Michelin nine-month net sales up 8.6% to 15.8 billion euros

Michelin's nine-month figures outperformed market averages in some, but not all, sectors

Michelin's nine-month figures outperformed market averages in some, but not all, sectors

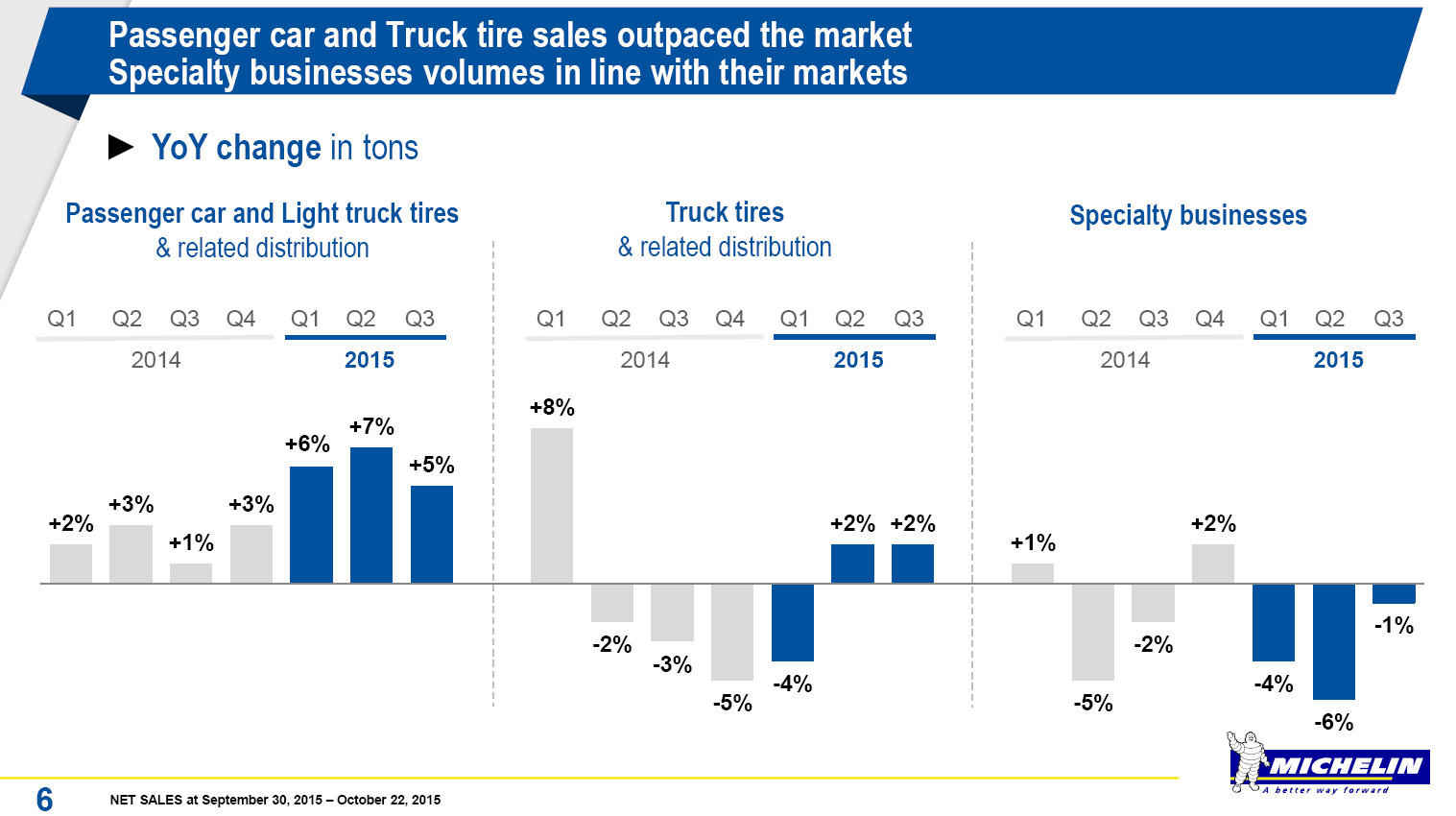

Michelin has reported growing nine-month 2015 financials that show an 8.6 per cent increase in net sales to 15.8 billion euros, with unit volumes up 2.8 per cent. Both are figures that outperform market averages. Car and light truck tyre sales growth outperformance was particular strong, while truck tyre and specialty business volumes were only slightly higher than their market levels.

Passenger car and light truck tyre sales accounted for 8,838 million euros of the total during the period, up 13.9 per cent from 7,759 million euros a year earlier.

To put the volume effect into perspective, tonnages in the sector rose 6 per cent, exceeding the 1 per cent growth in the market. Michelin puts this down to a 6 per cent gain on Michelin-branded sales, supported by a 13 per cent rise in sales of 17-inch and larger Michelin car tyres segment. As a result mix is said to remain “favourable”.

Nine-month net sales in of Michelin truck tyres amounted to 4,675 million euros, up 3.8 per cent from the 4,503 million euros in 2014. At the same time, Michelin reports that volumes were stable in a global market down 2 per cent. On 1 August, Michelin increased prices in Europe to offset the impact of the euro-dollar exchange rate on raw materials costs.

Net sales generated by Michelin’s Specialty Businesses division stood at 2,294 million euros for the first nine months of 2015, which was basically flat compared with the previous year.

Earthmover Tires saw net sales down slightly due to the general decline in volumes. But tonnages sold in the Infrastructure and OE segments ended the period higher. Agricultural tyre net sales were down, in line with the contraction in sales volumes. At the same time two-wheel net sales increased, lifted by higher volumes in mature and emerging markets. Aircraft tyre net sales rose on the back of favourable currency effects, while tonnages edged up, apparently lifted by radial sales.

However, while several of the figures outperformed the market – especially in relation to car and light-truck orientated products – financial analysts were not overwhelmed the latest set of figures, questioning the firm’s ability to increase profitability over the next year or so. Morgan Stanley, for example, expects full-year 2016 earnings per share to be 9 per cent below consensus estimates, dropping to 13 per cent below in 2017.

However, writing in an investor’s note dated 20 October, they also highlighted Michelin’s 2 billion euro capacity for mergers and acquisitions and/or further cash returns post the 750 million euro share buyback currently underway.

Comments