Cheap Chinese tyres put pressure on retreading

Are European tariffs the answer?

With more low-cost Asian-produced imports entering key European markets than ever, many within the retreading and wider truck tyre industry are anxious to address what they see as a growing concern. For them there are several problems with the continuing influx of Chinese tyres, but two points are particularly key: the increasing cost difference and increased quality disparities seen in the market. Both undermine the retread market and even its long-term future. As far as retreaders are concerned, the problem is that good quality and environmentally sound retreads are being priced out of the market by cheap first-life truck tyres bought as “disposable” items at virtually cost-price levels. All this raises questions that impact the whole market: How bad is the situation now? How has it got to this stage? What is the impact on new truck tyres and retreads alike? Tyres & Accessories recently met with representatives of the Retread Manufacturers Association (RMA) as well as leading retread and new tyre manufacturers in order to find out more.

As we observed in our most recent truck and bus tyre coverage (Tyres & Accessories March 2015 and September 2014 respectively), imports of Chinese truck tyres are at an all-time high. And while countries such as the UK have long been known for their relative preference for budget tyres, these two reports show that it is not just the UK that likes to buy cheap tyres. Indeed, at the other end of the spectrum, even markets such as Germany – which has always been known for the discerning approach of its tyre buyers – sourced 26.5 per cent of its truck tyre from non-ETRMA manufacturers in 2014 (see “Hankook UK bus and truck tyre market leader in 2014”, Tyres & Accessories, March 2015, page 61). The short story is that virtually every market in Europe is on course for 30 per cent of its truck tyres coming from the low-cost route. The UK is already ahead of the curve with over 33 per cent. But few – namely France with around 11 per cent – are far away from this. For many, this situation is probably more pronounced than you thought. If that’s the case, wait till you consider the implications.

Of course, the fact that a tyre was made in China does not automatically mean it is poor or even dangerous quality. Indeed, in conversation with Tyres & Accessories representatives of the leading new tyre players were charitable in their assessment of some of the top-end manufacturers in the Chinese segment – even going far as respectfully calling them “legitimate competitors” at times. (Low-cost imports could theoretically have been made in another county, but as chart 1 shows, the growth rate of Chinese-originated tyres is unmissable and the proportion of production emanating from China unmistakable. At 98 per cent share of the non-Europool imports brought into the UK, this means the terms non-Europool and import are pretty much synonymous). The point is that the higher quality Chinese products have to produce compliant products and sell them at reasonable prices in order to continue developing in pace with premium competitor technology. Therefore they will increasingly distance themselves from poor practice and low-cost products in order to achieve their long-term goals.

However with such large numbers of products entering the market, it is clear that there is a wide quality variance in the low-cost sector matched only by the width of the price variance between top and bottom. The fear is that with such a big price gap between new premium and low-budget tyres, retreads appear uncompetitive when considered on the basis of price alone. Some even draw parallels between the car tyre retread market (where low-cost imports rung the death knell for large swathes of this niche industry just a few years ago) and the rest of the truck tyre retreading segment. There are differences, but also too many similarities for the realities to be overlooked.

The gaping price gap

As we have seen, the price gap between low-cost one-life new truck tyres and retreads has been widening, but what’s the status quo? Figures passed to Tyres & Accessories at the end of April suggest 295/80 R22.5 truck tyres were selling into the UK market at £95 compared with £220 or more for more established brands, built on the back of multi-life strategies. With prices this low at the bottom end and with a gap this big between the top and the bottom, there is little room for a sustainable retreading option. With a price gap gaping this wide, you can bet the casings don’t last to the second life and so it becomes a retreading problem too; in effect manufacturing a casing shortage based on the first life products’ lack of longevity. But it doesn’t end here. All this has an impact on perceptions of tyres and tyre brands in general and there is clear environmental fall-out too.

