Nexen Tire profits and sales up in 2014

Nexen Tire reports that operating earnings increased 18 per cent in 2014. According to the Korea-based tyre manufacturer, this was based on lower raw material costs and improved sales. Meanwhile sales were 1.7 per cent higher at US$1.68 billion, raising the operating ratio nearly two points to 11.9 per cent. Net income rose 4.7 per cent to $123.6 million.

Nexen said revenue growth was limited by the slower replacement tyre market in the US and Europe. Tyre production, on the other hand, jumped 7.1 per cent to nearly 35 million units during 2014.

The financial success appears to have largely come from the end of 2014. Fourth quarter operating profit increased a huge 51.7 per cent, Nexen said, on 7.7 per cent higher sales.

Source: Nexen Tire

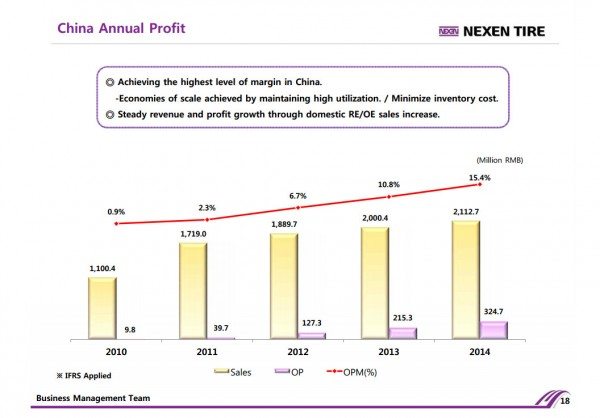

Qingdao, China plant increasingly profitable

The increased profitability of Nexen’s Qingdao, Shandong Province, China manufacturing operation (the source of most of the Nexen branded tyres in the UK) is likely to have made a significant contribution to the firm’s increased profitability in 2014. Annual operating profit has virtually doubled in the four years since 2010 and margin is 15 times greater (see chart).

Nexen reports that it has been able to achieve “the highest level of margin in China” by fully leveraging “the economies of scale achieved by maintaining high utilization.” At the same time, the firm has sought to minimize inventory cost. The result is described as “steady revenue and profit growth through domestic replacement and OE sales increase”.

Nexen reported sales in North America were down slightly in the quarter due to customers’ stocking up on tyres from China ahead of the US government’s import duties decisions. However, the tyremaker anticipates volume growth to rebound this year after inventories are reduced.

Nexen said it expects stable raw materials prices throughout 2015 based on oil price forecasts.

Altogether, the firm’s financial plans form the basis of its goal to report US$2.5 billion in annual sales revenue by 2015, which is of course this financial year.

Comments