cars sold in the European Union last year emitted three per cent less carbon dioxide than those sold in 2014. Yet average CO2 output was still close to 25 grams per kilometre – or more than 20 per cent – above the 95 gram limit the EU has set for 2020. Achieving the 2020 goal requires a further drop in vehicle running resistance, and car makers expect tyre OEMs to contribute to this goal by offering even lighter products with lower rolling resistance. This push for greener tyres that weigh less is music to the ears of the industry’s market-leading aramid supplier.

“We believe that the focus for optimising rolling resistance in passenger car tyres will move away from rubber compounding and the use of silacas, and increasingly embrace tyre design and the use of yarns,” states Teijin Aramid’s Sjaak Bensink. The company’s business manager for Tires, MRG, Umbilicals and Flowlines considers yarns and fibres the “next logical step” to improve rolling resistance. “Much of what can be done with rubber has already been done, at least for car tyres, and therefore tyre makers must look at other possibilities.”

The main product Teijin Aramid supplies to the tyre industry is Twaron, a para-aramid (see separate text, Twaron and aramid). Aramid has been used in tyre production since the 1970s, initially for racing tyres, and is perhaps best known for its presence in the cap-ply of ultra-high performance tyres such as the Michelin Pilot Super Sport. The material’s strength and heat resistance up to about 500 Celsius, not to mention its ability to eliminate the flat spotting experienced with a nylon cap-ply, are a good fit for high performance products. Yet the qualities Twaron possesses also make it very interesting for anyone wishing to manufacture an environmentally-friendlier tyre.

Sjaak Bensink, Teijin Aramid business manager for Tires, MRG, Umbilicals and Flowlines

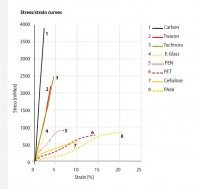

“Aramid is a light material,” shares Bensink. “It has a density of 1.44 grams per cubic centimetre. This makes it very light – around five times lighter than steel at the same weight.” Given this much higher weight-for-weight strength, the cords used to make a tyre’s casing can be significantly thinner, and this means the casing will be lighter and contain fewer raw materials. “When you look at the comparison between aramid and rayon and the amount you need for reinforcement, it is roughly one to three, with 100 grams of full aramid cord Twaron and 100 to 200 grams of rubber compound required for the same strength as achieved with 300 grams of rayon and 300 to 600 grams of rubber compound,” the business manager shares. “For aramid to polyester (PET) it is one to two.”

Substituting rayon for full aramid can lead to significant improvements in rolling resistance and dynamic stiffness, along with a substantial reduction in a tyre’s weight, however comfort may be compromised and the tyre might be more prone to fatigue. For these reasons, tyre makers commonly employ a hybrid aramid/PET material. The same strength as achieved with the above quantities of pure aramid or with rayon can be obtained with 67 grams of Twaron, 67 grams of PET and 135 to 270 grams of rubber compound – a considerably lighter concoction than the rayon equivalent.

Thinking green means looking at product use

A common assumption, or misassumption, about environmentally friendliness is that bio-based products are the greenest. “Many companies are investigating bio-based products such as guayule rubber, but 90 per cent of all environmental impact in a tyre’s value chain occurs during the use phase,” Bensink comments. “They shouldn’t only be looking at raw materials, if they want their products to be eco tyres, they should focus in the use phase.”

Unlike rayon, which is made from purified cellulose, aramid is a synthetic, non-bio product, and a per kilogramme comparison of its global warming potential with that of technical rayon and PET shows its value is the highest of the three by a wide margin; aramid’s CO2 equivalent per kilogramme is more than twice that of rayon (the exact value for Twaron is confidential). But as Sjaak Bensink points out, the “story looks different when looking at function over the lifetime.”

Not only do per kilogramme comparisons fail to take account of the respective quantities of rayon and aramid (and rubber) needed to make a tyre with the same strength characteristics, they also overlook the reduction in rolling resistance and CO2 emissions achieved when using a Twaron/PET hybrid rather than rayon. “Aramid is not intrinsically green, but nevertheless a green product when you look at the total chain,” Bensink reiterates.

Aramid in the aftermarket

As the high market share held by budget brands of passenger car tyres in the UK attests, price has traditionally played a far larger role in aftermarket purchase decisions than in the original equipment segment, and there is no getting around the fact that tyres containing aramid or aramid hybrid cords typically cost more than those that don’t. While private purchasers in particular tend to look at sticker price, Sjaak Bensink doesn’t see this as an obstacle to a wider adoption of aramid in replacement market tyres.

“We know that many like a product with a cheap purchase price, but consumers must have a longer perspective and look at things based on a lifetime of five to ten years, and consider factors such as reliability and rolling resistance,” he comments. “The good news is that many decisions are now being taken by lease companies rather than end consumers, and they have a completely different way of looking at things. They look in great detail at total life cost and how a tyre performs over a number of years. Lease companies define everything, including when tyres are changed and what kind of tyre to use. They have so many solutions and their own databases that show exactly what each tyre can bring over its lifetime.”

Registration figures for May 2016 confirm that the UK car parc is increasingly non-privately owned – while the number of private new car registrations fell 3.0 per cent year-on-year during the month, fleet car sales rose 8.8 per cent. The Society of Motor Manufacturers and Traders reports that fleet acquisitions accounted for 53.8 per cent of the 203,585 new cars registered in the UK during May. And Bensink believes that what we’re seeing now is just the tip of the iceberg. “I see growing demand for car use rather than car ownership. One day, consumers will not buy cars – they will simply open an app on their phone and order a car when they need one. The decision about tyres and other equipment won’t be taken by consumers, it will be taken by companies.”

Looking at the car and tyre market from a global perspective, we are still a long way from the future described by Sjaak Bensink, however evolving, greener legislation and an increasingly professional approach to tyre purchasing strongly suggest that the writing is on the wall for tyre makers who trade on purchase price rather than whole-life value. That’s certainly how Teijin Aramid sees it: “The whole industry is changing, and we believe aramid can play a role in this,” concludes the business manager. stephen.goodchild@tyrepress.com

Comments