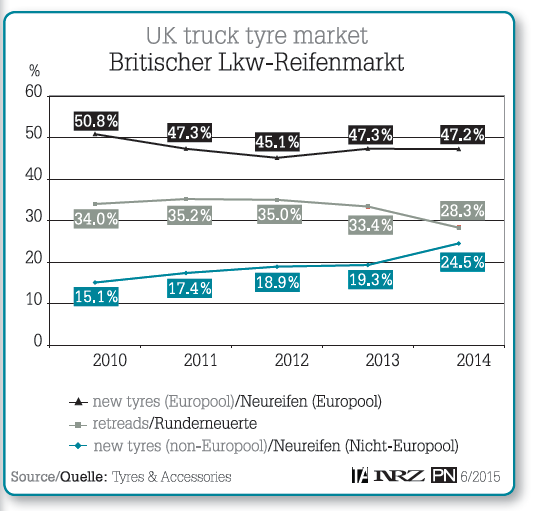

Low-cost tyres end up in European markets because over-production at home has pushed them towards the international market. The UK is a favourite destination because of our apparent taste for “cheap as chips” tyres. But are retreads and indeed retreading in general really under threat? Looking back at the combined UK retread and new tyre market data for the five years between 2010 and 2014, the answer would seem to be a clear “yes”. Back in 2010 new so-called Europool tyres accounted for just under 51 per cent of the market. Retreads occupied more than a third (34 per cent) and non-Europool tyres another 15 per cent. By the end of 2014, the premium block was showing as 47 per cent, down nearly four percentage points – but that’s the smallest decline on the map. During the same period retread share fell from 34 per cent in 2010 to 28.3 per cent in 2014 (see chart 2).

This means that while premium truck tyres have lost some share, owing to the fact that many of their retreads are produced on the back of customer-owned casings and/or their own products, things are still OK at the top of the tree. Volumes haven’t been impacted as much as others at this end of the spectrum and businesses can run as normal. At the other end, sales of non-Europool tyres shot up nearly 10 percentage points between 2010 and 2015. The problem is that as this sector has grown, retread share has fallen almost as fast (from 33.4 per cent in 2013 to 28.3 per cent in 2014 – again see chart 2). In unit terms, this means some 540,000 non-Europool truck tyres entered the UK market in 2014, 98 per cent of which were from China (see chart 1).

How can Chinese manufacturers make tyres this cheap?

Again, it is worth repeating that this research cannot suggest that all Chinese-produced truck tyres are poor quality. On the contrary, some are surprisingly good quality, perform well in labelling results and can be retreaded. However, with so many Chinese tyres entering the market and with this trend showing no signs of abating up till now, there is a potentially very large number of low quality products on the market. Is that a sweeping generalisation? Not if you look at the facts.

Chinese labour costs continue to rise each year and besides they are the same for all the big firms operating in China (which include all the global tyre majors). Therefore competitive price advantages cannot be found here. Likewise, a high-quality tyre production line is likely made out of components and equipment constructed in Europe or Japan. While the leading players manufacture some of their own bespoke machinery, on the whole the best quality machinery costs the same whether a company is using it in Europe or China. And thus this route doesn’t offer any price competitiveness either. Energy costs are the same for anyone producing in China, leaving raw materials and “know-how” as the two key ways that money can be saved when producing tyres. The problem for anyone aiming to manufacture truly cheap tyres, is that the ingredients and the research relating to how to put the whole thing together are about as important as can be in terms of tyre production.

If cheap tyre manufacturers are cutting corners on ingredients and truck tyre production, then questions of compliance are also raised. Do such cheap tyres continue to meet basic safety standards? How do they rate on tyre labels? Are they free of PAH-oil? Do their label results match their real-life performance in any meaningful way? On the one hand there are many that say that at £95 this is simply impossible. On the other hand – so far – there isn’t any robust enforcement or even testing mechanism in place. And so it is hard to demonstrate what everyone is thinking quietly out in the open. Assuming that there are non-compliant tyres in the market this has big impact as the implications work down the supply chain. Should this be discovered to be the case, this says everything we need to know about the originating manufacturer. But it is the importer or wholesaler selling the tyres into the market that is held liable by clean oil legislation, for example.

It doesn’t end there. Even after a consumer has used the product, compliance issues continue. If a tyre is retreadable – and this often isn’t the case – the next problem is whether or not the new retread will be tainted by the old casing. However compliant the hot or cold retreading procedure and components have been, if the sidewall still contains ‘dirty’ oil the whole product is sub-standard. And this raises another point: there are indications that some Chinese tyres are part-compliant. That is, the treads are compliant, but the beads and or sidewalls aren’t. As soon as such a part-compliant tyre gets to the end of its first life all that you are left with is a non-compliant casing. Again, this exacerbates the casing supply issues and therefore forces contraction on the retreading market.

The hypothetical presence of non-compliant tyres in the market even causes problems at end-of-life. Would recyclers and reprocessors want to continue making school playgrounds and football pitches from material known to be a) non-compliant and b) carcinogenic? Without the approved and accredited recycling routes how can the non-compliant low-cost tyres be appropriately disposed of?

Lobbying for tariffs

If tyres are not being produced this cheaply due to non-compliance, then how? If it is because of “supportive” measures on the part of the Chinese state, something which the US government and unions certainly believe, does this open the door to the possibility that the trade will lobby for European import tariffs in a similar vein to those imposed in USA? Up till now this has always been off the table, with most across the continent preferring legislation that pushes standards high and therefore forces the market to be a level playing field. However, now there are those – not least within associations like the RMA (but elsewhere too) – that are asking if the lack of enforcement of legislation is actually forcing the market towards this kind of action.

Import tariffs have certainly been implemented in other markets. The highest profile case is obviously the US, where the Obama administration announced the application of a second and more punitive round of countervailing and anti-dumping duties last year. However, these largely referred to passenger car tyres and therefore not to the more nuanced truck tyre and related retreading market we are referring to here.

As far as truck tyres are concerned, due to the lax nature of enforcement of rules like clean oil and tyre labelling legislation, certain parties are increasingly leaning towards tariffs as a more direct way of dealing with the issue of allegedly anti-competitive low-cost imports.

Brazil is leading the way in this respect, having picked up on the example of the USA and implementing tariffs. On 4 May the Brazilian authorities passed a resolution calling for anti-dumping tariffs to be levied against Chinese-produced truck tyres with rims between 20 and 22.5 inches in diameter for the next five years.

Specifically, the Brazilian Câmara de Comércio de Exterior foreign chamber of commerce, or Camex (as it is known), made the decision to collect the duty in the form of specific fixed US-dollar amounts per kilogram. These vary from manufacturer to manufacturer in a way reminiscent of the latest rounds of US anti-dumping tariffs levelled against Chinese-produced tyres.

Zhongce Rubber Group Co., Ltd. and Double Coin Holdings Ltd. come off lightest on the named list, with anti-dumping duties of US$1.12 per kilogram. However, the sliding scale goes up to $1.55/kilo for the highest named company (Shandong Bayi Tyre Manufacture Co., Ltd) and as a high as $2.59/kilo for all the companies not named on the list (see table for complete details).

The latest announcement follows a similar investigation in May 2008. This looked at the alleged dumping of radial construction tyres with rims between 20 and 22.5 inches in diameter as well as the same sized truck and bus products. Just like this time round, the accusation was that the low priced Chinese tyres were causing “injury to domestic industry”.

The subsequent ruling on 19 December 2008 found that anti-dumping measures were warranted and tariffs of US$1.33/kilo were applied to Brazilian imports of Chinese truck tyres for six months. By June 2009 Camex extended this for five years, naming many of the same firms and levelling comparable tariffs to the present round.

Four years later in June 2013 Brazil extended its investigation to include tyres originating from Republic of Korea, Kingdom of Thailand, Republic of South Africa, Russian Federation and Chinese Taipei.

In June 2014 the extended investigation ended with the “affirmative determination of dumping and injury to domestic industry arising therefrom without application recommendation provisional”. Or in other words – more tariffs.

The latest defensive trade tariffs were initiated by the Brazilian National Tyre Industry Association – ANIP on 31 January 2014 on behalf of leading local tyre manufacturers Pirelli, Goodyear and Michelin. Interestingly, considering its own recent history in relation to import tariffs, the USA was used as a third country market economy to calculate the normal value of tyres. According to Camex, this is because – for research purposes – China is considered a “non-market economy”.

By June 2014 the powers that be were convinced the absence of tariffs would encourage dumping and so began proposing a review of the anti-dumping duty in force, which – as we have seen – finally came in force in May 2015

Back to the subject of the European retreading industry, there are those that want to learn from the Brazilian example and take more direct action. Whatever action ends up being taken, the truck tyre sales data of the last five years suggests that serious questions face every major truck tyre and therefore retread market in Europe. And the long-term future of the independent retreading business to some extent depends on the answer.

Comments